Fed Rate Cut Fuels Market Highs

The feds 0 5 rate cut delivered new market highs – The Fed’s 0.5% rate cut delivered new market highs, signaling a potential shift in economic sentiment. This move, a significant departure from previous monetary policy, has sparked debate about its impact on inflation, interest rates, and the broader economy. The market’s immediate response was a surge in stock prices, with investors seemingly optimistic about the Fed’s willingness to stimulate growth.

But are these highs sustainable? And what are the long-term implications for businesses and consumers?

This rate cut is a bold move by the Federal Reserve, aiming to counter the current economic headwinds. While the Fed seeks to encourage growth, the rate cut also presents potential risks. It’s crucial to consider the intricate interplay between inflation, interest rates, and economic growth, and how this decision might impact these factors in the future.

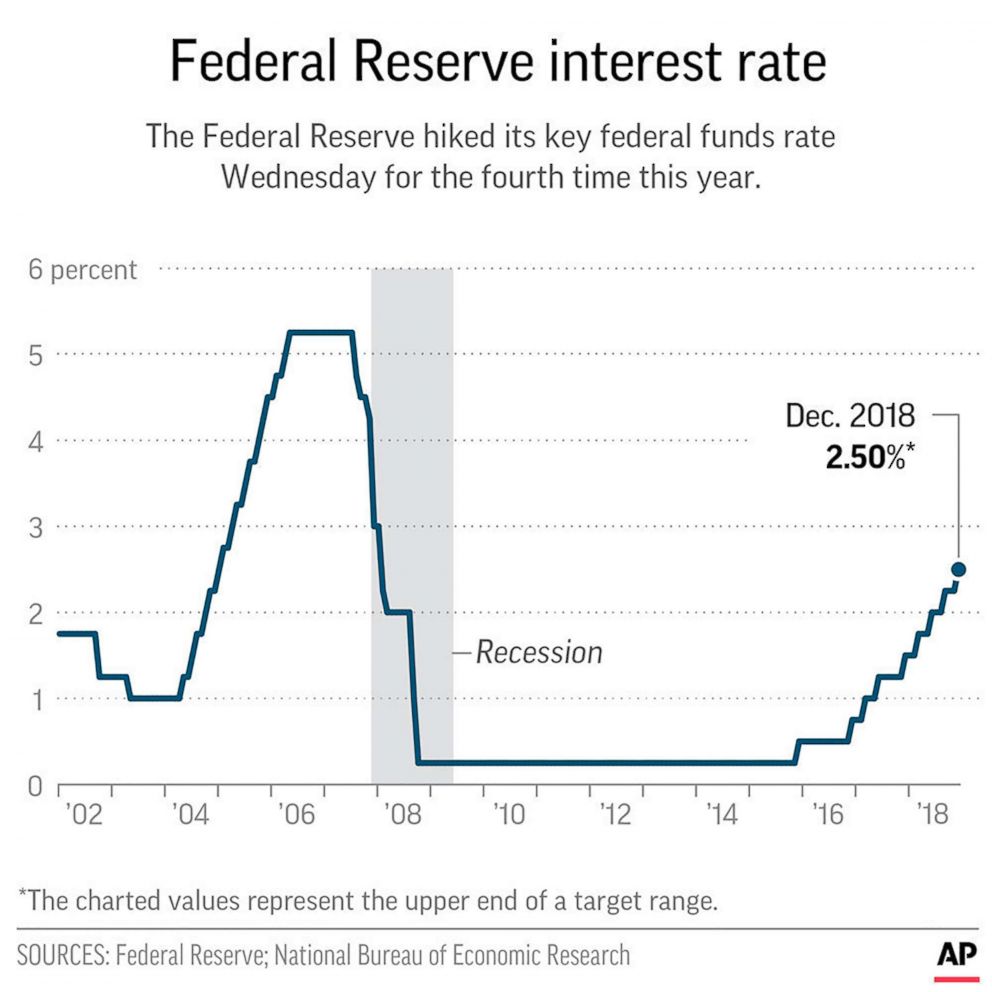

The Federal Reserve’s Rate Cut

The Federal Reserve’s decision to cut interest rates by 0.5% is a significant move aimed at mitigating the potential economic risks associated with the current environment. This action, taken amidst global economic uncertainties and a slowdown in domestic growth, reflects the Fed’s commitment to supporting economic stability and fostering sustainable growth.

The Impact of the Rate Cut

The rate cut is intended to stimulate economic activity by making it cheaper for businesses to borrow money and invest. Lower interest rates can also boost consumer spending as borrowing costs for mortgages, auto loans, and other consumer credit decrease.

This can lead to increased demand for goods and services, ultimately driving economic growth.

The Fed’s 0.5 rate cut has definitely energized the market, driving it to new highs. It’s interesting to see this happen amidst the growing legal effort to disqualify Republicans as insurrectionists , which could significantly impact the political landscape. While the market seems to be celebrating the rate cut, it’s unclear how this legal battle will play out and how it might affect the economy in the long run.

Potential Impact on Inflation

The rate cut could potentially impact inflation by increasing the money supply. With more money in circulation, demand for goods and services may rise, potentially leading to higher prices. However, the Fed’s primary objective is to ensure that inflation remains within its target range, and it will closely monitor economic data to adjust its monetary policy accordingly.

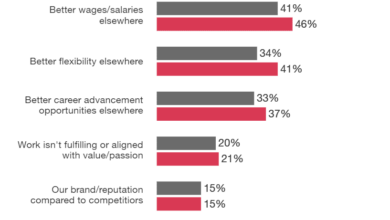

Comparison to Previous Fed Actions

This rate cut is a significant departure from the Fed’s previous policy stance, which involved gradual interest rate increases. The decision to cut rates reflects the changing economic landscape, with heightened concerns about global economic growth and potential risks to the U.S.

economy.

The Fed’s 0.5 rate cut has certainly sent the market soaring, with new highs being reached across the board. It’s interesting to see how this plays out in the long term, and whether it’s a sustainable trend. I’m curious to see what Sen Kevin Cramer would say about the impact of this move on the economy, given his focus on fiscal responsibility.

Ultimately, time will tell if the Fed’s actions are enough to bolster the market and drive continued growth.

Rationale Behind the Decision

The Fed’s decision to cut rates is based on a number of factors, including slowing economic growth, trade tensions, and uncertainty surrounding global economic conditions. The Fed believes that a rate cut is necessary to support economic activity and mitigate the potential risks to the U.S.

economy.

Market Reactions to the Rate Cut: The Feds 0 5 Rate Cut Delivered New Market Highs

The Federal Reserve’s decision to cut interest rates sent shockwaves through the financial markets, eliciting a wave of positive reactions. Investors, anticipating a boost to economic growth, responded with enthusiasm, pushing asset prices higher across various sectors.

Stock Market Response

The stock market, a bellwether of investor sentiment, immediately surged following the announcement. Major stock indices like the Dow Jones Industrial Average and the S&P 500 experienced significant gains, reflecting investors’ optimism about the rate cut’s potential to stimulate economic activity and corporate earnings.

This surge was driven by a combination of factors, including:

- Lower borrowing costs:The rate cut makes it cheaper for companies to borrow money, which can be used for expansion, investment, and hiring, leading to increased profitability and economic growth.

- Improved consumer spending:Lower interest rates can also encourage consumers to spend more, as they have more disposable income due to lower borrowing costs on mortgages, auto loans, and other consumer credit.

- Increased corporate investment:Lower borrowing costs can encourage businesses to invest in new projects, which can lead to job creation and economic growth.

Bond Market Response

The bond market, typically considered a safe-haven asset, also reacted positively to the rate cut. Bond yields, which move inversely to prices, fell as investors sought to lock in lower yields on newly issued bonds. This decline in yields reflects the expectation of a more favorable economic environment, where inflation is likely to remain low.

Other Financial Instruments

The rate cut also influenced other financial instruments, such as the US dollar and commodities. The US dollar weakened against other major currencies, as the rate cut made the dollar less attractive to foreign investors. Commodities, including oil and gold, rose in price as investors sought alternative investments with potential for higher returns.

Reasons for the Positive Response

The market’s positive response to the rate cut can be attributed to a number of factors, including:

- Expectations of economic growth:Investors anticipate that the rate cut will stimulate economic activity, leading to increased corporate earnings and higher stock prices.

- Low inflation:The current low inflation environment makes it easier for the Fed to lower interest rates without triggering a surge in prices.

- Global economic uncertainty:The rate cut provides some relief from global economic uncertainty, as it signals the Fed’s commitment to supporting economic growth.

Potential Concerns

While the market’s initial reaction to the rate cut was positive, there are potential concerns that could dampen investor enthusiasm in the long term:

- Effectiveness of the rate cut:There is no guarantee that the rate cut will have the desired effect on the economy, as it is just one tool in the Fed’s arsenal.

- Rising debt levels:Lower interest rates can encourage consumers and businesses to take on more debt, which could lead to financial instability in the future.

- Geopolitical risks:Global economic uncertainty, including trade wars and geopolitical tensions, could continue to weigh on market sentiment.

New Market Highs

The Federal Reserve’s decision to cut interest rates by 0.5% has sent shockwaves through the financial markets, leading to a surge in stock prices and pushing major indices to new highs. This bullish sentiment reflects a combination of factors, including investor optimism about the rate cut’s potential to stimulate economic growth, positive economic data releases, and strong corporate earnings reports.

Investor Sentiment and Market Performance

Investor sentiment plays a crucial role in driving market performance. The rate cut has instilled confidence among investors, leading to increased risk appetite and a willingness to allocate capital to equities. This is evident in the significant increase in trading volume and the surge in demand for growth stocks, which are often considered riskier but offer higher potential returns.

Economic Data and Market Trends, The feds 0 5 rate cut delivered new market highs

Recent economic data releases have provided further support for the market’s bullish trajectory. The unemployment rate has remained low, consumer spending has been robust, and inflation has shown signs of moderating. These positive indicators suggest that the economy is on a solid footing, supporting the argument that the rate cut will further fuel growth.

Corporate Earnings and Market Expectations

Strong corporate earnings reports have also contributed to the market’s upward momentum. Companies across various sectors have exceeded analysts’ expectations, demonstrating resilience and strong profit margins. These positive earnings announcements signal confidence in the future and provide investors with further justification for their bullish outlook.

Comparison to Historical Market Highs

While the current market highs are a positive sign, it’s important to consider historical periods of market exuberance. During periods of rapid economic growth and low interest rates, markets have often experienced significant gains, followed by sharp corrections. This cyclical nature of the market underscores the importance of remaining cautious and considering potential risks.

Potential Risks and Opportunities

The current market environment presents both opportunities and risks. While the rate cut and positive economic data suggest continued growth, investors should remain aware of potential headwinds, such as geopolitical tensions, rising inflation, and potential policy changes. However, the strong economic fundamentals and the rate cut’s potential to boost growth create opportunities for investors to capitalize on the market’s upward trajectory.

The Fed’s 0.5% rate cut sent the market soaring, pushing stocks to new highs. It’s hard to focus on anything else when the economy is booming, but the political scene is far from quiet. Speaker Johnson’s statement that the Trump trial is a “travesty of justice” speaker johnson says trump trial is a travesty of justice is a stark reminder that the nation is deeply divided.

Despite the economic optimism, the political climate remains tense, and the Fed’s rate cut might not be enough to bridge the gap.

Economic Outlook and Future Implications

The Federal Reserve’s rate cut, while intended to stimulate economic growth, is a complex measure with potential positive and negative implications for the economy. The impact of the rate cut will depend on various factors, including the response of businesses and consumers, the state of global markets, and the overall economic environment.

Impact on Future Economic Growth and Inflation

A rate cut can stimulate economic growth by making it cheaper for businesses to borrow money and invest. Lower borrowing costs can lead to increased business investment, hiring, and economic activity. However, the rate cut can also lead to increased inflation.

When interest rates are low, people are more likely to borrow money and spend, which can increase demand and push prices higher. The rate cut’s impact on future economic growth and inflation will depend on the balance between these opposing forces.

Global Economic Context

The Federal Reserve’s rate cut has implications that extend far beyond the US economy, impacting global economic conditions and financial markets. This decision is intertwined with the actions of other central banks and the broader economic landscape.

Impact on Other Countries’ Economies and Financial Markets

The Fed’s rate cut can influence other countries’ economies and financial markets through various channels.

- Currency Fluctuations:A rate cut can weaken the US dollar, making US exports more competitive and potentially impacting other currencies. For example, a weaker dollar can make US goods cheaper for buyers in countries with stronger currencies, potentially benefiting US exporters.

However, it can also lead to currency depreciation in other countries, making imports more expensive and potentially contributing to inflation.

- Capital Flows:Lower interest rates in the US can attract foreign investors seeking higher returns, leading to capital inflows to the US. This can appreciate the US dollar and potentially impact interest rates in other countries.

- Economic Growth:A rate cut can stimulate economic growth in the US, which can have spillover effects on other economies through trade and investment. However, the impact on other countries can vary depending on their economic structure and trade relationships with the US.

Comparison of Fed’s Approach to Other Central Banks’ Policies

The Fed’s approach to monetary policy is not always in sync with other central banks.

- Divergent Policies:While the Fed has opted for a rate cut, other central banks might have different policy stances. For instance, some central banks might maintain or even raise interest rates based on their own economic conditions and inflation targets.

- Global Economic Impact:Divergent monetary policies can create volatility in global financial markets and potentially impact exchange rates and capital flows. For example, if the Fed cuts rates while other central banks maintain or raise rates, it can create a differential in interest rates, potentially leading to capital outflows from countries with higher rates and inflows to the US.

- Coordination and Cooperation:Central banks often engage in communication and coordination to manage global economic stability. However, the extent of coordination can vary, and divergent policies can create challenges for global economic management.

Last Recap

The Fed’s rate cut has undoubtedly created a ripple effect in the market, but its long-term consequences remain uncertain. While the immediate response has been positive, it’s essential to remain vigilant and analyze the broader economic context. The interplay between the Fed’s actions, global economic conditions, and investor sentiment will shape the trajectory of the markets in the coming months.

It’s a time for both optimism and cautious observation, as we navigate the complex landscape of economic policy and market dynamics.