White House Urges Oil Companies to Boost Production

White House issues muted call for oil companies to ramp up production, a move aimed at addressing rising gas prices and bolstering energy security. The administration’s call comes amid a complex landscape of global energy markets, supply chain disruptions, and increasing demand.

This call highlights the delicate balancing act between economic needs, environmental concerns, and international relations.

The White House is hoping that increased oil production will lead to lower gas prices for consumers, a major concern for the administration. However, the call has been met with mixed reactions from oil companies, some expressing willingness to increase production while others cite challenges and economic uncertainties.

The potential impact on gas prices and the broader energy policy landscape remains a subject of debate.

The White House’s Call for Increased Oil Production

The White House’s recent call for increased oil production has sparked debate and controversy, highlighting the complex interplay between energy policy, economic considerations, and environmental concerns. This call comes at a time when global energy markets are experiencing significant volatility, with oil prices reaching record highs due to various factors, including the ongoing war in Ukraine, supply chain disruptions, and increased demand.

The White House’s muted call for oil companies to ramp up production seems to be a symptom of a larger trend: the administration’s willingness to cede authority to international organizations. Just this week, the Biden administration negotiated a deal to give the World Health Organization authority over US pandemic policies, a move that has raised concerns about national sovereignty.

It’s hard not to wonder if this trend will continue, especially when it comes to issues like energy independence, where the administration seems hesitant to take a strong stand.

The Current State of Oil Production and Supply

The current state of oil production and supply is characterized by a delicate balance between demand and supply. While global demand for oil continues to rise, driven by economic growth and increasing industrial activity, supply has been constrained by various factors, including geopolitical tensions, production cuts by OPEC+ countries, and the slow pace of investment in new oil production projects.

This imbalance has led to a tight oil market, with prices remaining elevated and subject to significant fluctuations.

The White House’s Rationale for Urging Oil Companies to Ramp Up Production

The White House’s call for increased oil production is driven by several key factors. First, the administration aims to address the rising cost of gasoline and other energy products, which are putting pressure on consumers and businesses. Second, the White House seeks to reduce America’s reliance on foreign oil imports, particularly from countries like Russia, which have become increasingly unreliable suppliers.

Third, the administration believes that increased domestic oil production can contribute to energy security and economic growth.

The White House’s muted call for oil companies to ramp up production comes at a time when political winds are shifting. Just yesterday, longtime Democrat senator announced she won’t seek another term , a move that could have implications for energy policy going forward.

With the political landscape in flux, it remains to be seen whether the White House’s call for increased oil production will gain traction.

Potential Benefits of Increased Oil Production

Increased oil production could bring several potential benefits, including:

- Lower gasoline prices: Increased domestic oil production could help lower gasoline prices, providing relief to consumers struggling with rising energy costs.

- Enhanced energy security: By reducing reliance on foreign oil imports, the US could strengthen its energy security and reduce its vulnerability to geopolitical disruptions.

- Economic growth: Increased oil production could stimulate economic activity, creating jobs in the energy sector and supporting related industries.

Potential Challenges and Drawbacks of Increasing Oil Production

While increased oil production offers potential benefits, it also presents several challenges and drawbacks, including:

- Environmental concerns: Increased oil production could lead to increased greenhouse gas emissions, contributing to climate change. Moreover, oil exploration and extraction activities can have significant environmental impacts, such as habitat destruction and water contamination.

- Long-term market volatility: Increased oil production could temporarily lower prices, but it may also lead to increased market volatility and price fluctuations in the long run.

- Dependence on fossil fuels: Increasing oil production could perpetuate the US’s dependence on fossil fuels, hindering the transition to a clean energy future.

Oil Companies’ Response to the Call: White House Issues Muted Call For Oil Companies To Ramp Up Production

The White House’s call for increased oil production has been met with a mixed response from major oil companies. While some companies have committed to increasing production, others have expressed hesitation or reluctance. This mixed response reflects the complex economic and political factors influencing the oil industry.

Companies Committing to Increased Production

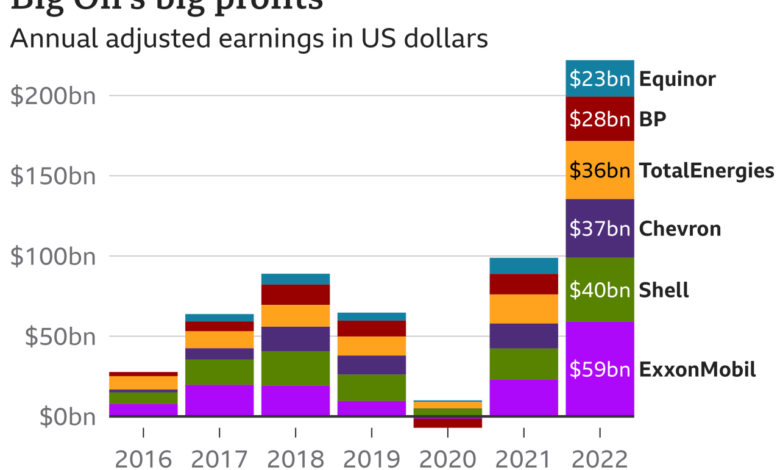

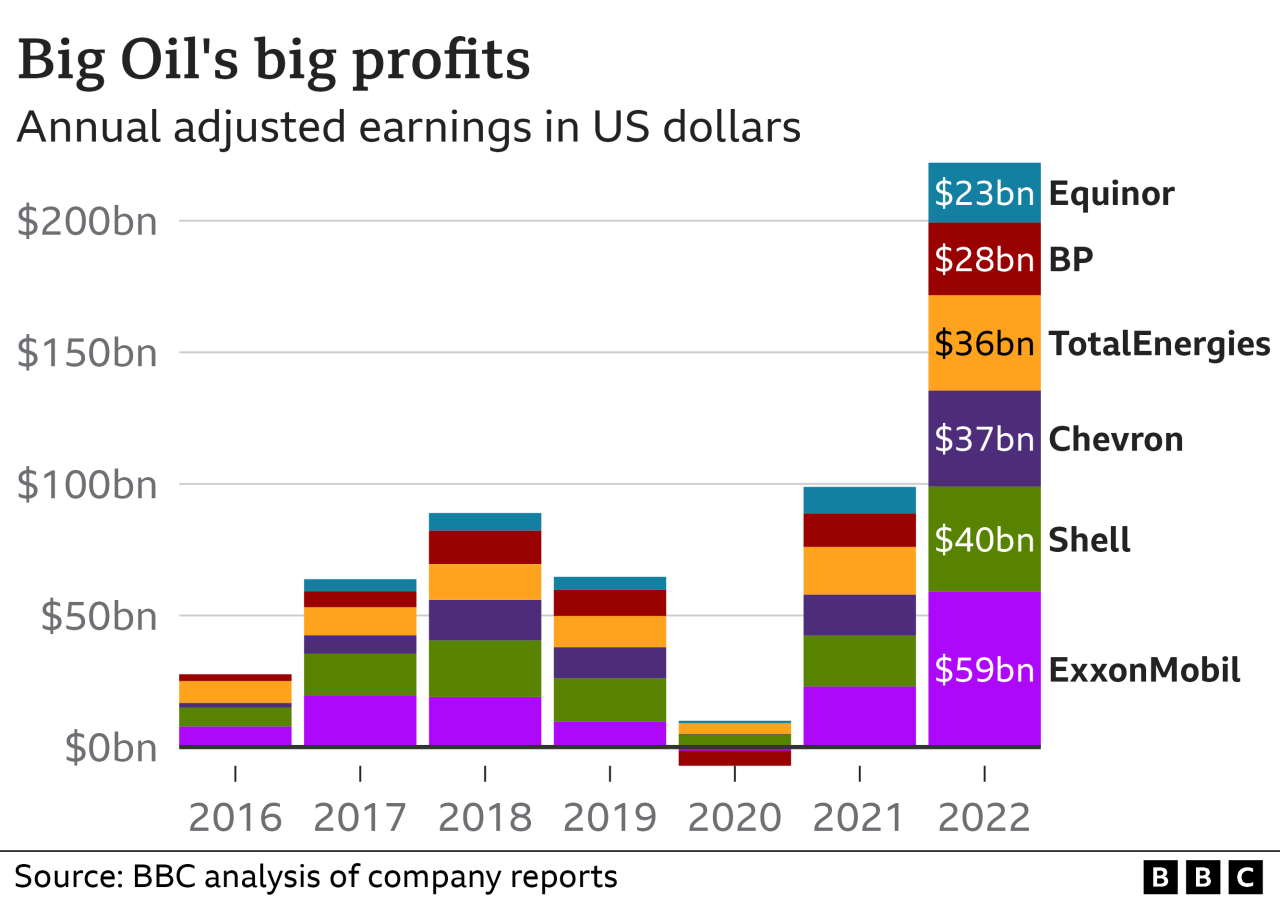

Several major oil companies have responded to the White House’s call by announcing plans to increase production. For instance, ExxonMobil has stated its intention to ramp up production in the Permian Basin, a major oil-producing region in the United States.

Similarly, Chevron has indicated plans to increase production in the Gulf of Mexico. These commitments are likely driven by the current high oil prices, which make increased production more profitable.

Reasons for Hesitation or Reluctance

While some oil companies are embracing the opportunity to increase production, others have expressed reservations. Some companies are hesitant due to concerns about long-term market demand. Despite current high prices, the transition to renewable energy sources is expected to continue, potentially leading to lower demand for oil in the future.

Additionally, some companies are facing difficulties in attracting investment and securing the necessary resources to expand production.

Economic Factors Influencing Oil Companies’ Decisions

Oil companies’ decisions on production levels are heavily influenced by economic factors. The current high oil prices are a major driver for increased production, as companies seek to maximize profits. However, other factors, such as the cost of labor, materials, and equipment, can also influence production decisions.

Additionally, companies must consider the long-term outlook for oil prices and demand, as well as the potential impact of government regulations and policies.

Alignment with Broader Energy Policy Goals

The White House’s call for increased oil production is intended to address concerns about rising energy prices and fuel shortages. However, this call is also seen by some as conflicting with broader energy policy goals, such as reducing greenhouse gas emissions and transitioning to renewable energy sources.

The push for increased oil production could potentially hinder progress towards these goals, as it could lead to increased reliance on fossil fuels and delay the transition to a cleaner energy future.

The Impact on Gas Prices

The White House’s call for increased oil production aims to address the rising gas prices that have burdened consumers and impacted the economy. The relationship between oil supply and demand, along with other factors, plays a significant role in determining gas prices.

Increased oil production, if successful, could potentially influence gas prices, but the impact is complex and depends on various factors.

The Relationship Between Oil Supply and Demand and Gas Prices

The fundamental principle of supply and demand governs gas prices. When oil supply increases, and demand remains relatively constant, the price of oil tends to decrease. Conversely, when oil supply decreases, or demand increases, the price of oil rises. This dynamic is influenced by global events, economic conditions, and geopolitical factors.

Factors Influencing Gas Price Fluctuations

Several factors contribute to gas price fluctuations beyond the basic supply and demand relationship:

- Refining Costs:The cost of refining crude oil into gasoline impacts gas prices. Factors like energy costs, maintenance, and environmental regulations can influence refining costs.

- Distribution and Transportation:The cost of transporting gasoline from refineries to gas stations, including pipeline and trucking costs, also affects prices.

- Government Policies:Taxes, subsidies, and regulations imposed by governments can influence gas prices. For example, fuel taxes can increase the price of gasoline at the pump.

- Seasonal Demand:Gas prices tend to fluctuate seasonally, with higher demand during peak driving seasons, such as summer vacations, leading to higher prices.

- Geopolitical Events:Global events, such as political instability in oil-producing regions or international sanctions, can disrupt oil production and supply, leading to price increases.

Potential Price Changes and Historical Trends

The potential impact of increased oil production on gas prices is difficult to predict with certainty. However, historical trends provide some insights. For instance, in 2020, when global demand for oil decreased due to the COVID-19 pandemic, oil prices plummeted.

The White House’s muted call for oil companies to ramp up production is a clear sign that they’re hesitant to directly address the rising cost of gasoline. This reluctance, coupled with the inflation fears among small business owners at highest level in 40 years , is likely contributing to the current economic uncertainty.

The White House seems to be walking a tightrope, trying to avoid further inflaming an already volatile situation.

This demonstrates the impact of reduced demand on oil prices. Conversely, in 2022, the global oil market experienced supply disruptions due to the Russia-Ukraine conflict, leading to significant price increases. This highlights the influence of supply disruptions on oil prices.

Economic Consequences of Rising or Falling Gas Prices

Rising gas prices can have several economic consequences:

- Increased Consumer Expenses:Higher gas prices lead to increased transportation costs for consumers, impacting their budgets and disposable income.

- Inflationary Pressure:Rising gas prices can contribute to broader inflation, as businesses pass on increased transportation costs to consumers in the form of higher prices for goods and services.

- Impact on Businesses:Businesses that rely heavily on transportation, such as trucking and delivery companies, may face increased costs, potentially affecting their profitability and employment.

- Economic Growth:High gas prices can stifle economic growth by reducing consumer spending and business investment.

Falling gas prices can have positive economic consequences:

- Increased Consumer Spending:Lower gas prices free up disposable income for consumers, potentially leading to increased spending on other goods and services, boosting economic activity.

- Reduced Inflationary Pressure:Falling gas prices can help alleviate inflationary pressures, as businesses may be able to reduce their own costs and pass on savings to consumers.

- Economic Growth:Lower gas prices can stimulate economic growth by encouraging consumer spending and business investment.

Public Opinion and Energy Policy

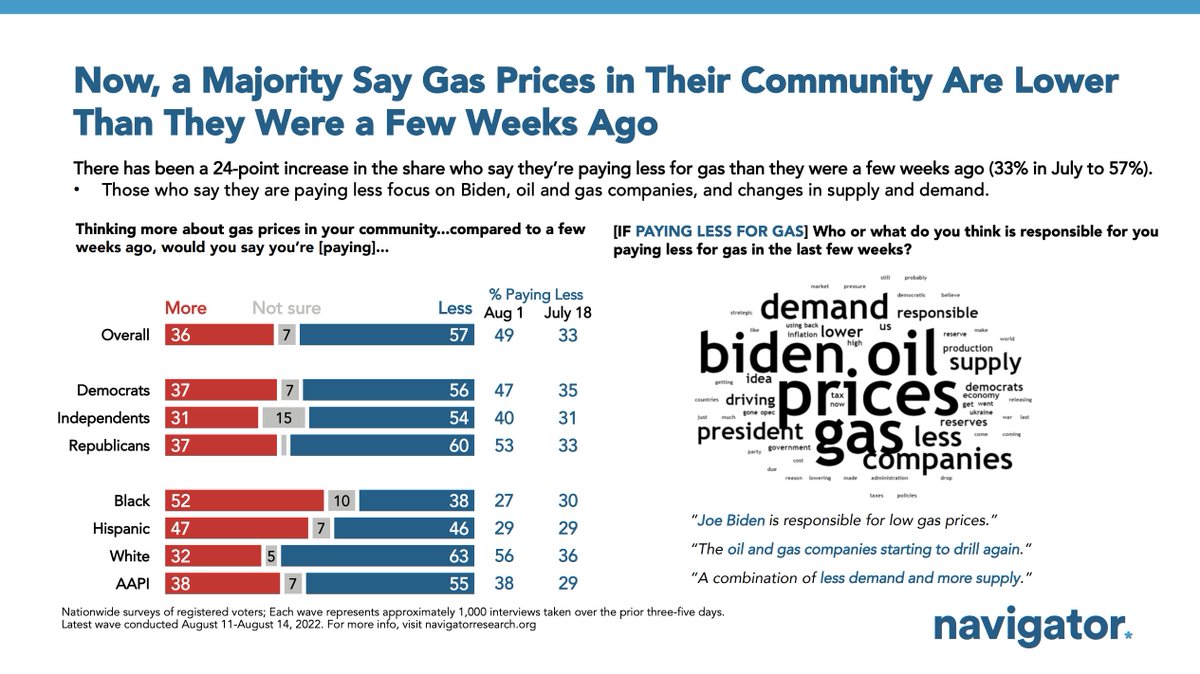

The White House’s call for increased oil production has sparked a debate about the role of energy policy in shaping public opinion. While some Americans support the move to increase domestic oil production, citing concerns about energy security and affordability, others express reservations due to environmental implications.

This complex issue involves balancing competing priorities, and understanding public sentiment is crucial for navigating the path forward.

Public Opinion on Increased Oil Production

Public opinion on the White House’s call for increased oil production is divided, with a range of factors influencing individual perspectives. Some Americans support the move, arguing that it will enhance energy independence, reduce reliance on foreign oil, and lower gasoline prices.

They emphasize the importance of domestic energy production for national security and economic stability. However, others express concerns about the environmental impact of increased oil production, citing potential damage to ecosystems, climate change, and public health risks. These individuals prioritize environmental sustainability and advocate for alternative energy sources.

Impact on Public Perception of Energy Policy

The White House’s call for increased oil production has the potential to significantly impact public perception of energy policy. Those who support the move may view it as a positive step towards achieving energy independence and economic prosperity. However, those who oppose it may perceive it as a step backward in terms of environmental protection and sustainability.

This divergence in perspectives can lead to increased polarization and complicate efforts to develop comprehensive and sustainable energy policies.

Trade-offs Between Energy Security and Environmental Concerns

The debate surrounding increased oil production highlights the inherent trade-offs between energy security and environmental concerns. While increased oil production can enhance energy independence and potentially lower gas prices, it also contributes to greenhouse gas emissions and exacerbates climate change.

Finding a balance between these competing priorities is essential for formulating responsible energy policies.

Role of Renewable Energy Sources

The call for increased oil production has also reignited discussions about the role of renewable energy sources in meeting energy demands. Advocates for renewable energy argue that it offers a sustainable alternative to fossil fuels, reducing greenhouse gas emissions and promoting energy independence.

They emphasize the growing affordability and efficiency of renewable technologies, such as solar and wind power.

Increased Oil Production vs. Renewable Energy Investments, White house issues muted call for oil companies to ramp up production

| Feature | Increased Oil Production | Renewable Energy Investments ||—|—|—|| Energy Security| Enhanced domestic energy production, reduced reliance on foreign oil | Promotes energy independence by diversifying energy sources || Economic Impact| Creates jobs in the oil and gas industry, potentially lowers gas prices | Creates jobs in the renewable energy sector, stimulates innovation || Environmental Impact| Contributes to greenhouse gas emissions, exacerbates climate change | Reduces greenhouse gas emissions, promotes sustainable development || Cost| Relatively low upfront costs, but long-term environmental costs are significant | Higher upfront costs, but long-term benefits include lower energy costs and reduced environmental impact || Technological Advancement| Mature technology, but limited potential for further innovation | Rapidly developing technologies, significant potential for future advancements |

Closing Summary

The White House’s call for increased oil production presents a complex challenge with far-reaching implications. While the administration aims to address rising gas prices and strengthen energy security, the move faces obstacles related to oil company responses, environmental concerns, and international dynamics.

The outcome will likely shape the future of energy policy and influence global energy markets for years to come.