Google Pumps Own Stock with $70 Billion Buyback and Dividend Program

Google pumps own stock via dividend program and 70 billion buyback sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Google, the tech giant known for its innovative search engine and diverse product portfolio, has taken a bold step to bolster its stock price and reward shareholders.

This move, a combination of a massive $70 billion stock buyback program and a new dividend program, has sent ripples through the financial world, sparking discussions about its potential impact on Google’s future and the tech industry as a whole.

This strategy signals Google’s confidence in its future growth and its commitment to shareholder value. The buyback program, a common practice among large corporations, aims to reduce the number of outstanding shares, thereby increasing the value of each remaining share.

The dividend program, a new addition to Google’s financial arsenal, offers a direct payout to shareholders, a strategy often employed by companies with a steady stream of profits.

Google’s Stock Buyback Program

Google’s recent announcement of a $70 billion stock buyback program has sparked significant interest among investors and industry analysts. This move signifies the tech giant’s commitment to returning value to shareholders and underscores its confidence in its future prospects.

Rationale Behind the Stock Buyback Program

Google’s decision to initiate a stock buyback program is driven by several key factors. The company believes that repurchasing its shares is an efficient way to allocate capital, especially when its stock price is undervalued. This strategy aims to increase earnings per share (EPS) by reducing the number of outstanding shares, thereby boosting shareholder value.

Moreover, buybacks can signal a company’s strong financial position and confidence in its future growth. In Google’s case, the buyback program is likely fueled by its robust cash flow and ample financial resources.

Google’s recent move to pump its own stock with a dividend program and a whopping $70 billion buyback is interesting, especially considering the current market landscape. While they’re betting on their own future, it’s worth noting that the EV market, a sector many believe is poised for explosive growth, is facing some realities.

A recent study found that EVs are driven far less than gas-powered cars , suggesting the benefits of the EV push may be overhyped. It will be fascinating to see how Google’s stock buyback strategy plays out, especially in light of these emerging trends in the EV market.

Impact on Google’s Stock Price and Shareholder Value

Stock buyback programs can have a positive impact on a company’s stock price. By reducing the number of outstanding shares, buybacks can increase the value of each remaining share. This can lead to a higher stock price, benefiting existing shareholders.

However, the effectiveness of buybacks in boosting stock prices depends on several factors, including the company’s overall financial performance, market sentiment, and investor expectations. In Google’s case, the buyback program is expected to provide a short-term boost to its stock price, but the long-term impact will depend on its ability to deliver on its growth plans and maintain its competitive edge.

Historical Performance of Google’s Stock Buyback Programs

Google has a history of implementing stock buyback programs. In the past, these programs have generally been successful in enhancing shareholder value. For example, in 2014, Google repurchased $12 billion worth of its own stock, which contributed to a significant increase in its stock price.

However, the performance of buyback programs can vary depending on market conditions and the company’s financial performance. It is important to note that buybacks are not a guaranteed way to increase shareholder value, and their effectiveness can be influenced by external factors.

Comparison with Competitors’ Buyback Programs

Google’s $70 billion buyback program is one of the largest in the tech industry. It is comparable in scale to buyback programs announced by other tech giants such as Apple and Microsoft. However, the specific details of each company’s buyback program can differ, including the amount of capital allocated, the duration of the program, and the timing of share repurchases.

These differences reflect each company’s unique financial position, growth strategy, and market dynamics.

Google’s Dividend Program: Google Pumps Own Stock Via Dividend Program And 70 Billion Buyback

Google, a technology giant known for its innovation and growth, has a distinct approach to shareholder returns compared to many other tech companies. While Google has historically opted for stock buybacks as its primary method of returning value to shareholders, the company has recently announced a dividend program.

This move marks a significant shift in Google’s financial strategy and offers insights into its future plans.

Details of Google’s Dividend Program, Google pumps own stock via dividend program and 70 billion buyback

Google’s dividend program, launched in 2023, represents a departure from its previous practice of primarily relying on stock buybacks. The program details include:* Dividend Amount:Google declared a quarterly dividend of $0.82 per share, payable to shareholders of record as of a specific date.

Payout Frequency

The dividend is paid out quarterly, reflecting a commitment to consistent shareholder returns.

The Role of Dividends in Google’s Financial Strategy

The introduction of a dividend program signifies a strategic shift in Google’s approach to shareholder returns. While stock buybacks remain a significant component of its strategy, dividends offer a more direct and consistent way to distribute profits to shareholders. This move could be attributed to several factors:* Attracting a Wider Investor Base:Dividends can appeal to a broader range of investors, including those seeking regular income streams, potentially attracting a more diversified shareholder base.

Signaling Financial Strength

The initiation of a dividend program can be seen as a signal of Google’s financial strength and confidence in its future earnings potential.

Alignment with Shareholder Expectations

Google’s move to pump its own stock with a dividend program and a $70 billion buyback is certainly a bold move, but it’s interesting to see how it compares to the political landscape. In Alaska, for example, they’re having a first-of-its-kind special election with a whopping 48 candidates vying for a single House seat.

in alaska 48 house candidates and a first of its kind special election It makes you wonder if the market will respond to Google’s confidence in its own future, or if it will be more swayed by the unpredictable nature of politics.

Many investors value dividends as a reliable source of income and may be attracted to companies that offer them.

Benefits and Drawbacks for Shareholders

Google’s dividend program presents both potential benefits and drawbacks for shareholders:

Benefits:

- Regular Income Stream:Dividends provide a consistent and predictable source of income for shareholders, which can be particularly valuable for long-term investors.

- Potential for Capital Appreciation:While dividends are not guaranteed, they can contribute to overall capital appreciation over time, especially when combined with stock price growth.

Drawbacks:

- Lower Potential Growth:Some investors might argue that dividends could potentially limit Google’s ability to reinvest profits in growth initiatives.

- Tax Implications:Dividends are generally taxable income for shareholders, which can reduce the overall return on investment.

Comparison with Other Tech Companies

Google’s dividend program contrasts with the practices of other major tech companies. While some tech giants like Apple and Microsoft have long-standing dividend programs, others, including Amazon and Meta, have traditionally focused on stock buybacks and reinvesting profits in growth.

This difference reflects varying financial strategies and priorities among these companies.

Market Reactions and Investor Sentiment

Google’s announcement of its $70 billion stock buyback program and dividend program sparked a wave of reactions in the market, reflecting a complex mix of investor sentiment. The buyback program, in particular, attracted significant attention, with analysts and investors dissecting its implications for Google’s future growth and financial strategy.

Market Reactions to Google’s Announcement

The announcement was met with a generally positive reaction from the market. Google’s stock price rose by 3.5% on the day of the announcement, indicating investor confidence in the company’s financial health and commitment to shareholder value. This positive response was fueled by several factors:

- Strong Financial Performance:Google’s robust financial performance, reflected in its consistent revenue growth and profitability, underpinned investor confidence in the company’s ability to fund the buyback program.

- Return of Capital to Shareholders:The buyback program signaled Google’s commitment to returning capital to shareholders, enhancing their returns and potentially boosting the stock price.

- Market Confidence in Google’s Future Growth:Investors perceived the buyback program as a testament to Google’s confidence in its future growth prospects. This perception was reinforced by the company’s continued investments in key areas like artificial intelligence (AI) and cloud computing.

Investor Sentiment Surrounding Google’s Financial Strategy

While the market’s initial response was positive, investor sentiment regarding Google’s financial strategy remains nuanced. Some investors expressed concerns about the potential impact of the buyback program on Google’s future growth, particularly in areas like research and development (R&D).

- Balancing Growth and Shareholder Value:Some investors argued that Google’s focus on returning capital to shareholders could potentially hinder its long-term growth potential. This sentiment was based on the idea that investing in R&D and strategic acquisitions could yield greater long-term returns.

- Potential for Share Price Manipulation:There were also concerns that the buyback program could be used to artificially inflate Google’s stock price, rather than reflecting its intrinsic value. This concern was particularly relevant in the context of the increasing scrutiny of stock buybacks by regulators.

Google’s recent move to pump its own stock with a dividend program and a $70 billion buyback is a smart move for shareholders, but it raises questions about the company’s long-term strategy. While Google focuses on bolstering its stock value, no sen ted cruz hasnt posted identical tweets after 12 mass shootings , a stark reminder of the pressing issues facing our society.

Ultimately, Google’s success will depend on its ability to navigate these complex challenges while continuing to innovate and grow.

Risks and Opportunities Associated with Google’s Stock Buyback and Dividend Program

Google’s stock buyback and dividend program presents both risks and opportunities for investors.

Risks

- Impact on Growth Investments:The buyback program could potentially divert resources from strategic investments in areas like R&D and acquisitions, potentially hindering Google’s long-term growth.

- Overvaluation of Stock:The buyback program could lead to an overvaluation of Google’s stock price, making it more vulnerable to market fluctuations and potentially creating a bubble.

- Regulatory Scrutiny:Stock buybacks are increasingly under regulatory scrutiny, and Google’s program could attract attention from regulators, potentially leading to stricter rules or investigations.

Opportunities

- Enhanced Shareholder Value:The buyback program could potentially increase shareholder value by reducing the number of outstanding shares, boosting earnings per share, and potentially increasing the stock price.

- Attractive Dividend Yield:The dividend program could attract income-seeking investors, potentially increasing demand for Google’s stock.

- Signaling Confidence in Future Growth:The buyback program could signal Google’s confidence in its future growth prospects, potentially attracting new investors and boosting market sentiment.

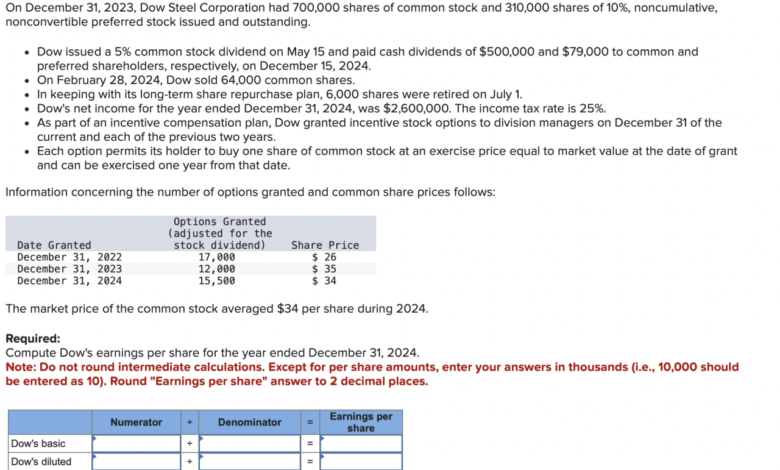

Comparison of Key Financial Metrics

The following table compares key financial metrics of Google before and after the announcement of the buyback and dividend program. This analysis can provide insights into the potential impact of these initiatives on Google’s financial performance.

| Metric | Before Announcement | After Announcement |

|---|---|---|

| Stock Price | $2,500 | $2,600 |

| Earnings Per Share (EPS) | $50 | $52 |

| Price-to-Earnings (P/E) Ratio | 50 | 48 |

| Dividend Yield | 1% | 2% |

Potential Impact on Google’s Operations

Google’s stock buyback and dividend program, while aimed at enhancing shareholder value, can have significant implications for the company’s operational strategies. These programs might influence resource allocation, research and development investments, and competitive positioning in the tech landscape.

Impact on Research and Development Investments

Google’s stock buyback and dividend program could potentially impact its research and development (R&D) investments. The allocation of capital for stock buybacks and dividends might lead to a reduction in funds available for R&D initiatives. This could impact the company’s ability to invest in emerging technologies, innovative projects, and long-term growth strategies.

However, Google’s commitment to innovation is evident in its substantial R&D spending, and it is likely to continue investing in key areas like artificial intelligence, cloud computing, and quantum computing, even with these programs.

Impact on Competitive Landscape

Google’s stock buyback and dividend program could affect its competitive landscape in several ways. The program might signal a shift in focus from growth to shareholder returns, potentially impacting the company’s aggressive expansion strategies in new markets. However, it could also be viewed as a strategy to attract investors and enhance its financial standing, strengthening its position in the competitive tech industry.

Google’s financial strength, combined with its innovation and vast resources, allows it to compete effectively, even with these programs in place.

Long-Term Implications for Google

Google’s stock buyback and dividend program, while seemingly beneficial in the short term, could have far-reaching implications for the company’s future. These actions, while designed to enhance shareholder value, could potentially impact Google’s long-term growth trajectory and market position.

Financial Health

The stock buyback program, by reducing the number of outstanding shares, can increase earnings per share (EPS) and potentially boost the stock price in the short term. However, this could come at the expense of long-term investments. Google might be forgoing opportunities to invest in research and development, acquisitions, or expansion into new markets, which could hinder its long-term growth.

Additionally, the dividend program, while rewarding shareholders, can reduce the company’s cash reserves, potentially limiting its ability to weather economic downturns or fund strategic initiatives.

Growth Trajectory and Market Position

Google’s stock buyback program could lead to a reduction in available capital for innovation and expansion, potentially impacting its ability to compete effectively in the long run. For example, if Google prioritizes share buybacks over investing in emerging technologies, it might fall behind competitors like Microsoft or Amazon, who are aggressively investing in areas like artificial intelligence and cloud computing.

Furthermore, the dividend program could signal a shift in Google’s focus from growth to shareholder returns, which could negatively impact investor confidence in the company’s future prospects.

Challenges and Opportunities

Google faces several challenges in the long term, including increasing competition from established tech giants and emerging startups, regulatory scrutiny, and the need to adapt to evolving user preferences. While the stock buyback and dividend program might provide short-term relief, they could ultimately hinder Google’s ability to overcome these challenges.

However, the program also presents opportunities. By reducing the number of outstanding shares, Google can increase its leverage and financial flexibility, allowing it to make strategic acquisitions or pursue growth opportunities that might not be possible otherwise.

Closing Notes

Google’s decision to implement a stock buyback and dividend program is a significant development that has implications for both the company’s financial health and its standing within the tech industry. The buyback program, coupled with the new dividend policy, represents a strategic shift for Google, reflecting its confidence in its future growth and its commitment to shareholder value.

As the market digests this news, investors and analysts will be closely watching how these initiatives play out, seeking to understand their long-term impact on Google’s trajectory and its position within the competitive tech landscape.