Dow Jones Plunges 230 Points as Wall Streets Comeback Fails

Dow jones drops 230 points lower as wall street comeback attempt fizzles out – Dow Jones Plunges 230 Points as Wall Street’s Comeback Fails – a headline that echoed across financial news outlets, reflecting a day of market turmoil. The Dow Jones Industrial Average, a bellwether for the US stock market, experienced a significant drop, signaling a shift in investor sentiment.

This downturn, however, wasn’t a sudden storm. It was the culmination of a series of factors, including rising inflation, concerns about interest rate hikes, and a global economic outlook that seemed increasingly uncertain.

The market’s recent performance had been a roller coaster ride, with hopes of a rebound dashed by the Dow’s dramatic decline. This event wasn’t an isolated incident, as history has shown us that market volatility is a constant companion.

The question on everyone’s mind was whether this drop was a temporary blip or a harbinger of things to come.

Market Overview

The Dow Jones Industrial Average (DJIA) is a widely recognized benchmark for the US stock market, reflecting the performance of 30 large, publicly traded companies. A significant drop in the DJIA, such as the 230-point decline witnessed recently, indicates a negative sentiment within the broader market, prompting investors to reassess their positions.The recent downturn can be attributed to a confluence of factors, including concerns about inflation, rising interest rates, and the ongoing war in Ukraine.

These factors create uncertainty in the market, leading to a cautious approach by investors.

The Dow Jones dropping 230 points lower as Wall Street’s comeback attempt fizzles out is a stark reminder that economic uncertainty remains. While we grapple with these financial anxieties, it’s crucial to remember that cyber threats are also a growing concern.

It’s alarming to learn that Chinese hackers are using VLC Media Player to spy on you , highlighting the need for increased cybersecurity vigilance. As we navigate these turbulent times, staying informed about both economic and digital risks is paramount.

Market Sentiment and Contributing Factors

The market sentiment on the day of the drop was largely negative, with investors exhibiting risk aversion due to the prevailing economic uncertainties. The recent surge in inflation has eroded purchasing power and led to concerns about potential economic slowdown.

The Federal Reserve’s aggressive interest rate hikes aim to combat inflation but also carry the risk of slowing economic growth. Additionally, the ongoing war in Ukraine has introduced geopolitical risks and disrupted global supply chains, further contributing to market volatility.

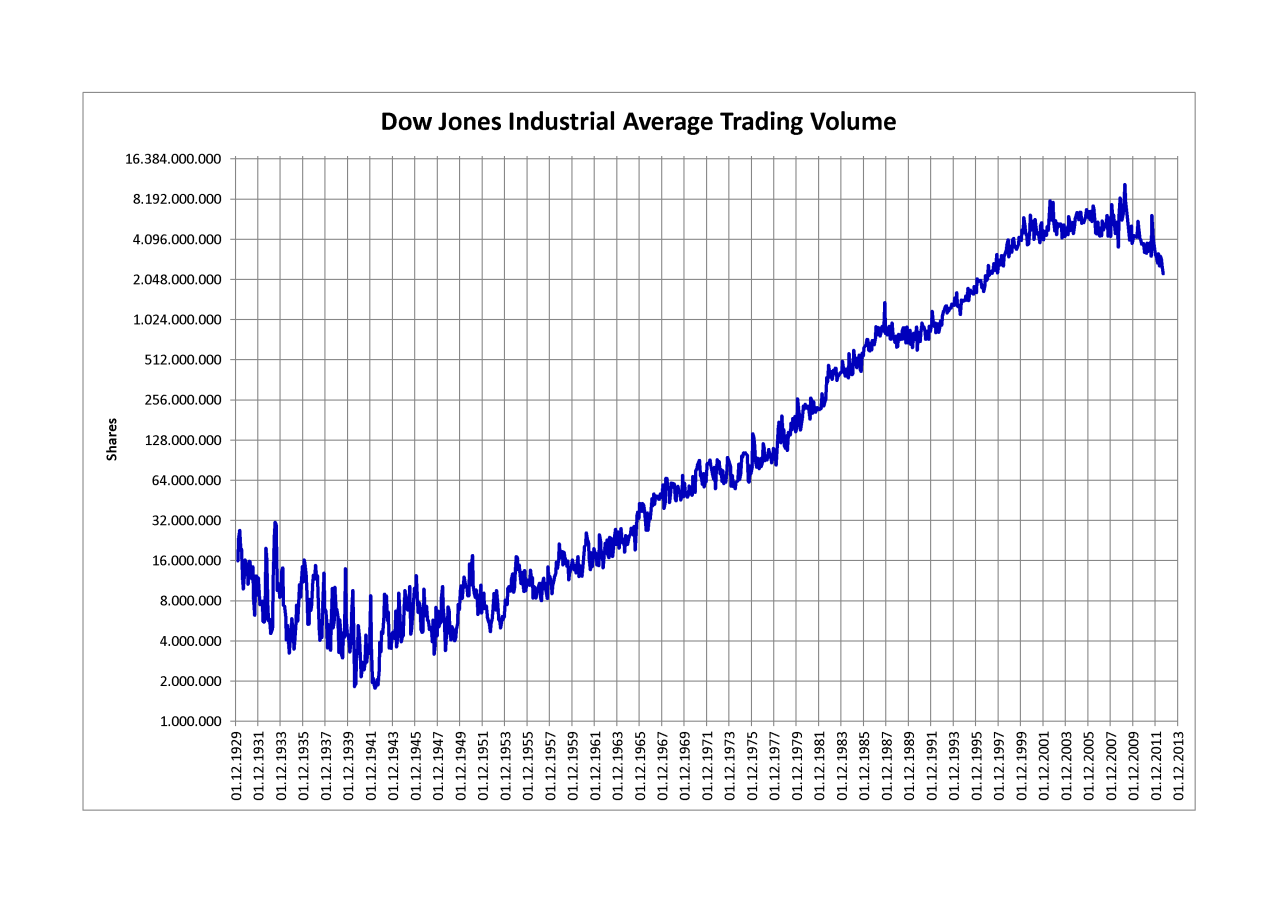

Historical Context of Market Performance

The recent market drop is not an isolated event. The stock market has experienced numerous periods of volatility throughout history, driven by various factors such as economic recessions, geopolitical tensions, and financial crises. For instance, the 2008 financial crisis resulted in a significant decline in the DJIA, with the index plummeting by over 50% from its peak.

The Dow Jones dropping 230 points lower as Wall Street’s comeback attempt fizzles out reflects a wider sense of uncertainty in the market. It’s hard to know what to expect, especially with the latest news regarding Michael Cohen’s former legal adviser disputing his Trump trial allegations, which adds another layer of complexity to the already volatile political landscape.

Ultimately, these events underscore the interconnectedness of our world, where political and legal developments can have a direct impact on the financial markets.

However, the market eventually recovered, demonstrating its resilience and capacity for rebound.

Reasons for the Dow Jones Drop

The Dow Jones Industrial Average’s 230-point decline reflects a combination of factors, including heightened concerns about inflation, rising interest rates, and a potential economic slowdown. These anxieties are fueled by recent economic data releases and the Federal Reserve’s ongoing efforts to curb inflation.

Impact of Economic Indicators

The recent decline in the Dow Jones can be attributed to investor concerns about the state of the economy. The Federal Reserve’s aggressive interest rate hikes have begun to impact the economy, with some sectors, like housing, already showing signs of weakness.

The Fed’s continued commitment to raising rates to combat inflation has raised concerns about a potential recession, prompting investors to seek safety in assets perceived as less risky.

Inflationary Pressures

Inflation remains a major concern for investors and businesses alike. While recent data has shown some signs of cooling, the rate of inflation is still significantly above the Fed’s target. The persistence of high inflation could lead to further interest rate hikes, potentially pushing the economy into a recession.

The uncertainty surrounding inflation has made investors cautious, leading to a sell-off in stocks.

Sector-Specific Concerns

The decline in the Dow Jones was also influenced by concerns in specific sectors. The technology sector, which has been a major driver of the stock market’s performance in recent years, has faced headwinds due to rising interest rates and slowing growth in consumer spending.

The energy sector has also been under pressure due to concerns about slowing global economic growth and the potential impact on oil demand.

The Dow Jones dropping 230 points lower is a stark reminder of the volatility in the market. While Wall Street tries to find its footing, it’s interesting to see how alternative investments like what are nft games are gaining traction.

Whether these new ventures can provide a safe haven from the economic storm remains to be seen, but it’s clear that investors are seeking new avenues for growth in this uncertain landscape.

Wall Street’s Comeback Attempt

Wall Street investors, in an attempt to reverse the market’s downward trajectory, employed various strategies, hoping to reignite the bullish sentiment. These efforts, however, were ultimately unsuccessful, failing to restore the market’s earlier momentum.

Factors Hindering the Comeback Attempt

Several factors contributed to the failure of Wall Street’s comeback attempt.

- Persistent Inflation Concerns:The market remains apprehensive about the Federal Reserve’s aggressive interest rate hikes, which are intended to combat inflation. This uncertainty, coupled with the ongoing inflation pressures, dampens investor confidence, making them hesitant to invest heavily.

- Economic Growth Concerns:The global economy faces various headwinds, including the ongoing war in Ukraine, supply chain disruptions, and rising energy prices. These factors cast a shadow over the future economic outlook, leading investors to adopt a more cautious approach.

- Geopolitical Tensions:Escalating geopolitical tensions, particularly the conflict in Ukraine and the rising tensions between the US and China, create a sense of uncertainty and volatility in the market. Investors are reluctant to take on significant risk in such an environment.

- Earnings Season Uncertainty:The upcoming earnings season is a crucial period for the market. Investors are closely watching corporate earnings reports for signs of resilience or weakness in the face of the challenging economic conditions. This uncertainty adds to the market’s volatility.

Comparison with Past Comeback Attempts

The current market situation shares similarities with past instances of attempted comebacks, particularly in the aftermath of major market downturns.

- The 2008 Financial Crisis:Following the 2008 financial crisis, the market experienced several attempted comebacks, often fueled by government intervention and monetary easing. However, these attempts were frequently met with skepticism and uncertainty, as the underlying economic problems remained unresolved.

- The 2020 COVID-19 Pandemic:The market’s recovery from the COVID-19 pandemic was characterized by periods of rapid growth and sudden corrections. This volatility reflected the uncertainty surrounding the pandemic’s impact on the economy and the effectiveness of government stimulus measures.

While the current market situation shares some similarities with past instances, the specific factors driving the market’s decline and the effectiveness of attempted comebacks are unique to each situation. The current environment is marked by a confluence of challenges, including persistent inflation, economic uncertainty, and geopolitical tensions, making it difficult for investors to gauge the market’s direction.

Potential Implications: Dow Jones Drops 230 Points Lower As Wall Street Comeback Attempt Fizzles Out

A significant drop in the Dow Jones Industrial Average can have far-reaching consequences for investors and the broader economy. It can signal a shift in market sentiment, potentially impacting investment decisions and economic activity.

Short-Term Implications for Investors

A sudden drop in the Dow Jones can cause anxiety and uncertainty among investors. Short-term implications include:

- Portfolio Value Loss:Investors holding stocks in the Dow Jones may experience a decline in their portfolio value, leading to potential losses. This can impact individual investors, retirement funds, and institutional investors.

- Increased Volatility:The market becomes more volatile, with rapid price fluctuations, making it difficult for investors to predict future trends and potentially leading to impulsive trading decisions.

- Reduced Investor Confidence:A Dow Jones drop can erode investor confidence, causing them to become more risk-averse and hesitant to invest in the market.

Long-Term Implications for the Economy, Dow jones drops 230 points lower as wall street comeback attempt fizzles out

While a Dow Jones drop is not necessarily a direct indicator of a recession, it can be a warning sign of underlying economic weakness. Long-term implications include:

- Reduced Business Investment:Companies may become more cautious about investing in new projects or expanding operations, fearing a potential economic downturn.

- Slower Economic Growth:A decline in business investment and consumer spending can lead to slower economic growth, impacting job creation and overall economic activity.

- Potential for Recession:In extreme cases, a prolonged decline in the Dow Jones and the broader market can signal a potential recession, characterized by widespread economic contraction.

Impact on Different Sectors and Industries

The impact of a Dow Jones drop on various sectors and industries can vary depending on the specific factors driving the decline.

- Technology Sector:The tech sector is often sensitive to market sentiment and economic uncertainty. A Dow Jones drop can lead to a decline in tech stock valuations, impacting companies like Apple, Microsoft, and Amazon.

- Energy Sector:The energy sector is closely tied to global economic activity and demand for oil and gas. A Dow Jones drop can indicate reduced economic growth, potentially impacting oil prices and the profitability of energy companies.

- Consumer Discretionary Sector:This sector includes companies that sell non-essential goods and services, such as automobiles, retail, and travel. A Dow Jones drop can lead to reduced consumer spending, impacting these industries.

Market Scenarios

The future direction of the market depends on various factors, including investor confidence, economic data, and geopolitical events. Here are some potential scenarios:

| Scenario | Investor Confidence | Economic Data | Geopolitical Events |

|---|---|---|---|

| Bullish | High | Strong | Stable |

| Bearish | Low | Weak | Unstable |

| Neutral | Moderate | Mixed | Uncertain |

| Volatile | Fluctuating | Unpredictable | Significant Events |

Investor Perspective

The recent Dow Jones drop has undoubtedly raised concerns among investors. To understand how this event impacts investment strategies, let’s consider a hypothetical scenario involving a portfolio manager navigating this volatile market. Imagine a portfolio manager, Sarah, who specializes in long-term growth investments.

Sarah recognizes that the Dow Jones drop, while concerning, is a normal part of market cycles. Her strategy involves maintaining a balanced portfolio, diversifying across different asset classes, and focusing on companies with strong fundamentals. Sarah believes that the current market downturn presents an opportunity to acquire undervalued assets at attractive prices.

Investor Considerations During Market Volatility

Navigating market volatility can be challenging for individual investors. Here are some key considerations:

- Maintain a Long-Term Perspective:Market fluctuations are temporary. Investors should focus on their long-term financial goals and avoid making impulsive decisions based on short-term market movements.

- Review Your Risk Tolerance:Market volatility can exacerbate anxieties. It’s essential to reassess your risk tolerance and ensure your investment portfolio aligns with your comfort level.

- Diversify Your Investments:Diversification is crucial for mitigating risk. By spreading investments across different asset classes, sectors, and geographic regions, investors can reduce the impact of any single asset’s performance on their overall portfolio.

- Seek Professional Advice:For complex financial decisions, seeking advice from a qualified financial advisor can provide valuable insights and guidance.

Investor Sentiment and Market Performance

The relationship between investor sentiment and market performance is often complex and cyclical. During periods of uncertainty, investor sentiment can significantly influence market direction.

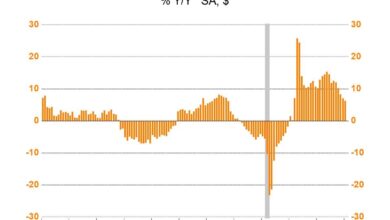

A common visual representation of this relationship is a chart depicting the investor sentiment indexagainst the market performance index.

Hypothetical Chart:* The X-axisrepresents time, and the Y-axisrepresents the index values.

- During periods of high investor confidence, the investor sentiment index tends to be high, and the market performance index typically rises.

- Conversely, during periods of fear or uncertainty, the investor sentiment index falls, and the market performance index may decline.

Example:Imagine a scenario where the Dow Jones Industrial Average (DJIA) experiences a sharp decline. This event might trigger a wave of negative investor sentiment, leading to further selling pressure and potentially exacerbating the market drop. However, as the market stabilizes and investor confidence gradually recovers, the DJIA could rebound, reflecting a positive correlation between sentiment and performance.It’s important to remember that this relationship is not always linear and can be influenced by various factors.

However, understanding the interplay between investor sentiment and market performance can provide valuable insights for navigating market volatility.

Final Thoughts

The Dow Jones’s 230-point drop served as a stark reminder of the inherent risks in the stock market. While Wall Street’s attempt to stage a comeback fizzled out, investors are left grappling with the potential implications for their portfolios and the broader economy.

The market’s future trajectory remains uncertain, dependent on a complex interplay of economic indicators, investor confidence, and global events. As the dust settles, one thing is clear: navigating this volatile landscape requires a measured approach, informed decision-making, and a keen understanding of the forces at play.