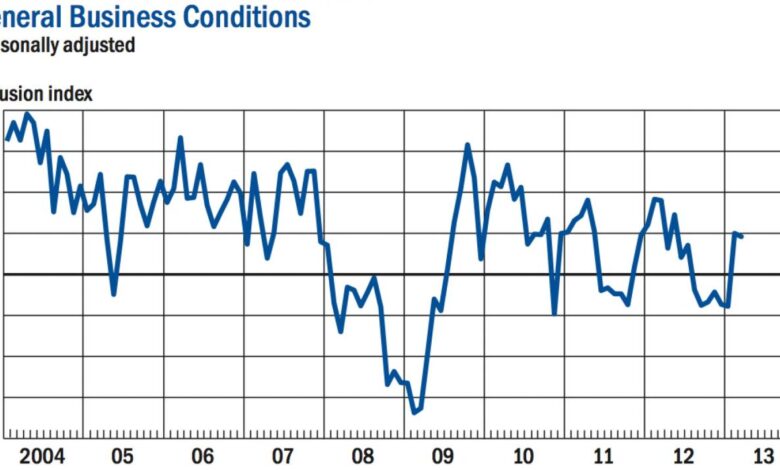

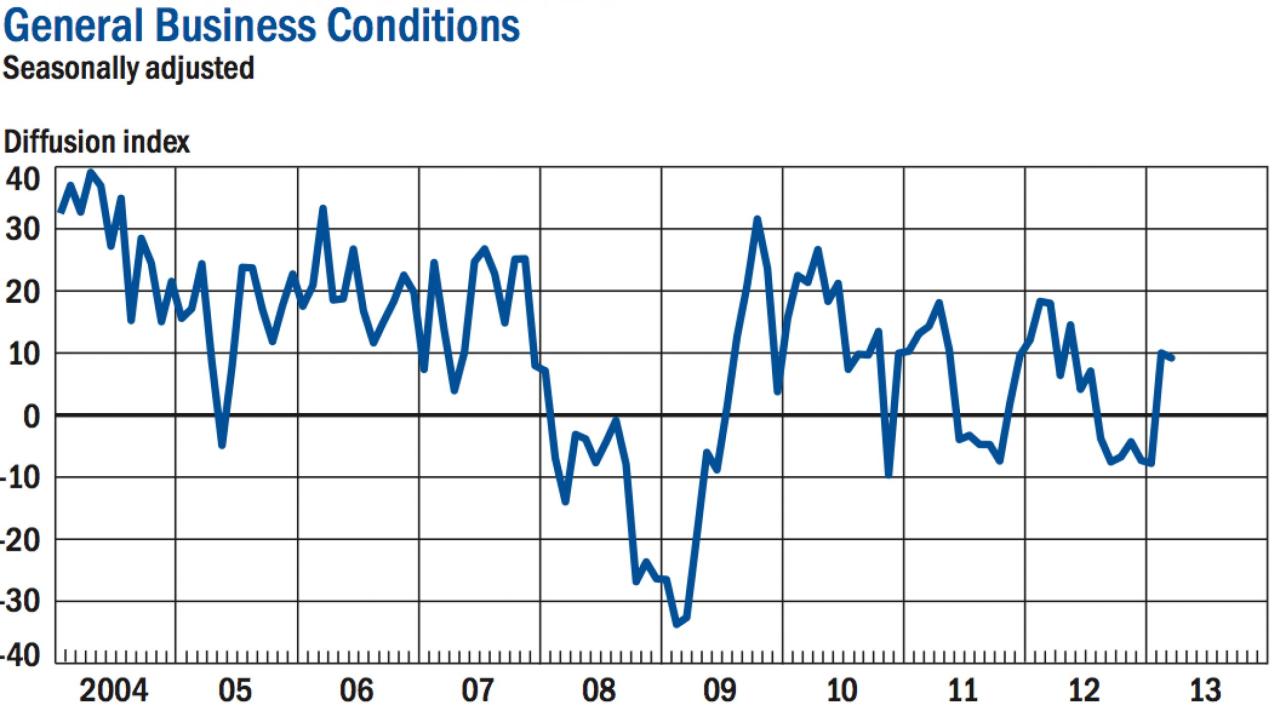

New York Fed Survey Shows Ongoing Price Rises and Elevated Inflation

The New York Fed Manufacturing Survey shows ongoing substantial price rises and elevated future inflation expectations, painting a picture of a manufacturing sector facing significant headwinds. The survey, a key indicator of economic health, reveals a continued upward trend in prices across various sectors, with manufacturers reporting a strong expectation that inflation will persist in the coming months.

This data highlights the ongoing pressure on businesses, who are grappling with rising input costs and a tight labor market. The survey’s findings are particularly concerning as they suggest that inflationary pressures are not only present but also expected to endure, potentially impacting consumer spending and overall economic growth.

Impact on Manufacturing Sector

The recent New York Fed Manufacturing Survey’s findings on substantial price rises and elevated future inflation expectations pose significant challenges for the manufacturing sector. These developments could have a profound impact on manufacturing output, investment, and employment, potentially altering the sector’s overall health in both the short and long term.

Impact on Manufacturing Output, New york fed manufacturing survey shows ongoing substantial price rises and elevated future inflation expectations

Rising input costs, particularly for raw materials and energy, directly impact manufacturers’ production expenses. As prices increase, manufacturers may face pressure to raise their selling prices, potentially leading to reduced demand for their products. This could, in turn, result in lower output levels, as businesses adjust to the changing market conditions.

For instance, the automotive industry has experienced significant price increases for components like semiconductors and steel, leading to production constraints and reduced vehicle output.

Impact on Investment

Elevated inflation expectations create uncertainty for businesses, making them hesitant to invest in new equipment, facilities, or expansion projects. The fear of rising costs and potentially lower returns on investment can discourage manufacturers from committing to long-term capital expenditures.

A survey by the National Association of Manufacturers found that nearly half of manufacturers reported delaying or canceling investment plans due to concerns about inflation.

Impact on Employment

Rising input costs and potential production slowdowns could lead to job losses in the manufacturing sector. As businesses face pressure to control expenses, they may resort to layoffs or hiring freezes, particularly if demand weakens.

The Bureau of Labor Statistics reported a decline in manufacturing employment in the first quarter of 2023, partly attributed to inflationary pressures and supply chain disruptions.

Strategies for Mitigation

Manufacturers can implement various strategies to mitigate the impact of rising prices and inflation:

- Cost Optimization:Manufacturers can focus on streamlining operations, improving efficiency, and negotiating better prices with suppliers to reduce production costs. This could involve exploring alternative materials, optimizing inventory management, and adopting lean manufacturing principles.

- Price Adjustments:Manufacturers may need to adjust their pricing strategies to reflect rising input costs. However, careful consideration is required to avoid pricing themselves out of the market and losing customers.

- Innovation and Diversification:Investing in research and development, exploring new technologies, and diversifying product offerings can help manufacturers stay competitive and adapt to changing market conditions. This could involve developing new products, entering new markets, or finding innovative ways to reduce reliance on expensive inputs.

- Supply Chain Resilience:Building a more resilient supply chain can help manufacturers mitigate disruptions caused by inflation and other external factors. This could involve diversifying suppliers, shortening supply chains, and investing in inventory management systems.

- Government Support:Manufacturers may seek government support, such as tax incentives or subsidies, to help offset the impact of inflation.

Conclusion: New York Fed Manufacturing Survey Shows Ongoing Substantial Price Rises And Elevated Future Inflation Expectations

The New York Fed Manufacturing Survey’s findings are a stark reminder of the challenges facing the manufacturing sector and the broader economy. While the survey indicates ongoing price rises and elevated inflation expectations, it also underscores the resilience of the manufacturing sector.

Manufacturers are actively seeking ways to mitigate the impact of rising prices and inflation, demonstrating their commitment to navigating these challenging economic conditions.

The New York Fed manufacturing survey paints a bleak picture, revealing ongoing substantial price rises and elevated future inflation expectations. This economic turbulence comes at a time when political turmoil is also brewing, as Kari Lake confirms she’s taking her election lawsuit to the Supreme Court.

With both economic and political uncertainty looming, it’s a challenging time for businesses and consumers alike.

The New York Fed’s manufacturing survey paints a grim picture: ongoing substantial price rises and elevated future inflation expectations. This economic turmoil, coupled with the increasing number of illegal immigrants crossing the northern border , adds further pressure on an already strained system.

It’s a complex situation with no easy answers, but it’s clear that the economic outlook remains uncertain and potentially volatile.

The New York Fed manufacturing survey paints a grim picture: ongoing substantial price rises and elevated future inflation expectations. This economic uncertainty, coupled with political turmoil like the recent announcement that Gaetz will move to oust McCarthy as House Speaker , only adds fuel to the fire.

It remains to be seen how these factors will impact the manufacturing sector and the overall economy in the coming months.