US Housing Market: Facing Tough Times

US housing market facing many challenges from high mortgage rates to lack of supply, the American dream of homeownership is facing a tough reality. Rising interest rates have made mortgages significantly more expensive, putting a strain on affordability for potential buyers.

Simultaneously, the housing market is grappling with a chronic shortage of available homes, fueled by factors like escalating construction costs, restrictive zoning regulations, and limited land availability. This perfect storm of challenges is pushing home prices to record highs, intensifying competition among buyers, and casting a shadow of uncertainty over the future of the market.

These challenges are not isolated to a single region, as the US housing market is experiencing regional variations, each with its own unique set of factors. For instance, booming metropolitan areas are facing fierce competition and skyrocketing prices, while suburban communities and rural areas are grappling with their own issues related to population growth, job opportunities, and infrastructure development.

The economic landscape also plays a crucial role, with inflation, recession fears, and job market volatility adding to the complexities of the market. This creates a complex and dynamic landscape that requires careful consideration for anyone looking to buy or sell a home.

Rising Mortgage Rates

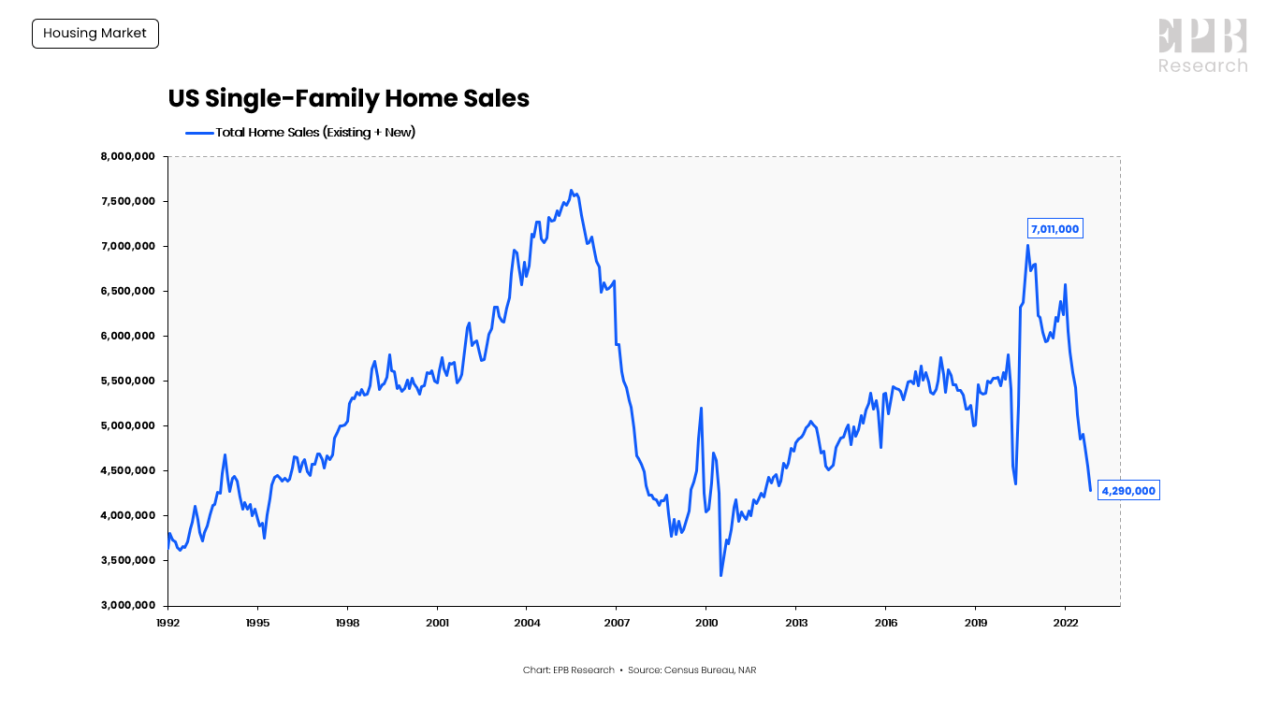

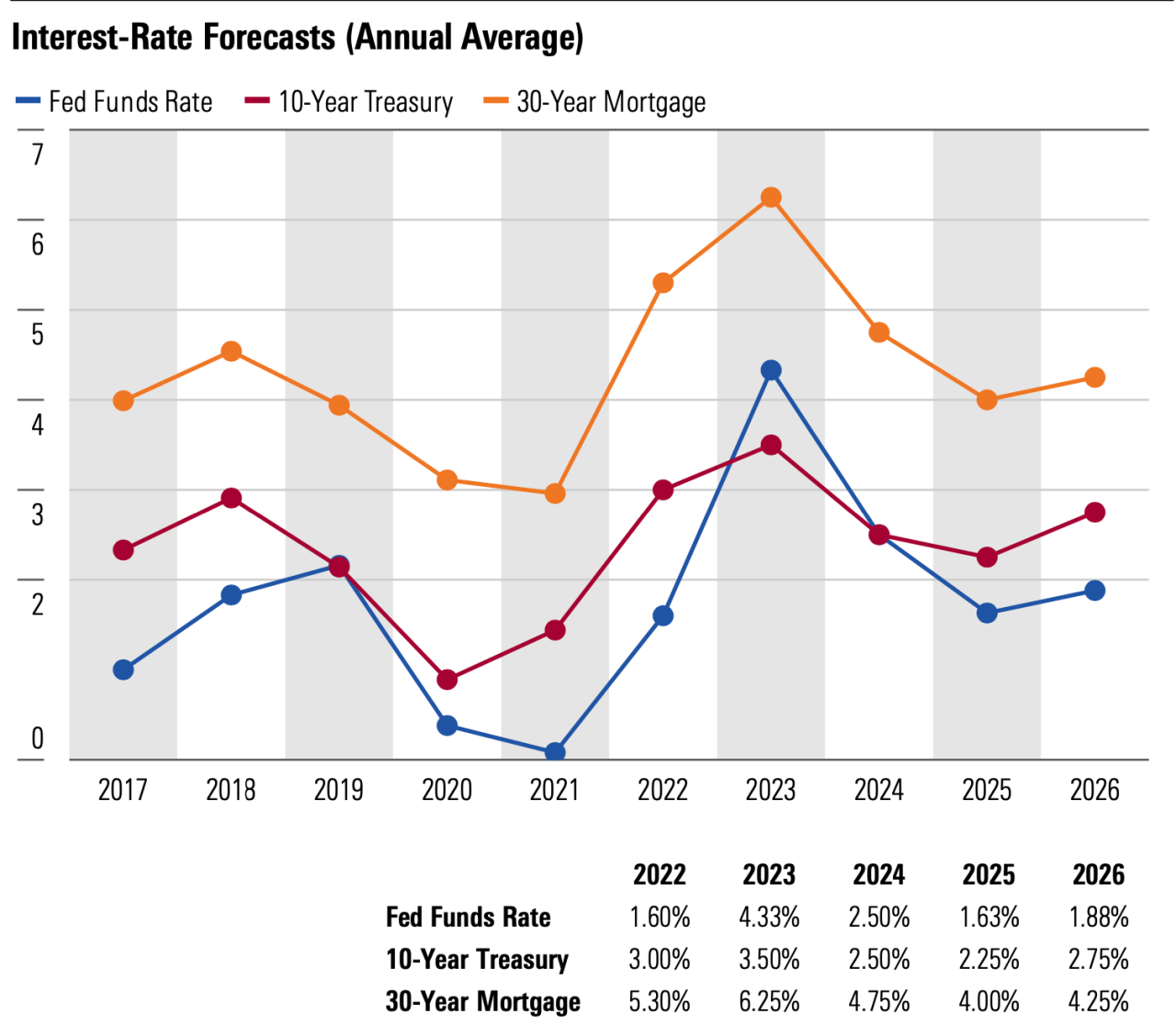

The recent surge in mortgage rates has significantly impacted the housing market, making homeownership less attainable for many potential buyers. This rise in rates has made borrowing money more expensive, resulting in higher monthly mortgage payments and a reduced purchasing power for buyers.

Impact on Affordability

The affordability of homes is directly tied to mortgage rates. When rates rise, the cost of borrowing money increases, making it more challenging for potential homebuyers to afford a mortgage. This is particularly true for first-time homebuyers who are often operating with tighter budgets.

For example, a $300,000 mortgage with a 30-year term at a 4% interest rate would have a monthly payment of approximately $1,432. However, if the interest rate were to increase to 6%, the monthly payment would jump to $1,798, representing a significant increase in monthly expenses.

The impact of rising mortgage rates on affordability is amplified by other factors, such as rising home prices and limited inventory.

The US housing market is a rollercoaster right now, with high mortgage rates making it tough for many to buy, and the lack of supply driving prices up. It’s a complex situation, and it makes me wonder if we’re seeing the same kind of misinformation that Dr.

Scott Atlas has been talking about, like in the case of Twitter’s COVID-19 censorship, which he claims led to loss of life. twitters covid 19 censorship led to loss of life says former white house adviser dr scott atlas Maybe we need to look beyond the headlines and consider how misinformation could be impacting the housing market as well.

Economic Uncertainty

The housing market is not immune to the broader economic landscape. Inflation, recession fears, and job market volatility all play a significant role in influencing homebuyer behavior and market dynamics. These economic factors can impact consumer confidence, affordability, and overall demand, ultimately shaping the trajectory of the housing market.

Impact of Inflation and Recession Fears

Inflation, characterized by a sustained increase in the general price level of goods and services, directly affects the housing market in several ways. Rising prices for building materials, labor, and other inputs contribute to higher construction costs, making new homes more expensive.

Additionally, inflation erodes the purchasing power of consumers, making it more challenging for them to afford a mortgage and save for a down payment. Recession fears, characterized by a significant decline in economic activity, can further dampen housing demand.

Consumers may become more cautious about making large financial commitments like buying a home if they anticipate job losses or reduced income.

The US housing market is facing a perfect storm of challenges, from sky-high mortgage rates to a persistent lack of supply. It’s almost enough to make you forget about the recent news that the US military recovered priority sensors and electronics from the downed Chinese spy balloon , though I guess that’s a whole other kind of “high-flying” situation.

But back to the housing market, it’s clear that these factors are making it increasingly difficult for many Americans to achieve the dream of homeownership.

Consumer Confidence and Economic Outlook

Consumer confidence, reflecting consumer sentiment about the economy and their financial well-being, plays a crucial role in homebuying decisions. When consumer confidence is high, people are more likely to make significant purchases, including homes. Conversely, low consumer confidence can lead to a decline in home sales as people become more hesitant to take on debt or make major financial commitments.

Economic outlook, encompassing projections about future economic growth, inflation, and job market conditions, also influences homebuyer behavior. Positive economic forecasts can boost consumer confidence and stimulate demand for housing, while negative outlooks can lead to market uncertainty and reduced demand.

Government Policies and Their Impact, Us housing market facing many challenges from high mortgage rates to lack of supply

Government policies can have a significant impact on the housing market. Interest rate adjustments by the Federal Reserve, designed to control inflation and stimulate economic growth, directly influence mortgage rates. Higher interest rates make it more expensive to borrow money, leading to reduced affordability and potentially slowing down home sales.

Government housing programs, such as tax credits or subsidies for first-time homebuyers, can incentivize homeownership and increase demand. Conversely, restrictions on lending practices or changes in tax policies related to homeownership can have a dampening effect on the market.

Regional Variations

The US housing market is not a monolith; it is a diverse landscape with distinct regional variations. Understanding these differences is crucial for comprehending the current challenges and navigating the complex dynamics of the market.

Local Factors Influencing Housing Trends

Local factors play a significant role in shaping housing trends across different regions.

- Population Growth:Areas experiencing rapid population growth, such as the Sun Belt states, often face higher demand for housing, leading to increased prices and competition.

- Job Opportunities:Regions with strong job markets, particularly those with thriving technology or manufacturing sectors, attract more residents, boosting housing demand.

The US housing market is a wild ride right now, with high mortgage rates and a lack of supply making it tough for many to find a place to call home. It’s a stark contrast to the headlines about a state supreme court blocking a mother from vaccinating her children against COVID-19 , a decision that highlights the deeply personal and often conflicting nature of health choices.

Even as we navigate these turbulent times, the housing market remains a major concern for many, especially those trying to break into homeownership.

- Infrastructure Development:Investments in transportation, utilities, and public amenities can enhance a region’s desirability, influencing housing values and attracting new residents.

Major Metropolitan Areas

Major metropolitan areas, such as New York City, Los Angeles, and San Francisco, face unique challenges in the housing market.

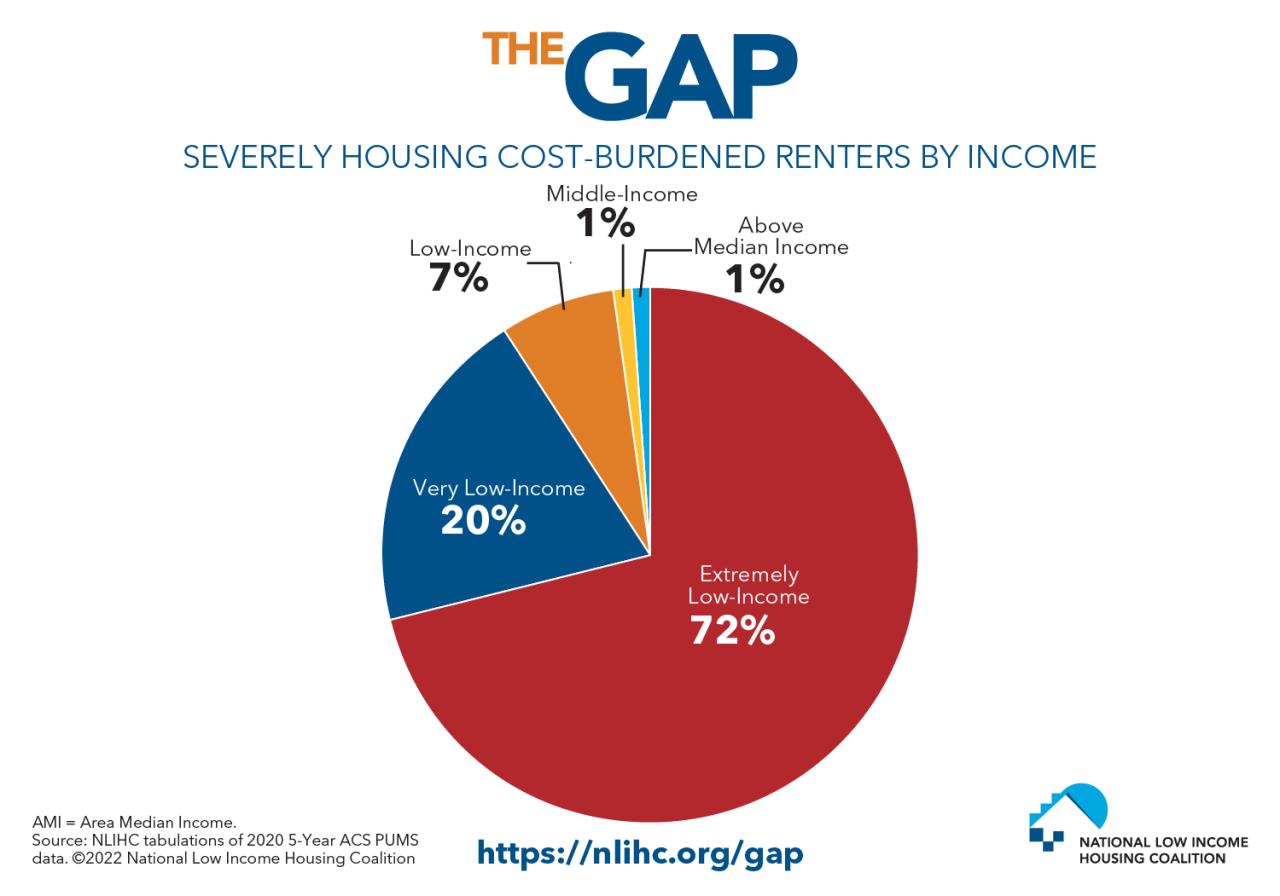

- High Demand and Limited Supply:These areas experience high demand due to their economic opportunities and cultural attractions, but limited land availability restricts new housing construction.

- Affordability Concerns:Rising housing costs make it difficult for many residents to afford living in these areas, particularly for lower-income households.

- Gentrification and Displacement:As these areas become more desirable, they may experience gentrification, pushing out long-term residents and contributing to affordability issues.

Suburban Communities

Suburban communities offer a different perspective on the housing market.

- Increased Affordability:Compared to major cities, suburbs often provide more affordable housing options, attracting families and individuals seeking more space and lower costs.

- Commuting Challenges:The trade-off for affordability is often longer commutes to urban employment centers, impacting residents’ time and expenses.

- Sprawl and Environmental Concerns:Suburban growth can lead to urban sprawl, raising concerns about environmental sustainability and the strain on infrastructure.

Rural Areas

Rural areas present a unique set of housing market dynamics.

- Lower Housing Costs:Rural areas generally offer lower housing costs, attracting retirees, remote workers, and those seeking a more affordable lifestyle.

- Limited Job Opportunities:Rural areas often face limited job opportunities, making it challenging for residents to find employment and support themselves.

- Infrastructure and Access:Rural areas may have limited access to healthcare, education, and other essential services, which can impact quality of life.

Future Outlook: Us Housing Market Facing Many Challenges From High Mortgage Rates To Lack Of Supply

Predicting the future of the US housing market is a complex task, influenced by a multitude of factors. While the current market is facing challenges, understanding the potential scenarios and influencing factors can help navigate the path ahead.

Potential Scenarios for the US Housing Market

The future of the US housing market is likely to be shaped by a combination of factors, leading to various potential scenarios. Here are some possibilities:

- A Soft Landing:This scenario envisions a gradual cooling of the market, with home prices stabilizing and sales slowing down. This could be driven by a moderation in mortgage rates and a gradual improvement in affordability. The market might experience a period of balanced growth, with a gradual increase in inventory and a more stable demand.

- A More Significant Correction:This scenario suggests a more pronounced downturn, with home prices experiencing a steeper decline. This could be triggered by continued high mortgage rates, a weakening economy, or a sudden shift in market sentiment. This scenario might lead to a period of increased inventory and lower sales volume.

- A Stagnant Market:This scenario presents a scenario of limited growth, with home prices remaining relatively flat and sales remaining low. This could be a result of persistent economic uncertainty, high mortgage rates, and a lack of inventory. The market might experience a period of prolonged stagnation, with minimal activity and price fluctuations.

Closure

The future of the US housing market is uncertain, but one thing is clear: the challenges it faces are multifaceted and interconnected. Navigating this complex landscape requires a deep understanding of the factors at play, as well as a willingness to adapt to changing market conditions.

Whether you’re a seasoned investor or a first-time homebuyer, staying informed about the latest trends and insights is essential to making sound decisions in this dynamic market.