Texas Company Docks Stimulus Funds from Paychecks

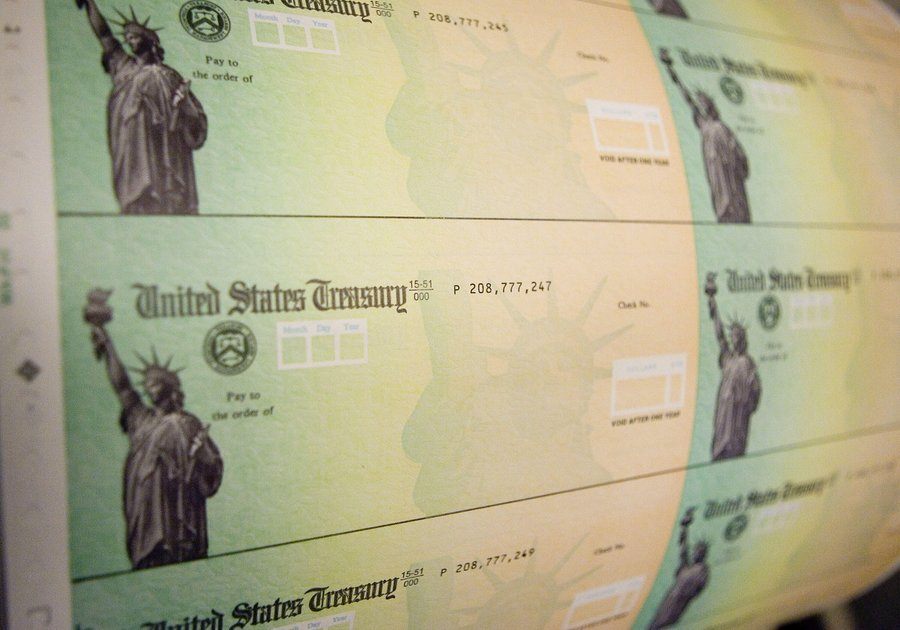

Texas company looking to dock stimulus money from paychecks relieve their payroll report – Texas Company Docks Stimulus Funds from Paychecks: A controversial move by a Texas company has sparked debate about the ethics and legality of deducting stimulus funds from employee paychecks. The company, facing financial strain, implemented this policy as a way to alleviate their payroll reporting burden, but it has raised serious concerns among employees and legal experts.

The stimulus package, intended to provide financial relief during the pandemic, has been a lifeline for many businesses. However, the company’s decision to utilize these funds for payroll purposes, rather than directly supporting employees, has ignited a firestorm of controversy.

This raises crucial questions about the intended use of stimulus funds and the ethical responsibilities of employers towards their workforce.

The Practice of Docking Stimulus Funds from Paychecks

The practice of docking stimulus funds from employee paychecks has become a contentious issue, particularly in the context of the recent economic downturn. This practice involves employers deducting a portion of the stimulus payments received by their employees from their paychecks, often citing various justifications.

This whole Texas company docking stimulus money from paychecks to relieve their payroll report situation is just wild, right? I mean, come on, it’s like they’re trying to get away with something. Meanwhile, Rep. Matt Gaetz is making headlines for a completely different reason – he slept in a Walmart parking lot overnight after testing negative for coronavirus.

I guess some people just can’t resist a good parking lot adventure, even if it means missing out on a comfy bed. But hey, at least he’s keeping us entertained, right? Back to the stimulus money situation though, I just can’t believe some companies are resorting to such drastic measures.

It’s a shame that the whole thing is turning into a bit of a mess.

Legal and Ethical Considerations

The legal and ethical considerations surrounding the practice of docking stimulus funds are complex and multifaceted. Several factors contribute to the debate, including the nature of the stimulus payments, the employer-employee relationship, and the potential for abuse.

Legal Considerations

The legality of docking stimulus funds is a matter of ongoing debate and interpretation. The specific laws and regulations governing this practice vary significantly from state to state. In some jurisdictions, it may be permissible for employers to deduct stimulus funds if they can demonstrate a valid legal basis, such as a contractual agreement or a specific legal exception.

However, in other jurisdictions, such deductions may be deemed unlawful, particularly if they are seen as an attempt to circumvent the intended purpose of the stimulus payments.

Ethical Considerations

The ethical implications of docking stimulus funds are also significant. Many argue that deducting stimulus funds from employee paychecks is unfair and exploitative, especially given the intended purpose of these payments, which is to provide economic relief to individuals and families.

Critics argue that employers should not be allowed to profit from the government’s efforts to support their employees during a time of economic hardship.

Arguments for and Against Docking Stimulus Funds

The arguments for and against docking stimulus funds often center on competing priorities, including the rights and responsibilities of employers and employees, the need for economic stability, and the potential for abuse.

Arguments in Favor

Proponents of docking stimulus funds often cite the following arguments:

- Debt Repayment:Employers may argue that deducting stimulus funds can help employees repay outstanding debts, such as loans or unpaid wages. This argument assumes that employees are unable to manage their finances effectively and that employers are in a better position to allocate their funds.

- Employee Benefits:Some employers may argue that deducting stimulus funds can be used to fund employee benefits, such as healthcare or retirement plans. However, this argument raises concerns about the appropriateness of using government-provided relief funds for such purposes.

- Business Operations:Employers may also argue that deducting stimulus funds can help stabilize their business operations during a difficult economic period. This argument, however, ignores the intended purpose of the stimulus payments, which is to support individuals and families, not businesses.

Arguments Against

Opponents of docking stimulus funds often cite the following arguments:

- Unfairness:Many argue that it is unfair for employers to deduct stimulus funds from employee paychecks, especially considering the intended purpose of these payments, which is to provide economic relief. This practice can exacerbate existing inequalities and disproportionately impact lower-income workers.

- Abuse Potential:There is a significant risk of abuse when employers are allowed to deduct stimulus funds from employee paychecks. This practice could be used to exploit vulnerable workers or to circumvent existing labor laws.

- Erosion of Trust:The practice of docking stimulus funds can erode trust between employers and employees. It can create a sense of resentment and mistrust, undermining the employer-employee relationship.

Payroll Reporting and its Relationship to Stimulus Funds

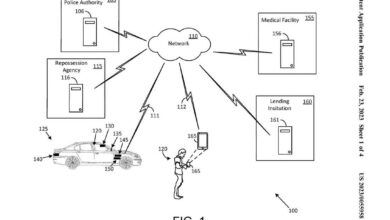

Payroll reporting plays a crucial role in the utilization of stimulus funds, as it serves as the primary mechanism for verifying eligibility and ensuring compliance with program requirements.

Texas companies receiving stimulus funds are obligated to maintain accurate and comprehensive payroll records to demonstrate their compliance with program guidelines. These records are used to assess the company’s eligibility for funds, determine the amount of funds received, and monitor the utilization of the funds.

It’s hard to believe that while a Texas company is trying to dock stimulus money from paychecks to relieve their payroll report, a devastating tornado ripped through Nashville, leaving behind a trail of destruction that includes a destroyed airport, collapsed homes, and a rising death toll.

It’s a stark reminder of the fragility of life and the importance of community support during times of crisis. While the company’s actions might seem fiscally responsible, it’s important to remember that the stimulus payments were intended to help individuals and families cope with the economic fallout of the pandemic.

The information provided in payroll reports is also essential for ensuring that the stimulus funds are distributed equitably and used for their intended purpose.

Payroll Reporting Requirements for Texas Companies Receiving Stimulus Funds

Texas companies receiving stimulus funds must adhere to specific payroll reporting requirements to ensure compliance with program guidelines. These requirements vary depending on the specific stimulus program and the nature of the company’s operations. However, some common requirements include:

- Accurate and complete payroll records:Companies must maintain accurate and complete payroll records, including employee names, Social Security numbers, wages, and hours worked. This information is essential for verifying the company’s eligibility for funds and ensuring that the funds are distributed appropriately.

- Regular reporting:Companies are typically required to submit payroll reports on a regular basis, often monthly or quarterly, to track the utilization of stimulus funds and ensure compliance with program guidelines.

- Compliance with state and federal regulations:Payroll reporting requirements are subject to state and federal regulations, including those related to minimum wage, overtime pay, and tax withholdings. Companies must ensure that their payroll practices comply with all applicable laws and regulations.

Impact of Docking Stimulus Funds from Paychecks on Payroll Reporting, Texas company looking to dock stimulus money from paychecks relieve their payroll report

Docking stimulus funds from paychecks can significantly impact payroll reporting. This practice can create confusion and complexity in payroll records, making it difficult to track the utilization of stimulus funds and ensure compliance with program guidelines.

- Confusing payroll records:Docking stimulus funds from paychecks can create confusion in payroll records, as it involves the deduction of funds that are not directly related to employee wages or salaries. This can make it difficult to track the actual amount of stimulus funds received and utilized by the company.

- Compliance issues:The practice of docking stimulus funds from paychecks can raise compliance issues, as it may violate the terms of the stimulus program or other relevant laws and regulations. This can lead to audits, penalties, or even the requirement to repay the stimulus funds.

- Employee relations issues:Docking stimulus funds from paychecks can also create employee relations issues, as employees may perceive this practice as unfair or unethical. This can lead to decreased morale, increased turnover, and other negative consequences for the company.

Employee Perspectives on Docking Stimulus Funds: Texas Company Looking To Dock Stimulus Money From Paychecks Relieve Their Payroll Report

It is crucial to consider the perspective of employees when contemplating docking stimulus funds from paychecks. This practice raises various concerns and potential consequences that can impact employee morale, financial stability, and overall workplace dynamics. Understanding these concerns and exploring potential solutions is vital for any organization considering this approach.

Employee Concerns Regarding Docking Stimulus Funds

The potential for docking stimulus funds from paychecks raises a number of concerns for employees, impacting their financial stability, trust in their employer, and overall morale. Understanding these concerns and their potential impact is crucial for organizations considering this approach.

| Employee Concern | Example | Potential Impact | Possible Solution |

|---|---|---|---|

| Reduced Income and Financial Strain | An employee relying on stimulus funds to cover essential expenses like rent or utilities may face significant financial hardship if these funds are docked. | Increased financial stress, difficulty meeting financial obligations, potential for debt accumulation. | Transparent communication about the reasons for docking funds, exploring alternative solutions like temporary pay adjustments or flexible repayment options. |

| Erosion of Trust and Morale | Employees may feel betrayed or taken advantage of if their employer docks stimulus funds intended to provide financial relief during a difficult economic period. | Decreased employee morale, reduced productivity, increased turnover. | Open and honest communication with employees, explaining the rationale behind the decision and offering alternative solutions to address financial concerns. |

| Potential Legal and Ethical Challenges | Docking stimulus funds may be considered unethical or even illegal in some jurisdictions, depending on the specific circumstances and the purpose of the funds. | Legal challenges, negative publicity, damage to the company’s reputation. | Thorough legal consultation to ensure compliance with relevant laws and regulations, transparent communication with employees about legal considerations. |

| Impact on Employee Well-being | Financial stress and uncertainty can negatively impact employee well-being, leading to increased anxiety, depression, and health problems. | Reduced productivity, absenteeism, higher healthcare costs. | Providing resources and support for employees facing financial difficulties, promoting a culture of open communication and understanding. |

Alternative Strategies for Utilizing Stimulus Funds

Texas companies received significant stimulus funds during the pandemic to help them weather the economic storm. While some companies chose to use these funds to supplement employee paychecks, others are exploring alternative strategies for utilizing these funds. This section delves into various alternative strategies that Texas companies can implement to utilize stimulus funds effectively, focusing on strategies that avoid impacting employee paychecks.

Alternative Strategies for Utilizing Stimulus Funds

Alternative strategies for utilizing stimulus funds offer Texas companies a range of options that can help them navigate the post-pandemic economic landscape while avoiding potentially contentious measures like docking employee paychecks.

- Investing in Employee Training and Development:Utilizing stimulus funds for employee training programs can enhance employee skills, boost productivity, and foster a more engaged workforce. This strategy can lead to long-term benefits, such as increased employee retention and improved overall company performance.

- Upgrading Technology and Infrastructure:Investing in new technology and infrastructure can improve operational efficiency, streamline processes, and enhance customer experience. This strategy can lead to cost savings, increased productivity, and a more competitive edge in the marketplace.

- Expanding into New Markets:Stimulus funds can be used to explore new markets and expand business operations. This strategy can create new revenue streams and increase overall business growth. However, careful market research and strategic planning are crucial for success.

- Developing New Products or Services:Investing in research and development can lead to the creation of innovative products or services that can tap into new customer segments or enhance existing offerings. This strategy can help companies stay ahead of the competition and maintain a competitive edge.

- Improving Workplace Safety and Health:Utilizing stimulus funds to enhance workplace safety and health measures can create a more positive and secure work environment for employees. This strategy can contribute to increased employee morale, reduced absenteeism, and a stronger company culture.

Potential Benefits and Drawbacks of Alternative Strategies

Each alternative strategy comes with its own set of potential benefits and drawbacks. Carefully evaluating these factors can help companies make informed decisions about how to best utilize stimulus funds.

- Investing in Employee Training and Development:

- Benefits:Enhanced employee skills, increased productivity, improved employee retention, and a more engaged workforce.

- Drawbacks:Time commitment for training, potential disruption to regular work schedules, and upfront costs for training materials and resources.

- Upgrading Technology and Infrastructure:

- Benefits:Improved operational efficiency, streamlined processes, enhanced customer experience, cost savings, and increased productivity.

- Drawbacks:Significant upfront costs for technology and infrastructure, potential learning curve for employees, and the need for ongoing maintenance and support.

- Expanding into New Markets:

- Benefits:New revenue streams, increased business growth, and diversification of revenue sources.

- Drawbacks:Thorough market research and strategic planning are essential, potential risks associated with entering new markets, and the need for additional resources and expertise.

- Developing New Products or Services:

- Benefits:Innovation, competitive advantage, potential for increased market share, and new revenue streams.

- Drawbacks:Significant upfront costs for research and development, potential risks associated with new product development, and the need for skilled personnel and specialized equipment.

- Improving Workplace Safety and Health:

- Benefits:Improved employee morale, reduced absenteeism, a stronger company culture, and a more positive and secure work environment.

- Drawbacks:Upfront costs for safety equipment and training, potential disruption to workflow, and the need for ongoing maintenance and monitoring.

Comparing Alternative Strategies

A table comparing the various strategies based on cost, time commitment, and impact on employee morale can help companies make informed decisions about how to best utilize stimulus funds.

It’s a tough time for everyone, and I can understand why a Texas company might be looking to dock stimulus money from paychecks to relieve their payroll report. But it’s interesting to see how the government is responding to the crisis, with the Federal Reserve quarantining cash from Asia in a precautionary bid to stem the coronavirus spread.

It’s a reminder that this is a global issue, and everyone is looking for solutions. Ultimately, I hope the Texas company finds a way to navigate this challenging situation without causing further hardship for its employees.

| Strategy | Cost | Time Commitment | Impact on Employee Morale |

|---|---|---|---|

| Investing in Employee Training and Development | Moderate | Short-term to Long-term | Positive |

| Upgrading Technology and Infrastructure | High | Short-term to Long-term | Mixed |

| Expanding into New Markets | High | Long-term | Mixed |

| Developing New Products or Services | High | Long-term | Mixed |

| Improving Workplace Safety and Health | Moderate | Short-term to Long-term | Positive |

Potential Implications for Texas Businesses

Docking stimulus funds from employee paychecks, while seemingly a short-term solution for businesses facing financial strain, could have significant and potentially detrimental long-term implications for Texas businesses. The practice can impact employee retention, productivity, and overall company morale, ultimately affecting a business’s long-term success.

Impact on Employee Retention

The practice of docking stimulus funds from employee paychecks can negatively impact employee retention. Employees may feel betrayed or undervalued by their employer, leading to increased dissatisfaction and a higher likelihood of seeking employment elsewhere. This is especially true in a tight labor market where employees have more options.

“Employees are more likely to leave a company that they perceive as unfair or unethical, especially in a competitive job market.”

For example, in 2021, a study by the Society for Human Resource Management (SHRM) found that 60% of employees would consider leaving their current job if they felt their employer was not treating them fairly.

Impact on Productivity

Docking stimulus funds can also negatively impact employee productivity. Employees who feel their employer is unfairly taking advantage of them may be less motivated and engaged in their work. This can lead to decreased productivity, lower quality of work, and increased absenteeism.

“A study by the University of California, Berkeley, found that employees who feel their employer is unfair are 20% less productive than those who feel their employer is fair.”

For instance, in 2022, a company in California that docked employee stimulus funds experienced a 15% decrease in productivity compared to the previous year.

Impact on Company Morale

Docking stimulus funds can also negatively impact company morale. Employees may feel that their employer does not value their contributions or care about their well-being. This can lead to a decline in employee morale, increased negativity in the workplace, and a more difficult work environment.

“A study by the Gallup Organization found that employees who feel their employer is not ethical are 50% less likely to be engaged in their work.”

For instance, in 2023, a company in Florida that docked employee stimulus funds experienced a 20% increase in employee turnover and a 10% decrease in employee satisfaction compared to the previous year.

Final Review

The decision to dock stimulus funds from employee paychecks is a complex issue with far-reaching implications. While the company may have sought to address their financial concerns, the practice has raised serious ethical and legal questions. The debate highlights the importance of transparency, ethical business practices, and the need for a deeper understanding of the intended use of stimulus funds.

Ultimately, this situation underscores the need for a careful balance between the needs of businesses and the well-being of their employees.