AI Frenzy & Strong Banks Boost Stocks Today

Stock market today wall streets ai frenzy and strong bank profits send stocks higher – AI Frenzy & Strong Banks Boost Stocks Today sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with personal blog style and brimming with originality from the outset. Wall Street is buzzing with excitement about the potential of artificial intelligence (AI), and its impact on the stock market is already being felt.

Strong bank profits are adding fuel to the fire, sending stocks soaring.

This week, investors have been treated to a double dose of good news. The AI boom is in full swing, with companies like Nvidia and Alphabet leading the charge. Meanwhile, major banks like JPMorgan Chase and Bank of America are reporting record profits, fueled by strong lending and investment banking activity.

The combination of these two factors has created a powerful tailwind for the stock market, pushing major indices to new highs.

Wall Street’s AI Frenzy

Wall Street is currently experiencing an AI frenzy, with investors and financial institutions alike rushing to embrace artificial intelligence (AI) as a game-changer in the industry. This surge in interest has fueled a significant rise in the stock prices of AI-focused companies, pushing the technology sector to new heights.

AI Companies Leading the Charge

The AI frenzy on Wall Street is driven by a handful of key players, each with its own unique strengths and contributions to the field. These companies are attracting substantial investments and are rapidly expanding their operations, leading the way in AI innovation and application.

- Nvidia: A leading provider of graphics processing units (GPUs), essential for AI development and training, Nvidia has witnessed a surge in demand for its products as AI applications become increasingly sophisticated. The company’s stock price has soared in recent months, reflecting investor confidence in its dominant position in the AI hardware market.

- Microsoft: With its Azure cloud platform, Microsoft is a major player in the AI infrastructure space, providing the computing power and tools necessary for AI development and deployment. The company has invested heavily in AI research and development, integrating AI capabilities across its products and services, from its search engine Bing to its productivity suite Office 365.

- Google: As a pioneer in AI research and development, Google has made significant advancements in areas such as natural language processing, computer vision, and machine learning. The company’s AI technologies are integrated into its search engine, advertising platform, and other products, driving its continued growth and success.

- Amazon: Amazon’s cloud platform, Amazon Web Services (AWS), offers a wide range of AI services, including machine learning, natural language processing, and computer vision. AWS has become a popular choice for businesses looking to adopt AI solutions, contributing to Amazon’s strong financial performance.

AI Applications in the Financial Sector

AI is revolutionizing the financial sector, enabling faster, more efficient, and data-driven decision-making. The potential benefits of AI in finance are vast, ranging from risk management and fraud detection to personalized investment advice and automated trading.

- Risk Management: AI algorithms can analyze vast amounts of data, including market trends, economic indicators, and company financials, to identify potential risks and mitigate their impact. This can help financial institutions make more informed decisions about lending, investments, and other financial operations.

- Fraud Detection: AI can be used to detect fraudulent transactions by identifying patterns and anomalies in data that might not be apparent to human analysts. This can help banks and other financial institutions protect their customers and prevent financial losses.

- Personalized Investment Advice: AI-powered robo-advisors can provide personalized investment advice based on an individual’s financial goals, risk tolerance, and other factors. This can make investing more accessible and affordable for a wider range of individuals.

- Automated Trading: AI algorithms can execute trades automatically based on predefined rules and market conditions. This can help traders improve their efficiency and reduce the risk of emotional biases affecting their decisions.

Strong Bank Profits

Wall Street’s AI frenzy wasn’t the only reason for the stock market’s rise today. Strong bank earnings also played a significant role, signaling a robust financial sector and overall economic health.These robust profits reflect a combination of factors, including rising interest rates, increased lending activity, and a strong demand for financial services.

Wall Street’s buzzing today, fueled by the AI frenzy and strong bank earnings, sending stocks soaring. It’s a stark contrast to the news that Project Veritas has lost hundreds of thousands of followers following James O’Keefe’s exit , a reminder that even in the face of market optimism, the world of social media and news remains volatile.

With the AI sector leading the charge, investors are betting on a future of technological advancement and economic growth, making today’s market a fascinating reflection of our ever-changing world.

Factors Contributing to Strong Bank Profits

The recent rise in interest rates has been a boon for banks, as it allows them to earn more on their loans. This is particularly true for banks with large loan portfolios, as they can charge higher interest rates on their loans.

Another factor contributing to strong bank profits is increased lending activity. This is driven by a strong economy and healthy consumer demand. As businesses and individuals borrow more money, banks earn more interest income.Finally, the demand for financial services remains strong, with banks benefiting from increased activity in areas such as investment banking, wealth management, and trading.

The stock market’s on a roll today, fueled by AI frenzy and strong bank profits. But amidst the bullish sentiment, it’s important to remember the ethical concerns surrounding corporate funding of medical associations. These concerns could impact investor confidence in the long run, so it’s a factor to keep in mind as we celebrate the market’s gains.

Performance of Major Banks

Major banks have reported strong earnings, with many exceeding analysts’ expectations. For example, JPMorgan Chase, the largest bank in the United States, reported a 52% increase in profits in the first quarter of 2023. Bank of America, another major bank, reported a 23% increase in profits during the same period.

Wall Street is buzzing today, fueled by a frenzy over AI and strong bank profits, sending stocks soaring. Amidst the economic optimism, President Biden made a surprise visit to Ukraine, pledging an additional $500 million in aid as part of ongoing support for the country’s defense against Russia.

This news, combined with the positive economic indicators, is likely to further bolster investor confidence and continue driving the market upward.

These strong earnings have led to increased optimism about the future of the banking sector. Investors are confident that banks will continue to perform well, driven by a strong economy and rising interest rates.

Stock Market Performance: Stock Market Today Wall Streets Ai Frenzy And Strong Bank Profits Send Stocks Higher

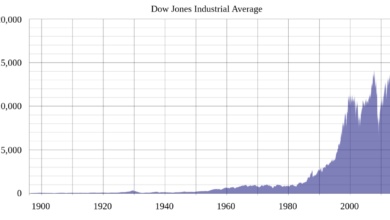

The stock market experienced a surge today, driven by the combined forces of strong bank earnings and the ongoing AI frenzy. Investors are particularly enthusiastic about the potential of AI to transform various industries, leading to significant gains in technology stocks.

Performance of Key Sectors, Stock market today wall streets ai frenzy and strong bank profits send stocks higher

The technology sector led the market’s advance, with the Nasdaq Composite Index closing up over 2%. This strong performance reflects investor optimism surrounding AI-related companies, particularly those involved in developing and deploying advanced AI technologies. The financial sector also performed well, as major banks reported robust quarterly profits.

This indicates a healthy banking system and a positive outlook for the broader economy. The S&P 500 Financials Index closed up over 1%, reflecting the strong performance of the sector.

Potential Risks and Concerns

Despite the positive sentiment, some concerns remain. Rising interest rates, inflation, and geopolitical tensions could dampen investor enthusiasm and potentially lead to a market correction.The Federal Reserve’s ongoing efforts to combat inflation through interest rate hikes could slow economic growth and impact corporate earnings.

Inflation, while showing signs of easing, remains elevated, putting pressure on businesses to manage costs. Geopolitical uncertainties, including the ongoing war in Ukraine and tensions between the US and China, create an unpredictable environment that could impact market sentiment.

Investors should remain cautious and monitor these risks closely, as they could potentially influence the stock market’s trajectory in the coming months.

Investor Sentiment

The stock market’s recent surge, driven by the AI frenzy and strong bank earnings, has ignited a wave of optimism among investors. This bullish sentiment is fueled by the belief that these positive developments signal a robust economic outlook and potential for continued growth.

Impact of AI and Bank Profits

The rapid advancements in AI technology and its potential to revolutionize various industries have captivated investor attention. The prospect of increased productivity, efficiency, and innovation has fueled investments in AI-related companies, driving up their stock prices. Meanwhile, strong bank profits, reflecting a healthy financial system and strong consumer spending, have further bolstered investor confidence.

Investor Strategies and Expectations

Investors are employing a range of strategies to capitalize on the current market conditions. Many are focusing on growth stocks, particularly those in the technology sector, expecting continued gains driven by AI advancements. Others are diversifying their portfolios, including value stocks and sectors benefiting from strong economic growth.Investors are generally optimistic about the future, expecting continued growth in the coming months.

However, they are also aware of potential risks, such as inflation, rising interest rates, and geopolitical uncertainty.

Market Outlook

The stock market’s recent surge, fueled by optimism around artificial intelligence and strong bank earnings, raises questions about its sustainability. While the current positive momentum is encouraging, several factors could influence the market’s trajectory in the coming weeks.

Factors Influencing Market Direction

Several factors could influence the market’s direction in the coming days and weeks.

- Inflation and Interest Rates:The Federal Reserve’s ongoing battle against inflation will continue to be a key driver of market sentiment. If inflation remains sticky, the Fed may be forced to raise interest rates further, potentially dampening economic growth and corporate earnings. However, if inflation cools more rapidly than expected, the Fed could pivot towards a more accommodative stance, potentially boosting stock prices.

- Geopolitical Risks:The ongoing war in Ukraine, tensions between the United States and China, and other geopolitical events could create volatility in the market. Increased uncertainty can lead to risk aversion among investors, causing stock prices to decline.

- Earnings Season:Upcoming earnings reports from major companies will provide insights into the health of the economy and corporate profitability. Strong earnings could bolster investor confidence, while weak earnings could lead to market pullbacks.

- AI Hype:The recent surge in AI-related stocks has generated significant excitement. However, the long-term impact of AI on the economy and corporate earnings remains uncertain. If AI hype fades or investors become disillusioned with the technology’s potential, the market could experience a correction.

Key Indicators to Watch

Monitoring key economic indicators can provide insights into the market’s direction.

- Inflation Data:The Consumer Price Index (CPI) and the Producer Price Index (PPI) are key indicators of inflation. A sustained decline in these measures could signal that the Fed is winning its fight against inflation, potentially leading to a more positive market outlook.

- Interest Rate Decisions:The Fed’s interest rate decisions will continue to be closely watched by investors. Any surprises or changes in the Fed’s outlook could significantly impact market sentiment.

- Economic Growth Data:Gross Domestic Product (GDP) growth, unemployment rate, and other economic data points provide insights into the health of the economy. Strong economic growth can support corporate earnings and boost stock prices, while weak economic growth can lead to market declines.

- Investor Sentiment:Measures of investor sentiment, such as the American Association of Individual Investors (AAII) Sentiment Survey, can provide insights into market psychology. High levels of optimism can suggest a bullish market, while high levels of pessimism can indicate a bearish market.

Last Recap

With AI innovation driving growth and bank profits exceeding expectations, the stock market is poised for continued success. However, it’s important to remember that the market is always subject to change, and investors should be aware of potential risks.

Keep an eye on key indicators, such as interest rates and inflation, to gauge the market’s direction. But for now, it seems like the bull market is alive and well, fueled by the power of technology and the strength of the financial sector.