US Economy Declines 1.4 Percent in 1st Quarter

Us economy declines 1 4 percent in 1st quarter – US Economy Declines 1.4 Percent in 1st Quarter, a stark reminder of the economic challenges facing the nation. This decline, the first contraction since the pandemic-induced recession of 2020, underscores the impact of inflation, rising interest rates, and ongoing supply chain disruptions on businesses and consumers alike. The first quarter of 2023 saw a significant decrease in consumer spending, a key driver of economic growth, as inflation eroded purchasing power and forced households to tighten their belts.

The decline in the US economy is a complex issue with multiple contributing factors. A deeper dive into the data reveals a slowdown in business investment, driven by uncertainty surrounding the economic outlook and rising interest rates. Government spending, while a potential tool for stimulating growth, has also been impacted by ongoing political debates and concerns about rising deficits.

Adding to the complexity, the global economic landscape remains fragile, with geopolitical tensions and the ongoing war in Ukraine adding further uncertainty to the outlook.

Economic Overview

The US economy experienced a 1.4% decline in the first quarter of 2023, marking a significant contraction in economic activity. This decline signifies a slowdown in economic growth, raising concerns about the potential for a recession. While a single quarter of negative growth doesn’t necessarily indicate a recession, it serves as a warning sign and prompts closer examination of the underlying factors contributing to this downturn.

Factors Contributing to the Decline

The decline in the US economy during the first quarter can be attributed to a combination of factors, including a slowdown in consumer spending, reduced business investment, and a decrease in government spending.Consumer spending, which accounts for a significant portion of US economic activity, slowed down during the first quarter. This decline can be attributed to several factors, including inflation, rising interest rates, and a decline in consumer confidence.Business investment also declined during the first quarter, reflecting uncertainty about the economic outlook.

Businesses are hesitant to invest in new projects or expand operations when they are unsure about future demand and economic conditions.Government spending also contributed to the decline in the first quarter, as federal spending on goods and services decreased. This reduction in government spending was largely driven by a decline in defense spending.

Historical Comparisons, Us economy declines 1 4 percent in 1st quarter

The 1.4% decline in the US economy during the first quarter of 2023 is comparable to other economic contractions in recent history. For instance, the US economy contracted by 3.5% in the first quarter of 2020, during the early stages of the COVID-19 pandemic. However, the current decline is less severe than the contraction experienced during the Great Recession, when the US economy shrank by 8.4% in the first quarter of 2009.

Business Investment: Us Economy Declines 1 4 Percent In 1st Quarter

Business investment plays a crucial role in driving economic growth. When businesses invest, they create jobs, increase productivity, and boost innovation. This investment can take various forms, including spending on new equipment, facilities, and research and development.

Challenges Facing Businesses

Businesses are facing a number of challenges in the current economic environment, which can impact their investment decisions. Two significant challenges are:

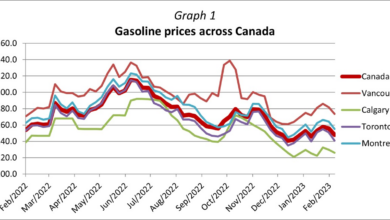

- Rising Interest Rates: Higher interest rates make borrowing more expensive, discouraging businesses from taking on debt to fund expansion or new projects. This can lead to a slowdown in investment and economic growth. For example, in the United States, the Federal Reserve has been raising interest rates to combat inflation, making it more expensive for businesses to access capital.

- Supply Chain Disruptions: The global supply chain has been disrupted by factors such as the COVID-19 pandemic and the war in Ukraine. These disruptions have led to higher input costs, delays in production, and uncertainty about future supply. This can make businesses hesitant to invest in new projects, as they are unsure of the long-term availability of materials and components.

Strategies for Optimizing Investment Decisions

Businesses can implement several strategies to navigate these challenges and make optimal investment decisions:

- Focus on Efficiency: Businesses can improve efficiency by optimizing their operations, reducing waste, and adopting new technologies. This can help them control costs and remain competitive even in a challenging economic environment. For example, companies can invest in automation to improve productivity and reduce labor costs.

- Diversify Supply Chains: Businesses can mitigate supply chain risks by diversifying their suppliers and sourcing materials from multiple locations. This can help them avoid disruptions and secure access to essential resources. For example, a company might source components from both domestic and international suppliers to reduce its dependence on a single source.

- Invest in Innovation: Businesses can invest in research and development to create new products, services, and technologies. This can help them gain a competitive advantage and drive growth in the long term. For example, companies can invest in developing sustainable products or technologies that meet emerging market needs.

- Strategic Partnerships: Businesses can form strategic partnerships with other companies to share resources, expertise, and risk. This can help them access new markets, reduce costs, and enhance their competitiveness. For example, two companies might collaborate on a joint venture to develop a new product or enter a new market.

The 1.4% decline in the US economy during the first quarter is a sobering reminder of the challenges facing the nation. While the full impact of this contraction remains to be seen, the data suggests that the road to economic recovery will be bumpy. The combination of inflation, rising interest rates, and global economic uncertainty presents a complex set of challenges that will require a multifaceted approach to address.

The effectiveness of policy responses will be crucial in determining the trajectory of the US economy in the coming months and years.

The US economy took a hit in the first quarter, declining by 1.4 percent. While this contraction might be attributed to various factors, it’s worth noting that the warning signs show great resignation not slowing down randstad survey , suggesting a continued labor shortage. This could further impact businesses, leading to reduced productivity and potentially exacerbating the economic downturn.

The US economy’s 1.4% decline in the first quarter is a stark reminder of the challenges we face. It’s a time when we need strong leadership and a focus on the needs of the people, not just the interests of a select few. The recent controversy surrounding the Twitter board, with many arguing they aren’t representing shareholders like Elon Musk , highlights the importance of prioritizing the collective good over individual agendas.

As we navigate these turbulent economic waters, it’s crucial to remember that a healthy economy requires a system that works for everyone, not just a privileged few.

The US economy’s decline of 1.4% in the first quarter is a worrying sign, and it’s interesting to see how this news intersects with the recent Twitter board’s approval of a poison pill after Musk’s $43 billion offer to buy the company. While these are seemingly separate events, they both point to a sense of uncertainty and volatility in the market.

It’s a reminder that even as we navigate economic challenges, the tech world is experiencing its own shakeups.