Federal Reserves Preferred Inflation Metric Decelerates to 2.2 Percent

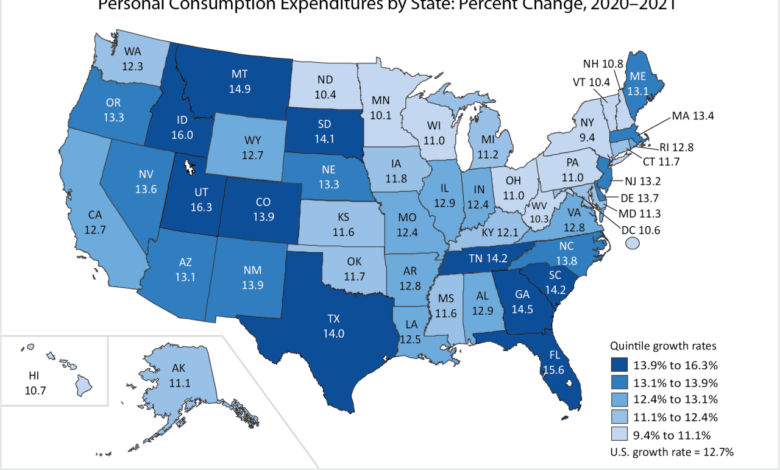

Federal reserves preferred inflation metric decelerates to 2 2 percent – Federal Reserve’s Preferred Inflation Metric Decelerates to 2.2 Percent, a significant shift that could impact the U.S. economy in various ways. The Federal Reserve, responsible for maintaining price stability and full employment, targets an inflation rate of 2%. Recently, the preferred inflation metric, the Personal Consumption Expenditures (PCE) price index, has shown a deceleration, reaching 2.2% in the last quarter.

This development is a welcome sign for many economists who have been concerned about high inflation rates, but it also raises questions about the potential impact on the economy and the Federal Reserve’s future monetary policy decisions.

The recent deceleration of inflation can be attributed to a number of factors, including easing supply chain bottlenecks, declining energy prices, and a cooling housing market. These factors have contributed to a decrease in demand-pull inflation, which occurs when consumers have more money to spend than there are goods and services available.

However, it’s important to note that inflation remains elevated compared to historical levels, and the Federal Reserve is still committed to bringing inflation back down to its 2% target.

Federal Reserve’s Inflation Target

The Federal Reserve, the central bank of the United States, has a mandate to maintain price stability and full employment. One of the key tools it uses to achieve these goals is its inflation target. The Federal Reserve’s current inflation target is 2%, which means it aims to keep inflation at around 2% per year, as measured by the Personal Consumption Expenditures (PCE) price index.This target is not a rigid goal, but rather a flexible range that allows for some fluctuation.

The Federal Reserve recognizes that inflation can vary in the short term due to factors like supply chain disruptions or energy price shocks. However, it aims to keep inflation consistently close to 2% over the long term.

Historical Context of the Inflation Target

The Federal Reserve’s inflation target has evolved over time. Before the 2000s, the Federal Reserve did not have a formal inflation target. Instead, it focused on keeping inflation low and stable. In the early 2000s, the Federal Reserve began to explicitly target inflation, initially setting a range of 1-2%.

In 2012, the Federal Reserve adopted its current target of 2%.The decision to adopt an explicit inflation target was based on several factors. First, it was believed that a clear target would provide greater transparency and accountability for the Federal Reserve’s monetary policy decisions.

Second, a target could help to anchor inflation expectations, making it easier for the Federal Reserve to control inflation. Third, a target could help to improve communication between the Federal Reserve and the public.

Consequences of Exceeding or Falling Short of the Inflation Target

Exceeding or falling short of the inflation target can have significant consequences for the U.S. economy.

Exceeding the Inflation Target

If inflation exceeds the target, it can erode purchasing power, lead to higher interest rates, and create uncertainty for businesses and consumers. High inflation can also make it difficult for the Federal Reserve to control the economy.

The Federal Reserve’s preferred inflation metric decelerating to 2.2 percent is a positive sign, but it’s hard to ignore the larger picture. While inflation cools, the economic landscape remains volatile, and certain corporations continue to operate in Russia, like Koch Industries, which even backs groups opposing US sanctions.

This highlights the complex interplay between economic forces and geopolitical tensions, which ultimately impacts inflation and the broader economic outlook.

For example, if inflation rises to 5%, the price of goods and services would increase by 5% per year. This would reduce the purchasing power of consumers and businesses, as they would have to spend more money to buy the same amount of goods and services.

Falling Short of the Inflation Target

If inflation falls short of the target, it can lead to deflation, which is a sustained decrease in the general price level. Deflation can be harmful to the economy because it can discourage spending and investment, leading to slower economic growth.

For example, if deflation occurs, businesses may be reluctant to invest in new projects because they expect prices to fall further in the future. Consumers may also delay purchases, hoping to get a better deal later.

The Federal Reserve carefully monitors inflation and adjusts its monetary policy to keep inflation close to its target. This involves setting interest rates, buying or selling government bonds, and other measures to influence the supply of money and credit in the economy.

The goal is to achieve a balance between price stability and full employment.

Deceleration of Inflation

The recent deceleration of inflation, while welcomed by many, is a complex phenomenon driven by a multitude of factors. Understanding the causes and potential implications of this trend is crucial for policymakers, businesses, and consumers alike.

The Federal Reserve’s preferred inflation metric decelerating to 2.2 percent is a welcome sign, but it’s important to remember that economic stability isn’t just about numbers. The story of Andy Dunn, co-founder of Bonobos, and his struggles with mental health, as detailed in this article , highlights the human cost of pressure and the importance of prioritizing well-being, even in the face of economic challenges.

Ultimately, a healthy economy needs healthy individuals, and a focus on mental health is crucial to achieving both.

Factors Contributing to Inflation Deceleration

The recent slowdown in inflation is attributed to a combination of factors, including:

- Easing Supply Chain Pressures:Post-pandemic supply chain disruptions have gradually eased, leading to increased availability of goods and services, thereby reducing price pressures. The normalization of global trade flows and improved logistics have also played a significant role.

- Cooling Consumer Demand:Rising interest rates and concerns about economic uncertainty have led to a decline in consumer spending. This reduced demand has contributed to a slowdown in price increases across various sectors.

- Falling Energy Prices:The decline in global energy prices, particularly for oil and natural gas, has significantly impacted inflation. This decrease in energy costs has been a major factor in the overall moderation of price pressures.

- Government Interventions:Policy measures implemented by central banks and governments, such as interest rate hikes and fiscal stimulus programs, have helped to control inflation by influencing demand and supply dynamics.

Comparison with Previous Inflation Periods

The current inflation rate, while still elevated, is significantly lower than the peak levels experienced in the latter half of 2022. This deceleration can be compared to historical periods of inflation, such as the 1970s, where persistent price increases led to economic instability and stagflation.

However, it is important to note that the current inflation trajectory is distinct from those past periods, with different contributing factors and potential implications.

Implications for the Economy

The deceleration of inflation has significant implications for various sectors of the economy:

- Consumer Spending:A decline in inflation can boost consumer confidence, leading to increased discretionary spending as households perceive their purchasing power to be improving. This can stimulate economic growth.

- Business Investment:A stable inflation environment provides businesses with greater certainty about future costs and returns. This can encourage investment in new equipment, technology, and expansion, driving economic activity.

- Employment:A moderating inflation rate can lead to more predictable wage growth and reduced pressure on businesses to raise prices. This can contribute to a more stable labor market and potentially support employment growth.

Monetary Policy Implications

The deceleration of inflation to the Federal Reserve’s target of 2% has significant implications for the central bank’s monetary policy decisions. The Fed will need to carefully assess the trajectory of inflation and economic growth to determine the appropriate course of action.

Potential Adjustments to Monetary Policy

The Federal Reserve’s primary tool for managing inflation is adjusting interest rates. With inflation slowing towards the target, the Fed is likely to consider pausing or even reversing its recent interest rate hikes. This approach aims to avoid unnecessarily tightening monetary policy and potentially stifling economic growth.

The Fed may also adjust other policy tools, such as the size of its balance sheet, to further influence the level of liquidity in the financial system.

Risks and Challenges

While a decelerating inflation rate is generally positive, the Fed faces several challenges in managing monetary policy during this transition. One key risk is that inflation could become entrenched at a level above the target. If the Fed eases monetary policy too quickly, it could reignite inflationary pressures.

The Federal Reserve’s preferred inflation metric has decelerated to 2.2 percent, which is good news for consumers and businesses. However, there are other concerns on the horizon, such as the 50 governors opposing a federal plan to move National Guard units , which could potentially undermine state sovereignty and create a more centralized government.

With these competing forces at play, it remains to be seen whether the Fed can successfully navigate these challenges and maintain a stable economy.

Another challenge is the potential for economic slowdown. As the Fed raises interest rates, it can impact borrowing costs for businesses and consumers, potentially slowing economic growth.

The Fed’s challenge is to strike a balance between controlling inflation and supporting economic growth.

The Fed will need to carefully monitor economic data and adjust its policy stance accordingly. The central bank must also communicate its intentions clearly to the public to avoid unnecessary market volatility.

Economic Outlook: Federal Reserves Preferred Inflation Metric Decelerates To 2 2 Percent

The deceleration of inflation to the Federal Reserve’s target range of 2-2.2% offers a glimmer of hope for a more stable economic landscape. However, the path ahead is not without its uncertainties. The impact of decelerating inflation on economic growth, employment, and other key economic indicators will be crucial to watch in the coming months and years.

Potential Economic Scenarios

The deceleration of inflation could lead to various economic scenarios. While a soft landing is the most desirable outcome, it is not guaranteed. Here’s a table illustrating potential scenarios for economic growth and inflation in the coming months and years:

| Scenario | Economic Growth | Inflation |

|---|---|---|

| Soft Landing | Moderate and Sustainable | Stable around 2% |

| Recession | Negative Growth | Potential Deflation |

| Stagflation | Slow Growth | High and Persistent Inflation |

Potential Risks and Opportunities, Federal reserves preferred inflation metric decelerates to 2 2 percent

The economic outlook is influenced by a range of factors, including:

- Global Economic Slowdown:A slowdown in global economic activity could impact US exports and overall economic growth.

- Geopolitical Tensions:Ongoing conflicts and geopolitical instability can disrupt supply chains, increase energy prices, and dampen consumer confidence.

- Labor Market Dynamics:Tight labor markets can lead to wage inflation, which could keep overall inflation elevated.

- Consumer Spending:Consumer confidence and spending are key drivers of economic growth. Declining consumer confidence could lead to a decrease in spending.

- Monetary Policy:The Federal Reserve’s monetary policy decisions will play a crucial role in shaping the economic outlook. Continued rate hikes could slow economic growth, while premature easing could reignite inflation.

- Technological Advancements:Technological innovation can drive productivity gains and economic growth, but it can also disrupt existing industries and create job displacement.

- Climate Change:Extreme weather events and climate-related disruptions can have significant economic impacts, affecting agriculture, infrastructure, and other sectors.

Closing Notes

The deceleration of inflation to 2.2% is a positive development, but it remains to be seen whether this trend will continue. The Federal Reserve will need to carefully monitor inflation and the broader economy to determine the appropriate course of action.

The central bank’s monetary policy decisions will have a significant impact on the economy, and investors and consumers alike will be watching closely to see how the Federal Reserve navigates this challenging environment.