Warren Buffett: Confidence in America, But Deficits Have Consequences

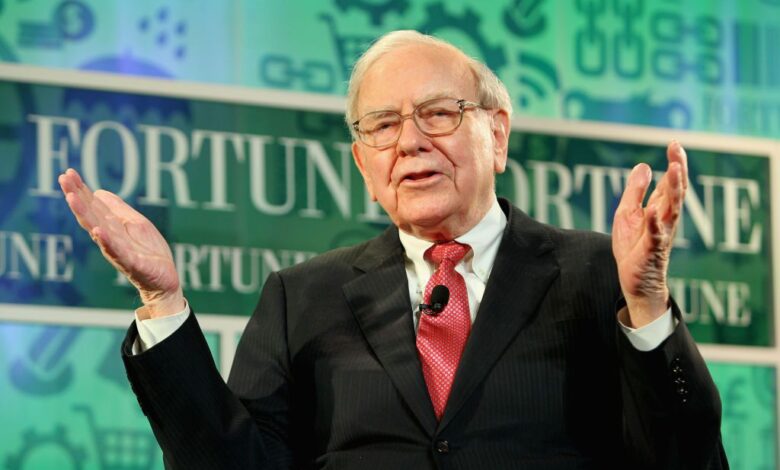

Warren Buffett preaches confidence in America warns deficits have consequences sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. The Oracle of Omaha, renowned for his investment prowess and wisdom, recently shared his thoughts on the American economy, expressing both optimism and caution.

Buffett, a long-time believer in the strength and resilience of the United States, acknowledged the potential for growth and prosperity, but also highlighted the concerning implications of government deficits.

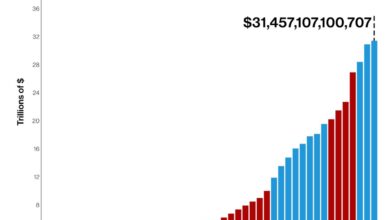

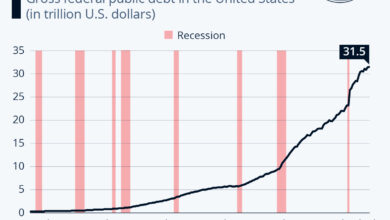

He argues that while the American economy remains fundamentally strong, the increasing national debt poses a significant risk to its long-term stability. Buffett’s analysis delves into the potential consequences of unchecked deficits, including inflation, higher interest rates, and a potential strain on future generations.

His perspective provides valuable insights into the delicate balance between economic optimism and the need for responsible fiscal management.

Warren Buffett’s Confidence in America

Warren Buffett, the renowned investor and CEO of Berkshire Hathaway, has long been a vocal advocate for the strength and resilience of the American economy. His unwavering belief in the US is reflected in his investment strategy, which focuses on long-term growth and value creation within American businesses.

Long-Term Investment Strategy

Buffett’s investment philosophy centers around identifying businesses with strong fundamentals, a durable competitive advantage, and a proven track record of success. He prioritizes companies that generate consistent cash flow, possess a strong management team, and operate in industries with long-term growth potential.

This approach, often referred to as “value investing,” emphasizes buying undervalued assets and holding them for the long haul, allowing for compounding returns over time.

Warren Buffett, a man who embodies American success, preaches confidence in the nation’s future, but he also cautions about the consequences of unchecked deficits. While he emphasizes the long-term resilience of the American economy, the current political climate seems to contradict his optimism.

It’s unsettling to see the political maneuvering play out, as highlighted in the article mccarthy dems would rather watch america suffer covid relief blocked , where partisan gridlock blocks vital aid. This kind of political deadlock only undermines confidence in the future and makes it harder for the country to address its financial challenges, echoing Buffett’s concerns about the consequences of neglecting fiscal responsibility.

Confidence in the American Economy

Buffett’s confidence in the American economy stems from his belief in the nation’s entrepreneurial spirit, its ability to innovate, and its capacity to adapt to changing circumstances. He views the US as a land of opportunity, where businesses can thrive and create value for their stakeholders.

Warren Buffett’s recent pronouncements about American confidence and the consequences of our ballooning deficits are timely, given the current political climate. While he encourages optimism, the ongoing debate about the potential consequences of unchecked spending raises questions about accountability. It’s interesting to ponder why the scrutiny directed at former President Trump’s handling of classified documents, as exemplified by the Mar-a-Lago raid, hasn’t been mirrored in the current administration, prompting some to ask why no Mar-a-Lago raid for Biden.

Ultimately, the nation’s fiscal future hinges on responsible leadership and a shared commitment to addressing these critical issues.

He often points to the country’s history of overcoming economic challenges, highlighting the resilience and adaptability of the American people.

Warren Buffett’s recent comments about the US economy highlight the importance of fiscal responsibility. While he remains confident in America’s long-term prospects, he warns that unchecked deficits will inevitably have consequences. This sobering message is echoed in the Arizona Supreme Court’s response to Kari Lake’s second election petition , which underscores the need for a robust and transparent electoral process.

As we navigate these turbulent times, it’s crucial to remember that responsible governance, coupled with unwavering faith in our institutions, are vital for a strong and prosperous future.

Examples of Buffett’s Investments

Buffett’s investment portfolio provides tangible evidence of his confidence in the US. Some notable examples include:

- Coca-Cola:Buffett’s investment in Coca-Cola, a company with a global brand and a strong track record of success, exemplifies his belief in the power of consumer brands and the long-term growth potential of the beverage industry.

- Apple:His investment in Apple, a technology giant that has consistently innovated and expanded its market share, showcases his belief in the transformative power of technology and the potential for American companies to dominate global industries.

- American Express:His long-standing investment in American Express, a financial services company with a strong brand and a loyal customer base, demonstrates his confidence in the financial sector and the importance of trusted brands in a competitive marketplace.

Concerns Regarding Deficits

While Buffett exudes confidence in America’s long-term potential, he also recognizes the potential dangers of unchecked government deficits. He views these deficits as a ticking time bomb, capable of undermining the very foundations of the economy he believes in.

Potential Consequences of High Debt Levels, Warren buffett preaches confidence in america warns deficits have consequences

High debt levels can have a significant impact on the economy. One of the most immediate concerns is inflation. When the government borrows money, it increases the supply of money in circulation, which can lead to rising prices.

“Inflation is like a tax on everyone, especially those who are least able to afford it.”

Warren Buffett

Another potential consequence is higher interest rates. As the government borrows more money, it competes with other borrowers for available funds, driving up interest rates. This can make it more expensive for businesses to borrow money, slowing economic growth.

Responsible Fiscal Policy

Buffett advocates for a responsible fiscal policy that balances spending with revenue. He believes that the government should prioritize spending on essential services and infrastructure while avoiding unnecessary expenditures. He also stresses the importance of reducing the national debt over time.

“The best way to reduce the deficit is to grow the economy.”

Warren Buffett

Buffett acknowledges that deficits can be necessary during times of economic crisis, but he believes that they should be temporary measures. He emphasizes the importance of long-term fiscal responsibility to ensure the sustainability of the American economy.

Conclusion: Warren Buffett Preaches Confidence In America Warns Deficits Have Consequences

Warren Buffett’s message is a timely reminder that while America’s future holds promise, addressing the issue of government deficits is crucial. His words serve as a call to action for policymakers and investors alike, urging them to consider the long-term implications of fiscal decisions.

By balancing optimism with a healthy dose of caution, Buffett’s analysis offers a valuable framework for navigating the complex economic landscape of the 21st century. His insights encourage us to embrace a balanced approach, one that prioritizes both growth and sustainability, ensuring a brighter future for generations to come.