Dow Plunges Below 19,000, Erasing Trump Era Gains

Dow briefly craters below 19000 as market plunge wipes out trump era gains – The Dow briefly cratered below 19,000 as market plunge wipes out trump era gains, sending shockwaves through the financial world. This dramatic decline, a stark reminder of the market’s volatility, wiped out all the gains made during the Trump presidency, leaving investors reeling and questioning the future of the economy.

The sudden drop was triggered by a confluence of factors, including rising inflation, concerns about a potential recession, and geopolitical tensions.

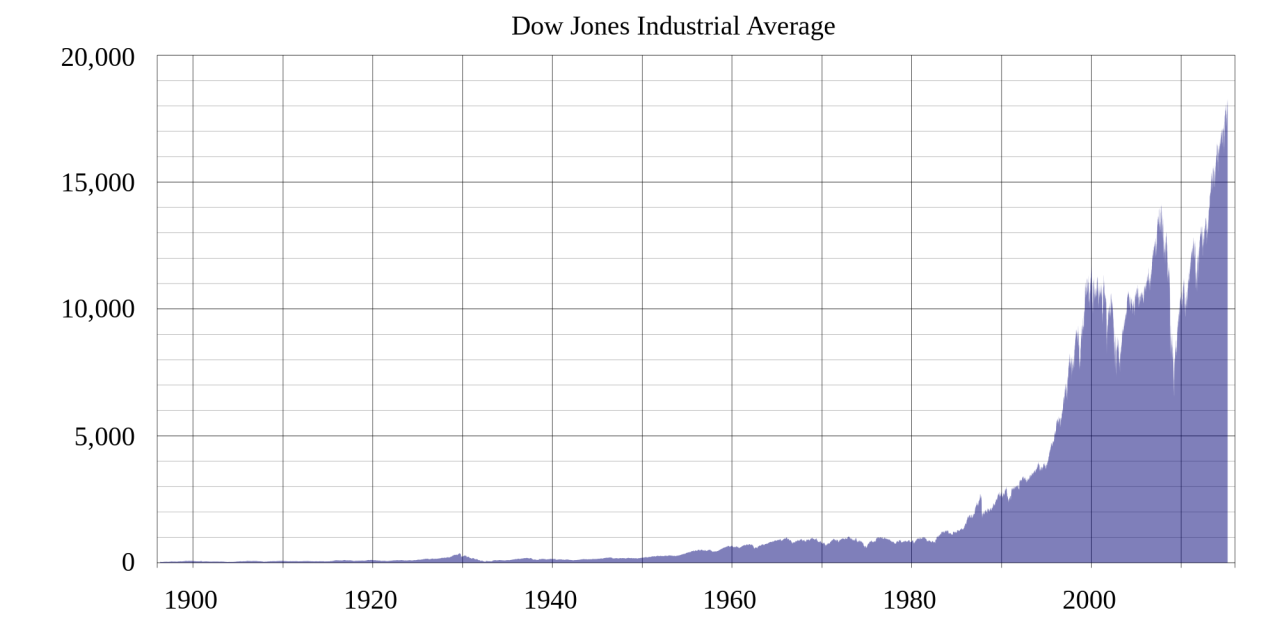

The Dow Jones Industrial Average (DJIA), a widely followed stock market index, has been a barometer of investor sentiment for decades. Its plunge below 19,000 marked a significant milestone, symbolizing a loss of confidence in the US economy. The decline was not isolated to the DJIA, as other major indices, including the S&P 500 and the Nasdaq, also experienced significant losses.

This broad-based sell-off reflected a widespread sense of uncertainty and anxiety among investors.

Market Plunge

The Dow Jones Industrial Average (DJIA) plummeting below 19,000 marks a significant moment in the market, signifying a substantial loss of value and a shift in investor sentiment. This decline, which wiped out gains made during the Trump era, reflects a combination of factors that have collectively pushed the market into a downward spiral.

Factors Contributing to the Market Plunge, Dow briefly craters below 19000 as market plunge wipes out trump era gains

The market plunge can be attributed to a confluence of economic indicators, geopolitical events, and investor sentiment.

- Economic Indicators:Rising inflation, coupled with the Federal Reserve’s aggressive interest rate hikes, has dampened economic growth prospects and increased uncertainty among investors. The recent data showing a decline in consumer confidence and a slowdown in manufacturing activity has further exacerbated these concerns.

- Geopolitical Events:The ongoing war in Ukraine, coupled with escalating tensions between the United States and China, has created a volatile global landscape. These geopolitical uncertainties have increased market volatility and eroded investor confidence.

- Investor Sentiment:The combination of economic challenges and geopolitical risks has led to a shift in investor sentiment, with many becoming more cautious and risk-averse. This has resulted in a sell-off across various asset classes, including stocks, bonds, and commodities.

Magnitude of the Decline and its Impact

The Dow’s decline below 19,000 represents a significant drop from its recent highs, highlighting the severity of the market downturn. This decline has had a ripple effect across various sectors, with technology and consumer discretionary stocks bearing the brunt of the losses.

- Technology Sector:The technology sector has been particularly hard hit, with valuations for many growth companies coming under pressure. The decline in growth expectations and the rising cost of capital have weighed heavily on tech stocks.

- Consumer Discretionary Sector:Consumer discretionary stocks, which are sensitive to economic conditions, have also experienced significant losses. The rising cost of living and the potential for a recession have dampened consumer spending, impacting the performance of companies in this sector.

Erased Gains

The recent market plunge, which saw the Dow Jones Industrial Average (DJIA) briefly dip below 19,000, has wiped out gains made during the Trump presidency. This dramatic downturn has sparked discussions about the economic legacy of the Trump era and its impact on the stock market.

The Dow’s Performance During the Trump Presidency

The Dow Jones Industrial Average, a key indicator of the US stock market’s performance, experienced a significant upward trajectory during the Trump presidency. From the time Trump took office in January 2017 to the beginning of the COVID-19 pandemic in February 2020, the Dow rose by over 70%, reaching a record high of over 29,000 points.

This surge was attributed to a combination of factors, including tax cuts, deregulation, and trade agreements.

Comparing Trump’s Performance to Previous Presidencies

The Dow’s performance during the Trump era has been compared to previous presidencies. For example, during the Obama presidency (2009-2017), the Dow rose by approximately 150%, recovering from the 2008 financial crisis. However, this growth occurred over a longer period, and the Dow’s performance during Trump’s presidency was significantly faster, especially during the first three years.

Key Economic Policies During the Trump Administration

Several key economic policies implemented by the Trump administration are believed to have influenced the market’s performance:

- Tax Cuts and Jobs Act (2017):This legislation reduced corporate tax rates from 35% to 21%, leading to increased corporate profits and potentially stimulating investment and job creation.

- Deregulation:The Trump administration rolled back a number of regulations across various industries, aiming to reduce the regulatory burden on businesses and stimulate economic growth.

- Trade Deals:The Trump administration renegotiated trade deals with Mexico, Canada, and China, aiming to create a more favorable environment for US businesses.

While the Trump administration’s economic policies are credited with boosting the stock market, critics argue that these policies were unsustainable and ultimately contributed to the current economic downturn. The long-term impact of these policies remains to be seen.

Impact on Investors

The Dow Jones Industrial Average’s dramatic plunge below 19,000, wiping out gains made during the Trump era, has sent shockwaves through the financial world. This market decline has significant implications for both individual and institutional investors, demanding a careful assessment of its potential impact and appropriate responses.

Strategies for Investors

The market decline presents investors with a range of challenges and opportunities. Understanding these nuances is crucial for navigating the turbulent waters of the market.

The Dow Jones Industrial Average plummeted below 19,000, erasing all the gains made during the Trump era, as investors grapple with the ongoing economic uncertainty. It’s a stark reminder of the volatility we’re facing, and it’s hard not to be reminded of the chaos in Washington, even amidst the market turmoil.

For example, Rep. Matt Gaetz slept in a Walmart parking lot overnight after testing negative for coronavirus , a story that’s as bewildering as it is unsettling. While the market crash is a serious matter, it’s stories like Gaetz’s that highlight the disconnect between the realities of everyday life and the political landscape.

- Rebalancing Portfolios:Investors may consider rebalancing their portfolios to align with their risk tolerance and long-term investment goals. This may involve adjusting the allocation between stocks, bonds, and other asset classes. For example, a conservative investor might shift a portion of their equity holdings to fixed-income investments to reduce overall portfolio volatility.

- Dollar-Cost Averaging:Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of market conditions. This strategy helps to mitigate the impact of market volatility by averaging the purchase price over time. For example, an investor could choose to invest $100 per week into a diversified stock index fund, regardless of whether the market is rising or falling.

This approach helps to reduce the risk of buying high and selling low.

- Seeking Professional Advice:In times of market uncertainty, seeking guidance from a qualified financial advisor can be beneficial. Financial advisors can provide personalized recommendations based on an investor’s specific circumstances, risk tolerance, and investment objectives. They can help investors develop a comprehensive investment plan that aligns with their goals and navigate the complexities of the market.

Psychological Impact

Market downturns can have a profound psychological impact on investors. Fear, uncertainty, and doubt can lead to impulsive decisions, such as selling assets at a loss or avoiding investment opportunities altogether.

- Fear of Missing Out (FOMO):The fear of missing out on potential gains can lead investors to chase after high-performing assets, even if they are not aligned with their investment strategy. This can lead to overpaying for assets and increased risk.

- Herding Behavior:Investors may be influenced by the actions of others, leading to herd behavior. This can result in buying or selling assets based on the prevailing sentiment rather than on fundamental analysis. For example, if many investors are selling a particular stock, others may follow suit, even if there is no sound reason to do so.

- Loss Aversion:Investors tend to feel the pain of a loss more strongly than the pleasure of a gain. This can lead to holding onto losing investments for too long, hoping for a recovery, or avoiding new investments due to the fear of further losses.

Market Volatility and Future Outlook

The recent market plunge, erasing gains from the Trump era, has highlighted the inherent volatility of the stock market. Understanding the factors driving this volatility and their potential impact on the future direction of the market is crucial for investors.

Factors Influencing Market Volatility

The current market volatility is driven by a confluence of factors, including:* Inflation and Interest Rate Hikes:The Federal Reserve’s aggressive interest rate hikes to combat inflation have increased borrowing costs for businesses and consumers, leading to economic uncertainty and potentially slowing growth.

Geopolitical Tensions

The ongoing war in Ukraine, tensions between the US and China, and other geopolitical events contribute to market uncertainty and risk aversion among investors.

Supply Chain Disruptions

Ongoing supply chain disruptions caused by the pandemic and geopolitical events have led to higher prices and reduced production, impacting corporate earnings and economic growth.

Recession Fears

The Dow plummeting below 19,000, wiping out Trump-era gains, is a stark reminder of the economic uncertainty we’re facing. This market turmoil is likely to impact voters in the upcoming elections, as many are feeling the strain on their wallets.

It’s interesting to consider that, as Charlie Hurt warns, a Sanders surge could spell trouble for Democrats down the ballot , potentially further impacting the economic landscape. It’s a complex situation, and the Dow’s continued downward trajectory could have significant implications for the future of the country.

Concerns about a potential recession in the US and other major economies are weighing on investor sentiment, leading to increased volatility.

Factors Influencing Future Market Direction

The future direction of the stock market will depend on a number of factors, including:* Inflation and Interest Rate Trajectory:The pace of inflation and the Federal Reserve’s future actions on interest rates will be crucial in determining the outlook for economic growth and corporate earnings.

Geopolitical Developments

The resolution of the war in Ukraine and other geopolitical tensions will have a significant impact on market sentiment and risk appetite.

Corporate Earnings

Corporate earnings growth is a key driver of stock prices. Investors will closely watch earnings reports to assess the health of the economy and the outlook for future profits.

Consumer Spending

The Dow plummeting below 19,000, wiping out Trump-era gains, feels like a punch to the gut. It’s hard to focus on anything else, but even in the midst of this financial chaos, some things just can’t be ignored. A coronavirus alert on Tinder surprises dating apps users reminds us that the pandemic is still a real threat, even as the market reels from its impact.

It’s a stark reminder that while the Dow might be down, our health and safety are still paramount.

Consumer spending accounts for a significant portion of economic activity. Changes in consumer confidence and spending patterns can have a major impact on the stock market.

Market Scenarios and Investment Strategies

The following table Artikels potential market scenarios and corresponding investment strategies:

| Potential Scenario | Market Impact | Investment Strategies | Key Indicators |

|---|---|---|---|

| Continued Economic Growth | Stock market likely to rise, with higher valuations for growth companies. | Invest in growth stocks, sectors benefiting from economic expansion, and emerging markets. | Strong GDP growth, low unemployment, rising corporate earnings, and positive consumer sentiment. |

| Moderate Economic Slowdown | Stock market likely to experience moderate volatility, with value stocks potentially outperforming growth stocks. | Diversify portfolio across different asset classes, including value stocks, bonds, and real estate. | Slower GDP growth, rising interest rates, moderate inflation, and stable consumer spending. |

| Recession | Stock market likely to decline significantly, with defensive sectors like healthcare and utilities potentially outperforming. | Shift to a more conservative portfolio, including cash, bonds, and defensive stocks. | Negative GDP growth, high unemployment, rising inflation, and declining consumer spending. |

| Inflationary Surge | Stock market likely to experience significant volatility, with value stocks and commodities potentially outperforming. | Invest in inflation-hedging assets like commodities, real estate, and value stocks. | High inflation, rising interest rates, and uncertainty about future economic growth. |

The Broader Economic Context: Dow Briefly Craters Below 19000 As Market Plunge Wipes Out Trump Era Gains

The recent market plunge, erasing gains from the Trump era, has understandably sparked concerns about the broader economic landscape. While the stock market serves as a barometer of investor sentiment, it’s crucial to understand its relationship with the overall health of the economy.

Examining factors like inflation, interest rates, and unemployment can provide a more comprehensive picture.

The Current Economic Landscape

The US economy is currently navigating a complex landscape, marked by persistent inflation, rising interest rates, and a resilient labor market. Inflation, as measured by the Consumer Price Index (CPI), has been steadily declining from its peak in 2022, but remains above the Federal Reserve’s target of 2%.

The Fed has aggressively raised interest rates to combat inflation, aiming to slow economic growth and curb demand. Despite these measures, the unemployment rate remains historically low, suggesting a strong labor market.

Impact of Market Decline on the Broader Economy

While the stock market decline can be a significant indicator of investor sentiment, its impact on the broader economy is not always direct or immediate. A decline in stock prices can lead to reduced consumer spending, as investors feel less wealthy and may become more cautious.

Additionally, businesses may delay investment plans due to uncertainty about future economic conditions. However, the strength of the labor market and continued consumer spending can mitigate some of these negative effects.

Relationship Between the Stock Market and Economic Health

The stock market and the overall economic health of the nation are intertwined but not directly proportional. The stock market is a forward-looking indicator, reflecting investor expectations about future economic growth and corporate profits. A healthy economy generally leads to rising stock prices, as businesses thrive and investors are optimistic about the future.

However, the stock market can also be influenced by factors unrelated to the underlying economic fundamentals, such as geopolitical events or investor sentiment. It’s important to remember that the stock market is not a perfect reflection of the economy, and its fluctuations can sometimes be disconnected from the broader economic picture.

Epilogue

The Dow’s plunge below 19,000, erasing all the gains of the Trump era, serves as a stark reminder of the inherent risks associated with investing in the stock market. While the market is cyclical and prone to fluctuations, the recent decline highlights the importance of diversification, risk management, and a long-term investment horizon.

Investors must navigate this turbulent period with a clear understanding of the economic landscape, geopolitical risks, and their own investment goals. As the market continues to grapple with these challenges, it remains to be seen whether this decline is a temporary setback or a harbinger of a more significant downturn.