Jobs Report Shows Hiring Slowdown, Inflation Pressures Elevated

Jobs report shows hiring slowdown inflation pressures elevated – Jobs Report Shows Hiring Slowdown, Inflation Pressures Elevated sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. The latest jobs report reveals a concerning trend: hiring is slowing down while inflation pressures remain elevated. This combination paints a complex picture for the economy, with potential implications for businesses, workers, and policymakers alike.

The report highlights a significant shift in the labor market, where employers are becoming more cautious about hiring new staff. This slowdown can be attributed to a number of factors, including rising inflation, uncertainty about the future economic outlook, and potential recession fears. The impact of these trends is felt across various industries, with some sectors experiencing more pronounced hiring slowdowns than others.

Hiring Slowdown

The recent slowdown in hiring, as reflected in the latest jobs report, signals a potential shift in the economic landscape. While the unemployment rate remains low, the decline in job growth suggests a cooling labor market, which could have broader implications for the economy.

Comparison with Previous Economic Cycles, Jobs report shows hiring slowdown inflation pressures elevated

It is important to analyze the current hiring trends in the context of previous economic cycles to understand their significance. During periods of economic expansion, job growth typically accelerates, reflecting increased business confidence and consumer spending. Conversely, during economic slowdowns, hiring slows as businesses become more cautious and consumer demand weakens. The current slowdown in hiring appears to be a natural adjustment after the rapid job growth experienced during the post-pandemic recovery.

However, the persistence of inflation and rising interest rates may be contributing to a more cautious approach to hiring.

The latest jobs report paints a mixed picture, with a hiring slowdown signaling potential economic headwinds. While the economy is still adding jobs, inflation pressures remain elevated, adding to the anxieties of everyday Americans. In the midst of this economic uncertainty, it’s important to remember that divisive rhetoric, like the recent call by President Biden to label the MAGA movement “semi-fascism,” biden should apologize for calling maga movement semi fascism new hampshire governor , only serves to further polarize the country and distract from the real issues facing our nation.

We need our leaders to focus on solutions, not inflammatory language, to navigate these challenging economic times.

Industries Experiencing Significant Hiring Slowdowns

Several industries are experiencing particularly significant hiring slowdowns. The technology sector, which was a major driver of job growth in recent years, has seen significant layoffs and hiring freezes. The tech industry is sensitive to economic downturns, and the recent slowdown in consumer spending on tech goods and services has impacted hiring.

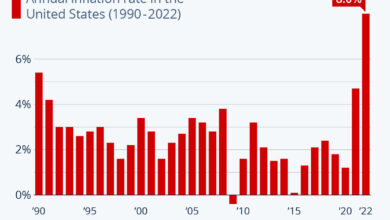

Inflation Pressures

The current state of inflation is a significant concern for both businesses and consumers. Inflation, a persistent increase in the general price level of goods and services, has been a major challenge in recent times. The persistent rise in prices has eroded purchasing power, leading to a decline in consumer confidence and impacting hiring decisions.

The latest jobs report shows a hiring slowdown and elevated inflation pressures, a concerning combination for the economy. Meanwhile, the legal drama surrounding former President Trump continues to unfold as he filed a motion seeking to prevent the Department of Justice from accessing records at Mar-a-Lago until a special master is appointed, as reported here. It’s unclear how these legal battles will impact the broader economic picture, but they certainly add another layer of uncertainty to an already challenging landscape.

Impact of Inflation on the Labor Market

Inflation exerts considerable pressure on the labor market, leading to several interconnected consequences. The rising cost of living compels workers to demand higher wages to maintain their standard of living. This pressure on wages, in turn, increases labor costs for businesses, making it challenging to maintain profitability.

Relationship between Inflation and Wage Growth

The relationship between inflation and wage growth is a complex one. In periods of high inflation, workers often demand higher wages to offset the decline in their purchasing power. This phenomenon is known as the “wage-price spiral,” where rising prices lead to higher wages, which in turn drive prices even higher.

The relationship between inflation and wage growth can be summarized by the following formula:Wage Growth = Inflation Rate + Productivity Growth + Labor Market Tightness

The latest jobs report paints a mixed picture: hiring is slowing down, but inflation pressures remain elevated. This economic uncertainty comes as a federal judge has ordered the release of the FBI search warrant affidavit for Trump’s home, fbi search warrant affidavit for trumps home to be made public judge , which could shed light on the investigation and its potential impact on the political landscape.

While the economy and politics are often intertwined, it remains to be seen how these events will ultimately play out.

This formula indicates that wage growth is influenced by inflation, productivity improvements, and the tightness of the labor market. When inflation is high, workers are likely to demand higher wages to maintain their real incomes. Conversely, when productivity growth is strong, employers may be willing to offer higher wages to attract and retain skilled workers.

Strategies to Mitigate the Impact of Inflation

Employers are actively seeking strategies to mitigate the impact of inflation on their businesses and workforce. Some of the common approaches include:

- Wage adjustments: Employers are increasingly adjusting wages to keep pace with inflation. This can involve providing cost-of-living adjustments (COLAs) or offering performance-based bonuses to attract and retain talent.

- Increased productivity: Employers are seeking to enhance productivity through automation, process optimization, and employee training. By increasing efficiency, businesses can minimize the impact of rising labor costs.

- Price adjustments: Businesses are carefully considering price adjustments to pass on some of the inflationary costs to consumers.

However, this strategy needs to be carefully managed to avoid alienating customers.

- Supply chain diversification: Diversifying supply chains can help mitigate the impact of rising input costs and supply chain disruptions. By sourcing from multiple suppliers, businesses can reduce their reliance on any single source and potentially secure better prices.

Labor Market Dynamics: Jobs Report Shows Hiring Slowdown Inflation Pressures Elevated

The recent hiring slowdown, coupled with persistent inflation pressures, has cast a spotlight on the intricate dynamics of the labor market. Understanding the interplay of supply and demand, worker bargaining power, and technological advancements is crucial for navigating this evolving landscape.

Unemployment Rates and Labor Participation Rates

Unemployment rates and labor participation rates are key indicators of labor market health. A declining unemployment rate generally suggests a robust economy with ample job opportunities. Conversely, a rising unemployment rate can signal a weakening economy and challenges in finding employment. The labor participation rate reflects the percentage of the working-age population that is actively seeking employment. A decline in the labor participation rate can indicate factors such as retirement, discouraged workers, or other reasons for not actively participating in the workforce.

Job Openings and the Hiring Slowdown

The number of job openings provides insights into the demand for labor. A high number of job openings suggests a strong demand for workers. The recent hiring slowdown, however, has resulted in a decrease in job openings, indicating a softening of demand for labor. This slowdown can be attributed to various factors, including economic uncertainty, inflation, and potential recessionary concerns.

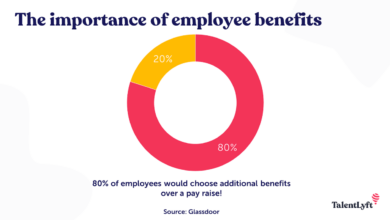

Impact of the Hiring Slowdown on Worker Bargaining Power

The hiring slowdown can impact worker bargaining power and wage negotiations. With fewer job openings and increased competition for available positions, workers may have less leverage in negotiating higher wages or better benefits. This dynamic can create a scenario where employers have more bargaining power in salary discussions.

Automation and Technological Advancements

Automation and technological advancements are transforming the labor market. These innovations can create new jobs and improve productivity, but they can also lead to job displacement in certain sectors. As automation becomes more prevalent, workers may need to adapt their skills and training to remain competitive in the evolving job market.

Policy Implications

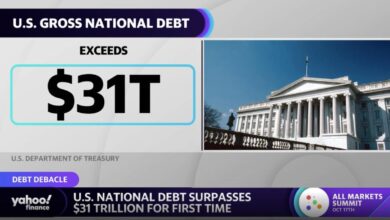

The recent hiring slowdown and persistent inflation pressures present policymakers with a complex challenge. Balancing the need to stimulate economic growth with the need to control inflation requires careful consideration of various policy tools and their potential impacts.

Interest Rate Adjustments

Central banks typically use interest rate adjustments as a primary tool to manage inflation. Raising interest rates makes borrowing more expensive, which can slow down economic activity and curb inflation. However, aggressive rate hikes can also lead to a recession by stifling investment and consumer spending. The Federal Reserve has been raising interest rates in recent months, but the pace and extent of future increases will depend on the trajectory of inflation and economic growth.

Fiscal Stimulus

Fiscal policy, which involves government spending and taxation, can also play a role in addressing economic challenges. In times of economic slowdown, fiscal stimulus, such as tax cuts or increased government spending, can boost demand and create jobs. However, excessive fiscal stimulus can exacerbate inflation if it leads to excessive spending and demand. The Biden administration has implemented some fiscal stimulus measures, but the effectiveness of these measures in the current environment remains to be seen.

Labor Market Interventions

Policymakers can also consider interventions that directly target the labor market. These interventions could include programs to increase job training and education, provide wage subsidies, or expand access to childcare. Such interventions can help address labor shortages and improve worker productivity, but they may not be effective in controlling inflation.

The recent jobs report serves as a stark reminder of the challenges facing the economy. The slowdown in hiring and persistent inflation pressures create a complex landscape that requires careful navigation. Policymakers must carefully consider the appropriate response to address these issues, while businesses need to adapt their strategies to navigate these turbulent times. The future of the labor market and the broader economy hinges on the ability of stakeholders to effectively address these challenges and foster sustainable growth.