Former Treasury Secretary Warns Inflation Could Resurge

Former Treasury Secretary warns inflation could resurge, sending ripples through the financial world. This stark warning, issued by a prominent figure in economic policy, has ignited concerns about the potential for a return to high inflation. The former Secretary’s concerns are rooted in a complex interplay of factors, including the current state of the economy, historical patterns of inflation, and the potential impact of ongoing geopolitical events.

The warning underscores the delicate balance of economic forces at play, highlighting the potential for a resurgence of inflation that could have significant consequences for individuals, businesses, and the global economy.

Former Treasury Secretary’s Warning

A former Treasury Secretary has recently expressed concern about the potential for inflation to resurface, raising alarm bells within the economic community. This warning highlights the ongoing challenges of managing the economy in the wake of the COVID-19 pandemic and the recent surge in global energy prices.

It’s a wild time in politics, with the former treasury secretary warning about inflation potentially surging again, and now we have McCarthy’s plans to remove Schiff, Omar, and Swalwell from House committees adding to the mix. With so much uncertainty, it’s hard to predict how these developments will impact the economy, but one thing’s for sure: it’s a time to pay close attention.

Potential Economic Factors Contributing to Inflation Resurgence

The former Treasury Secretary’s concerns are rooted in a complex interplay of economic factors that could potentially fuel renewed inflationary pressures.

- Supply Chain Disruptions:Ongoing supply chain bottlenecks, exacerbated by the war in Ukraine, continue to constrain production and drive up prices for goods and services. The inability to effectively move goods and materials across international borders contributes to shortages and higher costs for businesses, ultimately impacting consumers.

- Strong Consumer Demand:Robust consumer spending, fueled by pent-up demand and government stimulus measures, continues to put upward pressure on prices. As consumers have more disposable income, they are willing to pay higher prices for goods and services, creating a positive feedback loop that can escalate inflation.

- Rising Energy Prices:The war in Ukraine has sent global energy prices soaring, impacting not only the cost of fuel but also the production costs of a wide range of goods and services. Higher energy prices translate into higher prices for consumers, further fueling inflationary pressures.

- Labor Market Tightness:A tight labor market, characterized by low unemployment and high demand for workers, can drive up wages. As businesses compete for a limited pool of qualified workers, they are forced to offer higher salaries, which can contribute to higher prices for goods and services.

Current Economic Conditions: Former Treasury Secretary Warns Inflation Could Resurge

While inflation has cooled somewhat in recent months, concerns remain about the potential for a resurgence. The recent decline in inflation has been attributed to factors such as easing supply chain bottlenecks and a slowdown in consumer demand. However, underlying inflationary pressures persist, and several key economic indicators suggest that inflation could rise again.

Inflation Rates and Trends

The Consumer Price Index (CPI), a widely used measure of inflation, has shown signs of cooling. In June 2023, the CPI rose 3% year-over-year, down from a peak of 9.1% in June 2022. This slowdown has been driven by a decline in energy prices, as well as a moderation in the prices of goods and services.

However, core inflation, which excludes volatile food and energy prices, remains elevated. The core CPI rose 4.8% year-over-year in June 2023, suggesting that inflationary pressures are still present in the broader economy.

Key Economic Indicators

Several economic indicators suggest that inflation could resurge in the coming months.

- Wage Growth:Strong wage growth continues to put upward pressure on prices. As businesses face higher labor costs, they may pass these costs on to consumers in the form of higher prices.

- Sticky Inflation:The persistence of high prices for certain goods and services, such as housing and healthcare, suggests that inflation may be more entrenched than previously thought.

- Supply Chain Disruptions:While supply chain disruptions have eased somewhat, they remain a potential source of inflationary pressure. Geopolitical events, such as the war in Ukraine, could further disrupt global supply chains and lead to higher prices.

Comparison with Historical Periods

Current economic conditions bear some similarities to historical periods of inflation. For example, the high levels of inflation experienced in the 1970s were also driven by a combination of factors, including rising energy prices and strong wage growth. However, there are also key differences between the current situation and the 1970s.

For example, the Federal Reserve is currently more aggressive in its efforts to combat inflation than it was in the 1970s. This suggests that the current period of inflation may be less severe and more short-lived than the inflation experienced in the 1970s.

Potential Impact of Inflation Resurgence

A resurgence of inflation could have far-reaching consequences for the economy, affecting consumers, businesses, and the government in various ways. Understanding these potential impacts is crucial for navigating the economic landscape and mitigating the negative effects of rising prices.

Impact on Consumers

A surge in inflation would directly impact consumers’ purchasing power. As prices rise, consumers would have to spend more to acquire the same goods and services. This could lead to a decline in consumer spending, which is a significant driver of economic growth.

For example, if the price of gasoline increases significantly, consumers might have to cut back on other expenses like dining out or entertainment.

Impact on Businesses

Businesses would face a complex set of challenges in an inflationary environment. Rising input costs, including raw materials, labor, and energy, would eat into profit margins. Businesses might be forced to raise prices to maintain profitability, which could further fuel inflation.

Additionally, uncertainty about future inflation rates could discourage investment and hinder economic growth.

Impact on the Government

The government would also face challenges in managing an inflationary environment. Fiscal policy, which involves government spending and taxation, would need to be adjusted to address rising prices. The government might have to increase interest rates to curb inflation, which could slow down economic growth.

Additionally, the government might face pressure to provide support to consumers and businesses affected by inflation.

The former treasury secretary’s warning about a potential resurgence of inflation is a sobering reminder of the economic challenges we face. It’s a reminder that even as we grapple with these issues, other significant events are unfolding, like project veritas losing hundreds of thousands of followers following James O’Keefe’s exit , which could have ripple effects on the political landscape.

Ultimately, navigating these complex situations requires a nuanced understanding of both economic and social trends.

Impact on the Stock Market

Inflation can have a significant impact on the stock market. When inflation rises, investors might become less willing to invest in stocks, as the real value of their investments erodes. This could lead to a decline in stock prices. Additionally, higher interest rates, which are often used to combat inflation, can make it more expensive for companies to borrow money, which could hurt their profitability and stock prices.

Impact on Interest Rates

Inflation typically leads to higher interest rates. When inflation rises, lenders demand higher interest rates to compensate for the erosion of the purchasing power of their money. Higher interest rates can make it more expensive for businesses and consumers to borrow money, which can slow down economic growth.

Impact on the Value of the Dollar

Inflation can weaken the value of the dollar. When inflation is high, the purchasing power of the dollar declines, making it less attractive to foreign investors. This can lead to a depreciation of the dollar, which can make imported goods more expensive and hurt the competitiveness of American businesses.

The former Treasury Secretary’s warning about resurgent inflation is a serious concern, and it’s worth noting that we’re facing a multitude of economic headwinds. Adding to this complex situation, a recent report by an MIT expert has called for an immediate halt to mRNA COVID jabs, citing evidence of unprecedented harm.

This report raises critical questions about the long-term effects of these vaccines and their potential impact on our economy. With so many uncertainties, it’s clear that navigating this turbulent period requires careful consideration and decisive action.

Potential Positive and Negative Impacts of Inflation Resurgence, Former treasury secretary warns inflation could resurge

| Stakeholder | Potential Positive Impacts | Potential Negative Impacts ||—|—|—|| Consumers| | || | | || | | || Businesses| | || | | || | | || Government| | || | | || | | || Investors| | || | | || | | |

Policy Responses to Inflation Resurgence

A resurgence of inflation would require swift and decisive action from policymakers to mitigate its impact on the economy and restore price stability. The government has a range of tools at its disposal, each with its own potential benefits and drawbacks.

Potential Policy Responses

The government could implement a combination of monetary and fiscal policies to address inflation resurgence. These include:

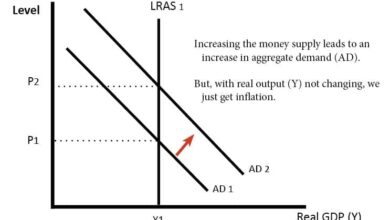

Monetary Policy

- Raising Interest Rates:This is the primary tool of central banks to combat inflation. By increasing interest rates, borrowing becomes more expensive, which can slow down economic activity and reduce demand for goods and services. This, in turn, can help to curb inflation.

For instance, the Federal Reserve raised interest rates several times in 2022 to combat rising inflation, demonstrating the effectiveness of this tool.

- Quantitative Tightening:This involves reducing the amount of money in circulation by selling government bonds. This can also help to slow down economic activity and reduce inflation. The Federal Reserve engaged in quantitative tightening in 2022, selling bonds to reduce the money supply and control inflation.

Fiscal Policy

- Increasing Taxes:Raising taxes can help to reduce the amount of money that consumers and businesses have to spend, thereby reducing demand and inflation. However, this can also have negative consequences for economic growth, particularly if taxes are raised too high.

For example, during periods of high inflation, governments may consider increasing taxes on high earners or corporations to generate revenue for inflation control measures.

- Controlling Government Spending:Reducing government spending can also help to reduce demand and inflation. However, this can also have negative consequences for social programs and infrastructure development. For instance, the government may prioritize spending on essential services and reduce discretionary spending on non-essential projects to control inflation.

Effectiveness and Consequences of Policy Options

| Policy Option | Potential Effectiveness | Potential Consequences |

|---|---|---|

| Raising Interest Rates | Can effectively slow down economic activity and reduce demand, leading to lower inflation. | Can slow down economic growth, increase unemployment, and make it more difficult for businesses to borrow money. |

| Quantitative Tightening | Can reduce the amount of money in circulation, leading to lower inflation. | Can slow down economic growth, increase unemployment, and make it more difficult for businesses to borrow money. |

| Increasing Taxes | Can reduce the amount of money that consumers and businesses have to spend, leading to lower inflation. | Can slow down economic growth, reduce consumer spending, and discourage investment. |

| Controlling Government Spending | Can reduce demand and inflation by reducing government spending. | Can lead to cuts in social programs and infrastructure development, potentially affecting economic growth and social welfare. |

Economic Outlook and Uncertainty

The former Treasury Secretary’s warning about a potential resurgence of inflation has injected a significant dose of uncertainty into the current economic outlook. While the economy has shown resilience in recent months, with strong job growth and declining unemployment, the threat of rising prices looms large.

This uncertainty stems from a confluence of factors, including the ongoing war in Ukraine, supply chain disruptions, and the Federal Reserve’s aggressive interest rate hikes.The economic outlook is currently characterized by a delicate balance between growth and inflation. While the economy is expected to continue growing, albeit at a slower pace, the risk of inflation resurgence remains a significant concern.

The uncertainty surrounding the future trajectory of inflation is further amplified by the conflicting views among economists and analysts.

Diverse Perspectives on Inflation Resurgence

The likelihood and potential severity of inflation resurgence are subjects of ongoing debate among economists and analysts. Some experts believe that inflation has already peaked and is likely to moderate in the coming months. They point to factors such as easing supply chain bottlenecks and declining commodity prices as evidence of a cooling inflation environment.On the other hand, some economists remain cautious, arguing that inflation could prove more persistent than anticipated.

They cite the ongoing geopolitical tensions, rising energy prices, and strong consumer demand as factors that could continue to fuel inflation.

“The path of inflation is highly uncertain, and it’s too early to declare victory over inflation,” said [Economist’s Name], a leading economist at [Institution].

“While inflation has shown signs of easing, we believe it’s too early to declare victory. The risk of inflation resurgence remains elevated,” said [Economist’s Name], an economist at [Institution].

Potential Economic Scenarios Associated with Inflation Resurgence

To illustrate the potential economic scenarios associated with inflation resurgence, we can visualize them using a simple graph. Graph:

X-axis

Time (Months)

Y-axis

Inflation Rate (%)

Scenario 1 (Green Line)

Inflation moderates gradually over time, eventually reaching a stable level below the target rate.

Scenario 2 (Yellow Line)

Inflation remains elevated for an extended period, fluctuating around the target rate.

Scenario 3 (Red Line)

Inflation resurges significantly, leading to a period of economic instability and potential recession. Scenario 1 (Green Line):Represents a scenario where inflation gradually subsides, potentially due to easing supply chain pressures, declining commodity prices, and a more balanced demand-supply dynamic. Scenario 2 (Yellow Line):Depicts a scenario where inflation remains stubbornly high, potentially due to ongoing geopolitical tensions, persistent supply chain disruptions, and a more robust demand environment.

Scenario 3 (Red Line):Represents a scenario where inflation surges significantly, potentially leading to a period of economic instability, a decline in consumer confidence, and potentially a recession.This graphical representation highlights the different potential economic outcomes depending on the future trajectory of inflation. While the current economic outlook is positive, the risk of inflation resurgence remains a significant concern, and policymakers must remain vigilant in their efforts to manage inflation expectations and maintain economic stability.

Ending Remarks

The former Treasury Secretary’s warning serves as a timely reminder of the ever-present possibility of inflation resurgence. While the current economic outlook is uncertain, understanding the potential causes, impacts, and policy responses to inflation is crucial for navigating the complexities of the global economy.

By analyzing historical trends, current economic indicators, and potential policy options, we can better prepare for the challenges that may lie ahead and work towards fostering a more stable and sustainable economic future.