US Home Prices Soar Despite High Mortgage Rates

US home prices continue to soar despite high mortgage rates, a seemingly contradictory trend that has baffled many. While interest rates have climbed, pushing up borrowing costs for homebuyers, the demand for housing remains strong, fueled by a variety of factors.

This creates a fascinating dynamic in the real estate market, one that begs the question: how can prices keep rising when it costs more to buy a home?

The answer lies in a complex interplay of economic forces, including low inventory, a robust job market, and a desire for larger living spaces in the wake of the pandemic. This perfect storm has propelled prices upward, leaving many prospective buyers wondering if they’ll ever be able to enter the market.

But is this just a temporary blip, or is this a sign of a new normal in the housing market?

Current Housing Market Dynamics

The US housing market is currently in a state of flux, grappling with a complex interplay of factors that are influencing home prices and buyer behavior. While home prices continue to climb, the pace of growth has slowed somewhat, and the market is showing signs of cooling.

The current dynamics of the housing market are largely driven by the interplay of supply, demand, and interest rates.

Factors Driving Home Price Increases

The persistent upward pressure on home prices can be attributed to several factors, including:

- Strong Demand:The demand for housing remains robust, fueled by a growing population, low unemployment, and a strong economy. This has resulted in a competitive market, with buyers often facing bidding wars and paying above asking prices.

- Limited Inventory:The supply of homes for sale has remained relatively low, further contributing to the high demand and price pressure. This shortage of inventory is partly due to factors like limited new construction, homeowners hesitant to sell due to low interest rates, and the lingering effects of the pandemic-induced housing boom.

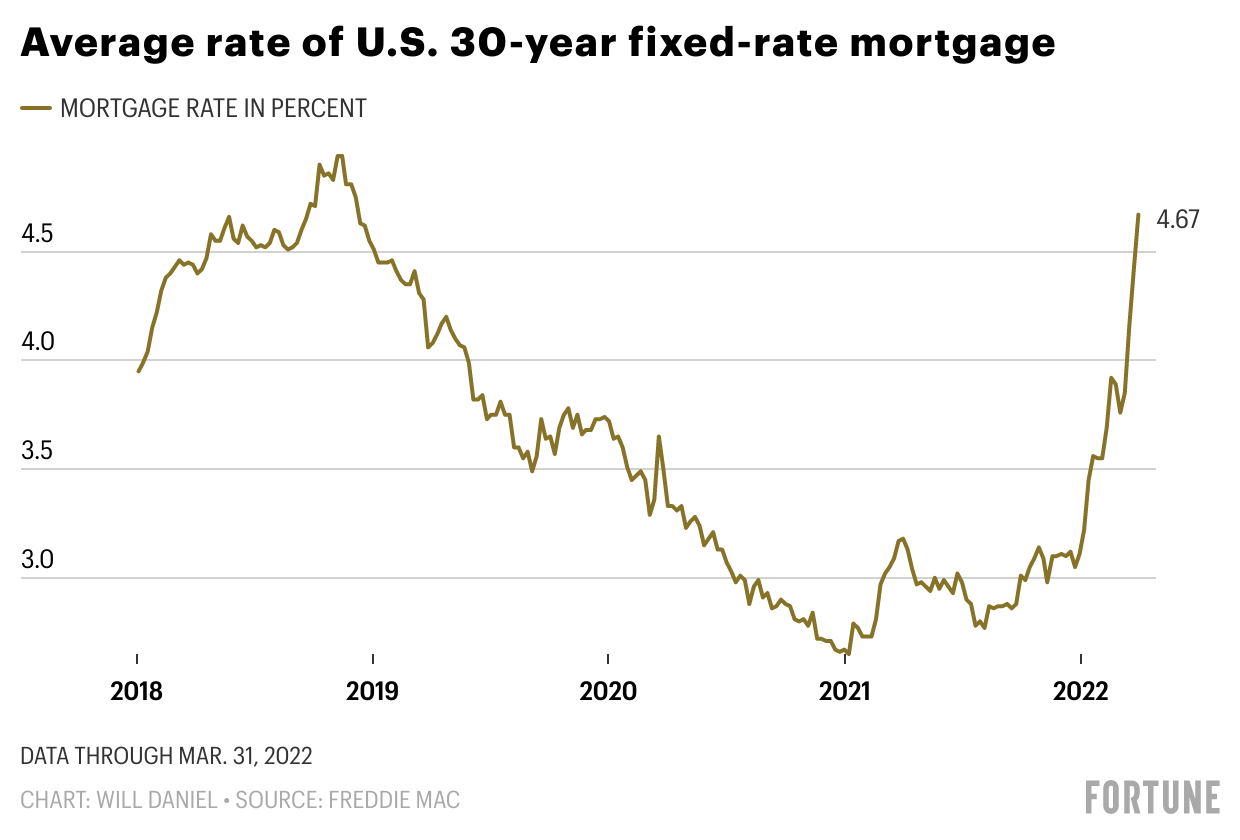

- Low Interest Rates (Historical):While interest rates have risen significantly in recent months, they remain historically low. This has allowed many buyers to afford larger mortgages, which has further fueled demand.

Impact of High Mortgage Rates on Affordability and Demand

The recent increase in mortgage rates has had a significant impact on buyer affordability and demand.

- Reduced Purchasing Power:Higher mortgage rates have reduced the amount of money that buyers can borrow, effectively shrinking their purchasing power. This has made it more challenging for some buyers to enter the market or afford homes in their desired price range.

It’s mind-boggling how US home prices keep climbing despite sky-high mortgage rates. Maybe it’s the same kind of disconnect that Dr. Scott Atlas, a former White House advisor, is talking about when he claims that Twitter’s COVID-19 censorship led to loss of life.

It’s a complex issue, and while the housing market is certainly a hot topic, I’m not sure what the answer is to the soaring prices.

- Cooling Demand:The rise in interest rates has led to a cooling of demand, as some buyers have been priced out of the market or are opting to wait for rates to stabilize. This has contributed to a slight slowdown in home price growth.

- Shift in Buyer Preferences:As mortgage rates have climbed, some buyers have shifted their preferences towards more affordable homes or locations. This has led to increased demand for smaller homes, townhouses, and condos, as well as properties in less expensive areas.

Supply and Demand Dynamics Influencing Home Prices

The relationship between supply and demand remains a key driver of home price fluctuations.

- Low Inventory:The ongoing shortage of homes for sale continues to put upward pressure on prices. This is particularly true in areas with high demand and limited new construction.

- Demand Outpacing Supply:The demand for housing continues to outpace supply in many markets, resulting in a competitive market with limited negotiation power for buyers.

- Potential for Price Stabilization:If inventory levels rise and demand cools further, it could lead to price stabilization or even a slight decline in some markets. However, it is difficult to predict the future trajectory of home prices with certainty, as the market is influenced by a complex interplay of factors.

Factors Contributing to Price Increases

The persistent rise in home prices, despite elevated mortgage rates, is a complex phenomenon driven by a confluence of economic and demographic forces. Understanding these factors is crucial for comprehending the current housing market dynamics and anticipating future trends.

Impact of Low Inventory and Strong Buyer Demand, Us home prices continue to soar despite high mortgage rates

The imbalance between supply and demand is a key driver of price increases. Low inventory, characterized by a limited number of homes available for sale, creates a competitive environment where buyers are often forced to bid above asking prices to secure a property.

It’s crazy how US home prices keep climbing even with mortgage rates skyrocketing. I mean, it’s hard enough to afford a house as it is, but now it feels like an impossible dream for many. And while we’re on the topic of unexpected hurdles, did you hear about the state supreme court blocking a mother from vaccinating her children against COVID-19 ?

Talk about a blow to personal autonomy! It just goes to show that even in the midst of financial turmoil, we’re facing some seriously strange and unpredictable situations. Anyway, back to the housing market… I’m just hoping we see some relief soon!

This scarcity is further amplified by strong buyer demand, fueled by factors such as population growth, low unemployment, and rising household incomes. In a scenario where demand outpaces supply, sellers hold a significant advantage, enabling them to command higher prices.

Rising Construction Costs

The escalating costs of construction materials, labor, and land are directly impacting the price of new homes. This upward pressure on building costs is transmitted to the existing housing market, as buyers often factor in the cost of new construction when making purchasing decisions.

For example, the price of lumber, a key component in home construction, has surged significantly in recent years, contributing to the overall increase in building costs.

Role of Inflation and Interest Rate Policies

Inflationary pressures, driven by factors such as supply chain disruptions and increased consumer demand, are contributing to the rise in home prices. As the cost of goods and services increases, so too does the cost of building and maintaining homes.

Interest rate policies, implemented by central banks to manage inflation, also play a role in shaping the housing market. Higher interest rates increase the cost of borrowing, potentially cooling demand and moderating price growth. However, the impact of interest rate policies on the housing market can be complex and may vary depending on other economic factors.

It’s hard to believe that US home prices are still climbing, even with mortgage rates at their highest point in years. It seems like everyone is scrambling for a piece of the American dream, but the market is definitely feeling the pressure.

Meanwhile, the news cycle keeps spinning, and it’s hard to ignore the latest developments in the legal battle against former President Trump. Totally exculpatory Trump reveals Cohen attorney letter he says will undercut Manhattan DA’s case , according to recent reports.

This news will likely fuel the fire of political discourse, but it’s unclear if it will have any lasting impact on the housing market. Perhaps, if the legal battles take a toll on the economy, we might see some softening in the housing market.

But for now, it seems like the demand for homes is still strong.

Regional Variations in Home Price Growth: Us Home Prices Continue To Soar Despite High Mortgage Rates

The US housing market is not monolithic. While nationwide trends are evident, regional variations in home price growth paint a more nuanced picture. Examining these disparities sheds light on the diverse factors driving the market in different parts of the country.

Regional Home Price Growth Rates

The following table displays average home price growth rates across different regions of the US, highlighting areas with the most significant increases:| Region | Average Home Price Growth Rate (Year-over-Year) ||—|—|| West | 10.5% || South | 9.8% || Midwest | 8.2% || Northeast | 7.5% | Note:These figures are based on data from the National Association of Realtors (NAR) for the first quarter of 2023.

Factors Contributing to Regional Differences

The disparities in home price growth across regions are driven by a complex interplay of factors, including:

- Population Growth and In-Migration:Regions experiencing strong population growth and in-migration, such as the West and South, often see higher demand for housing, driving up prices. For instance, the influx of people to cities like Phoenix, Arizona, and Austin, Texas, has significantly impacted their housing markets.

- Economic Strength and Job Market:Regions with robust economies and strong job markets tend to attract more buyers, boosting demand and supporting higher home prices. The technology sector’s presence in the San Francisco Bay Area, for example, has contributed to its consistently high home prices.

- Inventory Levels:Regions with low housing inventory, meaning fewer homes available for sale, experience higher competition among buyers, pushing prices upward. This is particularly true in areas with limited land availability or restrictive zoning regulations.

- Local Housing Market Dynamics:Unique local factors, such as the presence of desirable amenities, proximity to natural attractions, or specific lifestyle preferences, can also influence home price growth. For instance, coastal areas often command higher prices due to their desirable beachfront properties and lifestyle appeal.

Unique Market Conditions and Trends

Certain regions exhibit unique market conditions and trends that contribute to their distinct home price growth patterns:

- The Sun Belt:The Sun Belt region, encompassing states like Arizona, Florida, and Texas, has experienced a surge in home price growth fueled by population growth, favorable weather, and a lower cost of living compared to other parts of the country. This trend is expected to continue as more people seek out warmer climates and more affordable housing options.

- The West Coast:The West Coast, particularly California, remains a hotbed for home price growth, driven by a robust economy, a thriving technology sector, and a strong demand for housing in desirable coastal areas. However, affordability concerns and rising housing costs have led some residents to consider relocating to more affordable regions.

- The Northeast:The Northeast region, with its historic cities and established communities, has seen more moderate home price growth compared to other regions. Factors contributing to this trend include limited land availability, high property taxes, and a slower pace of population growth.

Implications for Homebuyers and Sellers

The current housing market, characterized by high home prices and mortgage rates, presents both challenges and opportunities for homebuyers and sellers. While sellers may enjoy favorable conditions, buyers face a more demanding landscape. Understanding the dynamics at play is crucial for navigating this complex market effectively.

Strategies for Homebuyers in a Competitive Market

Homebuyers in this market face significant challenges. High prices and rising interest rates increase the cost of homeownership, making it difficult for some to afford their dream home.

- Improve Financial Standing:Before entering the market, buyers should focus on improving their credit score and saving for a substantial down payment. This strengthens their financial position, making them more attractive to lenders and giving them greater negotiating power.

- Explore Alternative Financing Options:Buyers can consider alternative financing options, such as adjustable-rate mortgages (ARMs), which may offer lower initial interest rates but could increase over time. However, it is essential to carefully assess the risks and potential long-term implications of such options.

- Be Prepared to Compromise:In a competitive market, buyers may need to adjust their expectations and be willing to compromise on factors like location, size, or amenities. Focusing on essential needs and prioritizing affordability can help narrow the search and increase the likelihood of finding a suitable property.

- Work with a Knowledgeable Real Estate Agent:A skilled and experienced real estate agent can provide invaluable guidance and support throughout the homebuying process. They can help navigate the complexities of the market, identify potential properties, negotiate effectively, and ensure a smooth transaction.

Maximizing Returns for Home Sellers

Sellers in this market enjoy a favorable position, with high demand and strong prices. However, maximizing returns requires strategic planning and execution.

- Prepare the Property for Sale:A well-presented property attracts more buyers and can command a higher price. This includes making necessary repairs, decluttering, staging, and ensuring curb appeal. Investing in professional services like staging can significantly enhance the appeal and increase the chances of a successful sale.

- Set the Right Asking Price:Overpricing can deter potential buyers and prolong the sale process. A realistic asking price, based on market data and comparable properties, can attract serious offers and expedite the sale. Working with a knowledgeable real estate agent can help determine the optimal asking price.

- Be Flexible with Offers:While sellers are in a strong position, remaining open to negotiations and considering reasonable offers can help close a deal faster and avoid potential delays. Flexibility and a willingness to compromise can be advantageous in a competitive market.

- Market the Property Effectively:A well-executed marketing strategy can attract a wider audience and generate more interest. This includes professional photography, virtual tours, and online listings on multiple platforms. Utilizing social media and other channels can also broaden the reach and attract potential buyers.

Impact of Rising Home Prices on Market Stability

While rising home prices benefit sellers, concerns arise regarding long-term market stability. A rapid increase in prices can create a bubble, which could potentially burst, leading to a market correction.

- Affordability Concerns:Continued price increases can make homeownership increasingly unaffordable for many, particularly first-time buyers. This can limit market demand and potentially lead to a slowdown in price growth.

- Interest Rate Volatility:Rising interest rates can significantly impact affordability, making it more expensive to finance a mortgage. This can dampen demand and potentially trigger a price correction.

- Economic Factors:External economic factors, such as inflation, unemployment, and recessionary pressures, can also influence housing market stability. These factors can impact affordability, demand, and overall market sentiment.

Future Outlook and Potential Trends

Predicting the future of the housing market is a complex endeavor, as it’s influenced by a myriad of economic and social factors. However, by analyzing current trends and considering potential shifts, we can gain insights into the possible trajectory of home prices, mortgage rates, and buyer behavior in the coming months and years.

Impact of Economic Conditions on Home Price Growth

The current economic climate, characterized by inflation, rising interest rates, and potential recessionary pressures, will undoubtedly play a significant role in shaping the future of home prices. While home prices have remained resilient in the face of recent economic challenges, their growth rate is likely to slow down or even decline in the coming months.

The Federal Reserve’s ongoing efforts to curb inflation through interest rate hikes could lead to a decrease in affordability, making it more difficult for potential buyers to qualify for mortgages. This could result in reduced demand, ultimately impacting home price growth.

Factors Influencing Mortgage Rates

Mortgage rates are influenced by a complex interplay of factors, including the Federal Reserve’s monetary policy, inflation, and investor sentiment. As the Federal Reserve continues to raise interest rates to combat inflation, mortgage rates are expected to remain elevated in the near term.

However, the trajectory of mortgage rates is uncertain and will depend on the effectiveness of the Fed’s actions in controlling inflation. If inflation begins to cool down, the Fed may slow or even pause its rate hikes, potentially leading to a decline in mortgage rates.

Conversely, if inflation proves more persistent, the Fed may need to continue raising rates, potentially pushing mortgage rates even higher.

Potential Shifts in Buyer Behavior and Demand

The current economic landscape is likely to influence buyer behavior and demand in the housing market. As affordability becomes a growing concern, some buyers may choose to postpone their home purchase decisions, while others may shift their focus towards more affordable properties or locations.

This could lead to a decrease in demand in the higher-priced segments of the market, potentially resulting in price adjustments. Conversely, the growing demand for rental properties, driven by rising housing costs and limited homeownership opportunities, could lead to increased competition and higher rental rates.

Closure

The current housing market presents a unique challenge for both buyers and sellers. While high prices offer lucrative opportunities for those looking to sell, the rising cost of borrowing makes it difficult for many to enter the market. The future remains uncertain, with economists predicting a potential slowdown in price growth.

However, the underlying factors driving demand remain strong, suggesting that the market is likely to remain competitive for the foreseeable future. As we navigate this turbulent landscape, it’s crucial to stay informed and adapt to the evolving dynamics of the housing market.