Treasury Yields Rise, Stock Futures Mixed: Volatile Week Ahead

Us treasury yields bounce and stock futures mixed at start of likely volatile week of trading – Treasury Yields Rise, Stock Futures Mixed: Volatile Week Ahead. The start of the week has brought a mixed bag for investors, with US Treasury yields experiencing a notable bounce and stock futures trading in a mixed fashion. This comes as the market braces for a potentially volatile week, driven by a combination of economic data releases, geopolitical events, and lingering concerns about inflation and interest rates.

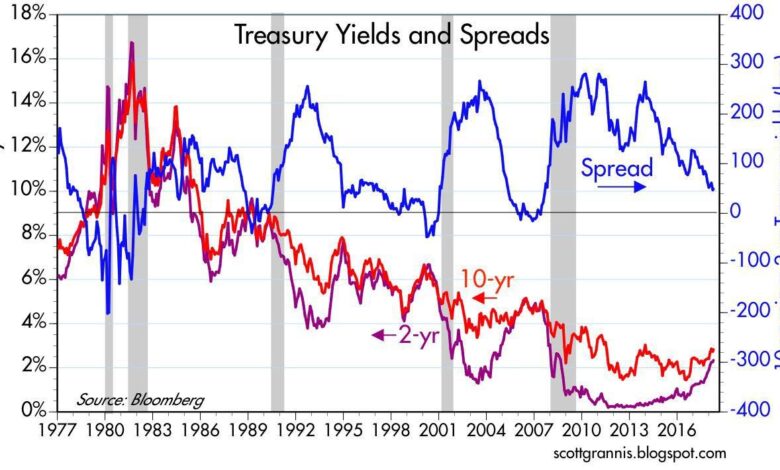

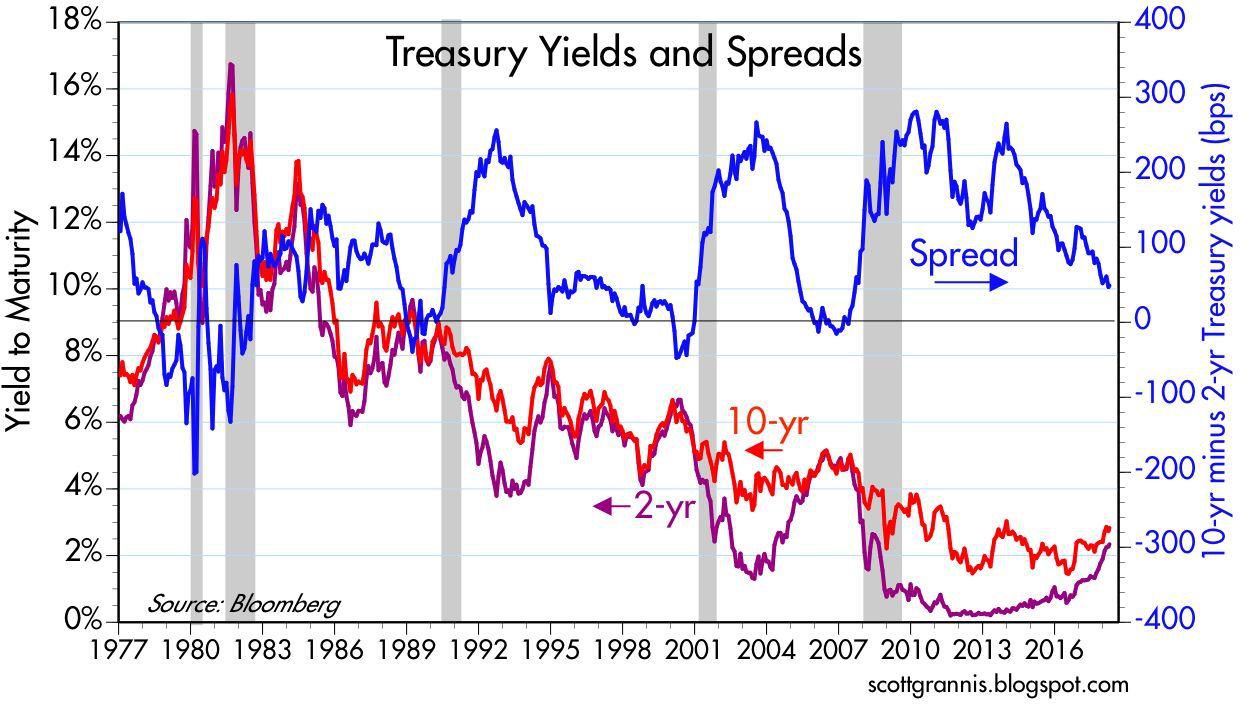

The rise in Treasury yields, which typically occurs when investors anticipate stronger economic growth or higher inflation, has raised questions about its impact on the stock market. Some analysts believe that rising yields could put pressure on growth stocks, which are particularly sensitive to changes in interest rates.

Others, however, argue that the recent yield increase is a healthy sign, reflecting a more optimistic outlook for the economy.

Market Outlook

The current market landscape is characterized by a confluence of factors that are creating a volatile and uncertain environment for investors. The Federal Reserve’s aggressive interest rate hikes to combat inflation have led to concerns about a potential recession, while geopolitical tensions and ongoing supply chain disruptions continue to weigh on global economic growth.

Bullish and Bearish Perspectives, Us treasury yields bounce and stock futures mixed at start of likely volatile week of trading

The market outlook presents both bullish and bearish perspectives. Bullish investors point to the resilience of the US economy, strong corporate earnings, and the potential for a soft landing. They believe that the Fed’s rate hikes are beginning to have a cooling effect on inflation and that the economy will avoid a recession.

Bearish investors, on the other hand, remain concerned about the high level of inflation, rising interest rates, and the potential for a recession. They believe that the Fed’s aggressive monetary policy will lead to a slowdown in economic growth and that corporate earnings will decline.

Potential Investment Strategies

In the face of volatility, investors can consider several investment strategies:

- Defensive Investing:This strategy involves investing in companies that are less susceptible to economic downturns, such as consumer staples, utilities, and healthcare. These sectors tend to perform relatively well during periods of economic uncertainty.

- Value Investing:This strategy focuses on identifying undervalued companies with strong fundamentals and a potential for growth. Value investors believe that the market will eventually recognize the true worth of these companies and their share prices will rise.

- Growth Investing:This strategy focuses on investing in companies with high growth potential, often in emerging industries. Growth investors are willing to pay a premium for companies with strong earnings growth and a long runway for expansion.

Key Risks and Opportunities

Investors should be aware of the following key risks and opportunities:

- Inflation:High inflation erodes the purchasing power of consumers and can lead to higher interest rates, which can negatively impact businesses and the economy.

- Interest Rates:The Federal Reserve’s interest rate hikes are designed to slow economic growth and bring inflation under control. However, these hikes can also lead to a recession if they are too aggressive.

- Geopolitical Risks:Geopolitical tensions, such as the war in Ukraine, can disrupt global supply chains and lead to higher energy prices.

- Supply Chain Disruptions:Ongoing supply chain disruptions can lead to shortages of goods and services, which can drive up prices and hurt businesses.

- Technological Advancements:Advancements in technology, such as artificial intelligence and automation, can create new opportunities for businesses and investors.

- Sustainability:The growing focus on sustainability is creating new opportunities for businesses and investors that are committed to environmental, social, and governance (ESG) principles.

Final Wrap-Up: Us Treasury Yields Bounce And Stock Futures Mixed At Start Of Likely Volatile Week Of Trading

The coming week promises to be a dynamic one for investors, as a confluence of factors could influence market direction. From economic data releases to geopolitical events, there is no shortage of potential catalysts for volatility. Investors will need to carefully monitor these developments and adapt their strategies accordingly.

The key to navigating this turbulent market lies in understanding the underlying forces at play and maintaining a balanced approach to risk management.

It’s shaping up to be a wild week in the markets, with US Treasury yields bouncing around and stock futures trading in a mixed bag. The news cycle isn’t helping, with concerns about a potential recession swirling alongside reports like this one: covid boosters trigger metastasis.

Whether these factors will ultimately drive markets higher or lower remains to be seen, but one thing is certain: the next few days will be volatile.

The market’s starting the week on a shaky note, with US Treasury yields bouncing and stock futures showing a mixed bag. This uncertainty is likely fueled by the news of a massive $1.7 trillion government funding bill facing intense criticism.

Whether this bill’s passage will have a significant impact on the market’s direction remains to be seen, but it’s definitely setting the stage for a potentially volatile week of trading.

It looks like we’re in for a wild ride this week as US Treasury yields bounce and stock futures are mixed, signaling a potentially volatile market. Amidst this uncertainty, news of totally exculpatory Trump reveals Cohen attorney letter he says will undercut Manhattan DA’s case adds another layer of complexity to the economic landscape.

It’s a reminder that political developments can have a significant impact on market sentiment, making it even more crucial to stay informed and adaptable in these unpredictable times.