Goldman Misses Profit Estimates as Dealmaking and Asset Management Take a Hit

Goldman misses profit estimates as dealmaking asset management take a hit – Goldman Misses Profit Estimates as Dealmaking and Asset Management Take a Hit, a stark reminder of the challenging economic landscape facing Wall Street. The investment banking giant, known for its prowess in mergers and acquisitions, has seen its profits dwindle as dealmaking activity slows down and its asset management business faces headwinds.

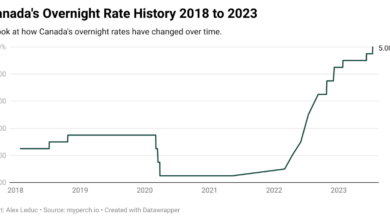

This downturn highlights the broader trends affecting the financial industry, with slowing economic growth and rising interest rates casting a shadow over market sentiment.

Goldman Sachs’ financial performance has been impacted by a confluence of factors, including a decline in investment banking fees, lower asset management returns, and a more cautious approach to risk-taking. The company’s revenue streams have been hit across the board, with its trading and investment banking divisions experiencing the most significant declines.

This performance comes as a surprise to many analysts, who had expected Goldman Sachs to weather the current economic storm better than its peers.

Goldman Sachs’ Financial Performance

Goldman Sachs, a global investment bank, reported weaker-than-expected earnings for the second quarter of 2023, highlighting the impact of a slowdown in dealmaking and asset management activities. The firm’s net income fell significantly compared to the previous year, underscoring the challenges faced by Wall Street giants amidst a turbulent economic environment.

Reasons for Missed Profit Estimates

The decline in Goldman Sachs’ profits can be attributed to a confluence of factors, including a significant drop in investment banking revenue, a challenging environment for asset management, and a decline in trading activity. The firm’s investment banking division, which generates revenue from underwriting mergers and acquisitions and initial public offerings (IPOs), experienced a sharp downturn as companies delayed deals due to economic uncertainty and rising interest rates.

Similarly, asset management revenue was impacted by market volatility and investor concerns, leading to lower performance fees and a decline in fund inflows.

Impact of Dealmaking Decline

Goldman Sachs’ recent miss on profit estimates highlights a broader trend in the investment banking industry: a decline in dealmaking activity. This slowdown is attributed to a confluence of factors, including rising interest rates, economic uncertainty, and geopolitical tensions.

Factors Contributing to the Decline in Dealmaking Activity

The decline in dealmaking activity can be attributed to several factors:

- Rising Interest Rates:Higher interest rates make it more expensive for companies to borrow money, making mergers and acquisitions (M&A) less attractive.

- Economic Uncertainty:The global economic outlook remains uncertain, with inflation and potential recessions weighing on business confidence. This uncertainty makes companies hesitant to undertake large transactions.

- Geopolitical Tensions:The war in Ukraine and other geopolitical tensions have created volatility in global markets, further dampening dealmaking activity.

- Regulatory Scrutiny:Increased regulatory scrutiny of M&A deals, particularly in the technology sector, has also slowed down the pace of transactions.

Implications of the Decline on the Investment Banking Industry

The decline in dealmaking activity has significant implications for the investment banking industry:

- Reduced Investment Banking Fees:Investment banks generate a significant portion of their revenue from fees associated with M&A transactions. A decline in dealmaking activity directly translates to lower fees for these institutions.

- Increased Competition:As deal flow shrinks, investment banks are facing increased competition for a smaller pool of transactions. This intensifies pressure on fees and profitability.

- Focus on Other Business Lines:Investment banks are responding to the changing dealmaking landscape by focusing on other business lines, such as asset management and wealth management, to diversify their revenue streams.

Goldman Sachs’ Response to the Changing Dealmaking Landscape

Goldman Sachs is responding to the decline in dealmaking activity in several ways:

- Investing in Asset Management:The firm is investing heavily in its asset management business, which has become a key growth driver.

- Expanding into New Markets:Goldman Sachs is expanding into new markets, such as emerging markets, to find growth opportunities.

- Focusing on Client Relationships:The firm is prioritizing building strong relationships with clients to secure future deal flow.

Potential Future Outlook for Dealmaking Activity

The future outlook for dealmaking activity is uncertain. While the current economic environment presents challenges, there are also potential catalysts for a rebound in deal flow:

- Potential for a Soft Landing:If the global economy manages to avoid a recession, this could boost business confidence and lead to increased dealmaking activity.

- Lower Interest Rates:If central banks begin to lower interest rates, this could make financing more affordable for companies, encouraging more M&A transactions.

- Technological Innovation:Continued technological innovation is creating new opportunities for growth and investment, which could drive dealmaking activity in certain sectors.

Asset Management Performance: Goldman Misses Profit Estimates As Dealmaking Asset Management Take A Hit

Goldman Sachs’ asset management division, which encompasses a range of investment products and services, also faced headwinds during the quarter. The decline in asset management revenue was driven by a combination of factors, including lower market valuations and reduced client activity.

Goldman Sachs’ recent miss on profit estimates, driven by a slowdown in dealmaking and asset management, paints a grim picture of the current economic climate. This coincides with a worrying trend in the housing market, as homebuilder sentiment drops for 12 months in a row to the lowest in a decade , further highlighting the challenges facing the financial sector and broader economy.

Reasons for Decline in Asset Management Performance

The decline in asset management performance at Goldman Sachs can be attributed to a confluence of factors.

- Market Volatility and Lower Valuations:The turbulent market conditions in 2023, characterized by rising interest rates and heightened inflation, have negatively impacted the performance of many investment portfolios. This volatility has led to lower valuations for assets, impacting the overall value of investment funds and reducing fee income for asset managers.

- Reduced Client Activity:The uncertain economic outlook has prompted investors to adopt a more cautious approach, leading to reduced investment activity. This decline in client activity has translated into lower transaction fees and asset flows for asset managers like Goldman Sachs.

- Increased Competition:The asset management industry is highly competitive, with a multitude of players vying for clients’ assets. The intense competition has put pressure on fee structures and margins, further impacting asset management profitability.

Challenges Faced by the Asset Management Industry

The asset management industry is facing several challenges, many of which are interconnected and contribute to the decline in performance at Goldman Sachs.

- Rising Interest Rates:The Federal Reserve’s aggressive interest rate hikes have made it more expensive for investors to borrow money, leading to a decline in demand for riskier assets and a shift towards more conservative investments. This trend has negatively impacted the performance of many asset management strategies.

It’s been a rough week for Wall Street, with Goldman Sachs missing profit estimates as dealmaking and asset management took a hit. It’s hard to say if the news of classified documents found at Penn Biden Center, President’s lawyer is playing a role in investor sentiment, but the timing certainly isn’t ideal.

Regardless, the overall economic picture is looking increasingly uncertain, and that’s likely to impact the bottom line for financial institutions like Goldman Sachs.

- Inflation and Economic Uncertainty:High inflation and the uncertainty surrounding the global economic outlook have created a challenging environment for investors. This uncertainty has led to increased volatility in markets and reduced investor confidence, making it difficult for asset managers to generate consistent returns.

- Regulatory Scrutiny:The asset management industry is subject to increasing regulatory scrutiny, with regulators focusing on areas such as fees, conflicts of interest, and ESG investing. This scrutiny has increased compliance costs and complexity for asset managers, impacting profitability.

- Technological Disruption:The emergence of new technologies, such as artificial intelligence and robo-advisory platforms, is disrupting the traditional asset management landscape. These technologies are challenging the established players and offering investors alternative investment options at lower costs.

Comparison to Competitors

Goldman Sachs’ asset management performance has been impacted by the industry-wide challenges, but the firm’s performance has also been compared to its competitors.

- BlackRock:BlackRock, the world’s largest asset manager, has also faced challenges in 2023 due to market volatility and reduced client activity. However, BlackRock’s vast scale and diverse product offerings have provided it with a degree of resilience. BlackRock’s performance has been relatively better than Goldman Sachs’ in 2023, indicating that size and diversification can offer advantages in challenging market conditions.

- Vanguard:Vanguard, known for its low-cost index funds, has also been impacted by market volatility but has generally maintained a strong position in the market. Vanguard’s focus on passive investing has made it less susceptible to the performance swings associated with active management strategies.

Strategies to Improve Asset Management Business

Goldman Sachs is implementing various strategies to improve its asset management business and navigate the challenging market environment.

Goldman Sachs missing profit estimates is a stark reminder of the volatile market we’re in. Dealmaking and asset management are taking a hit, which is understandable considering the recent economic uncertainty. And then there’s the news that new Twitter files show the company suppressed COVID information from doctors and experts , which adds another layer of distrust and instability.

It’s a tough time for businesses, and it seems like everyone is scrambling to adapt to the changing landscape.

- Expanding Product Offerings:The firm is expanding its product offerings to cater to a wider range of investor needs and preferences. This includes launching new investment funds, such as thematic ETFs and alternative investment products, to attract a broader investor base.

- Investing in Technology:Goldman Sachs is investing heavily in technology to enhance its investment processes and improve client service. This includes developing advanced analytics tools and platforms to support data-driven decision-making and provide clients with personalized investment insights.

- Cost Optimization:The firm is focused on cost optimization measures to improve efficiency and profitability. This includes streamlining operations, reducing redundancies, and negotiating favorable contracts with suppliers.

- Strengthening Client Relationships:Goldman Sachs is prioritizing client relationships and seeking to deepen engagement with existing clients. This involves providing personalized investment advice, offering tailored solutions, and fostering long-term partnerships.

Market Conditions and Economic Outlook

Goldman Sachs’ recent performance has been heavily influenced by the broader macroeconomic environment, particularly the slowdown in dealmaking activity and the volatile equity markets. The current market conditions, driven by factors like rising interest rates, inflation, and geopolitical uncertainty, have significantly impacted the financial industry.

Impact of Market Conditions on Goldman Sachs, Goldman misses profit estimates as dealmaking asset management take a hit

The current market conditions have had a direct impact on Goldman Sachs’ performance. The decline in dealmaking activity has reduced the bank’s investment banking revenue, a key driver of its earnings. The volatile equity markets have also affected the bank’s trading and asset management businesses.

- Decline in Dealmaking Activity:The global economic slowdown has led to a decrease in mergers and acquisitions (M&A) and initial public offerings (IPOs). Goldman Sachs, like its peers, has experienced a significant drop in investment banking revenue, as clients have become more cautious about making large transactions.

- Volatile Equity Markets:The rising interest rates, inflation, and geopolitical uncertainty have created a volatile environment for equity markets. This volatility has impacted Goldman Sachs’ trading and asset management businesses, leading to lower returns.

Economic Outlook and Implications for Goldman Sachs

The economic outlook remains uncertain, with various factors potentially influencing the trajectory of the financial industry. While some experts anticipate a recession, others predict a soft landing.

- Potential Recession:A recession could lead to further declines in dealmaking activity, reduced investment banking revenue, and increased loan losses for Goldman Sachs. The bank’s trading and asset management businesses could also be negatively impacted by a recession.

- Soft Landing:A soft landing, where the economy slows down without a recession, could provide some relief for Goldman Sachs. However, even a soft landing might not be enough to significantly boost dealmaking activity or stabilize equity markets in the short term.

Goldman Sachs’ Positioning for the Future

Goldman Sachs is taking steps to navigate the challenging economic environment and position itself for long-term growth. The bank is focusing on areas such as consumer banking, wealth management, and technology.

- Consumer Banking Expansion:Goldman Sachs is expanding its consumer banking business, offering products like credit cards and personal loans through its Marcus brand. This strategy aims to diversify its revenue streams and reduce reliance on investment banking.

- Wealth Management Growth:The bank is investing in its wealth management business, seeking to attract high-net-worth individuals and families. This strategy aims to capitalize on the growing demand for wealth management services.

- Technology Investments:Goldman Sachs is investing in technology to improve its efficiency and enhance its offerings. This includes developing new digital platforms and leveraging artificial intelligence (AI) to automate processes.

Long-Term Growth Strategy

Goldman Sachs’ long-term growth strategy involves leveraging its strengths in investment banking, trading, and asset management while diversifying its business and embracing new technologies. The bank aims to become a leading provider of financial services across a range of segments, including consumer banking, wealth management, and technology.

- Investment Banking and Trading:Goldman Sachs remains committed to its core businesses of investment banking and trading, seeking to capitalize on opportunities in the global markets. The bank is investing in its research and analytics capabilities to provide clients with sophisticated financial advice.

- Asset Management:Goldman Sachs is expanding its asset management business, offering a wide range of investment products and services. The bank is investing in its alternative investment capabilities, such as private equity and hedge funds.

- Strategic Partnerships:Goldman Sachs is forming strategic partnerships with technology companies and other financial institutions to expand its reach and enhance its offerings. These partnerships aim to leverage complementary capabilities and create new opportunities for growth.

Final Summary

Goldman Sachs’ struggles are a microcosm of the broader challenges facing the financial industry. The slowdown in dealmaking activity and the decline in asset management performance are symptoms of a larger economic malaise. While the company is taking steps to address these challenges, it remains to be seen how effectively it can navigate the current market environment.

The future of Goldman Sachs, and indeed the entire financial industry, will depend on the ability to adapt to a changing landscape and find new sources of growth.