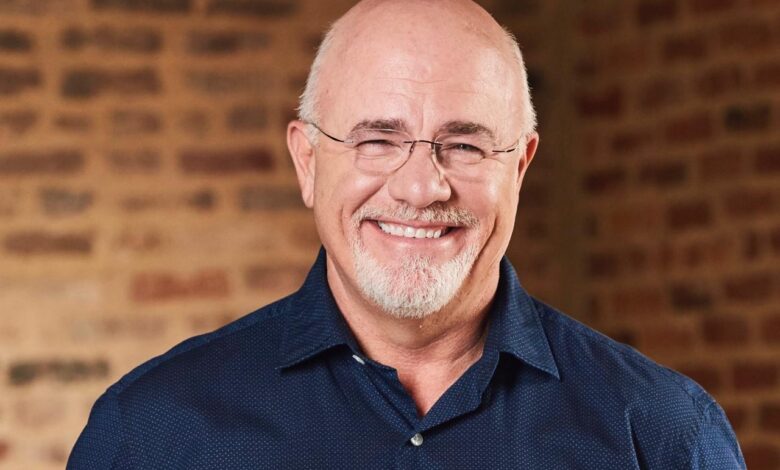

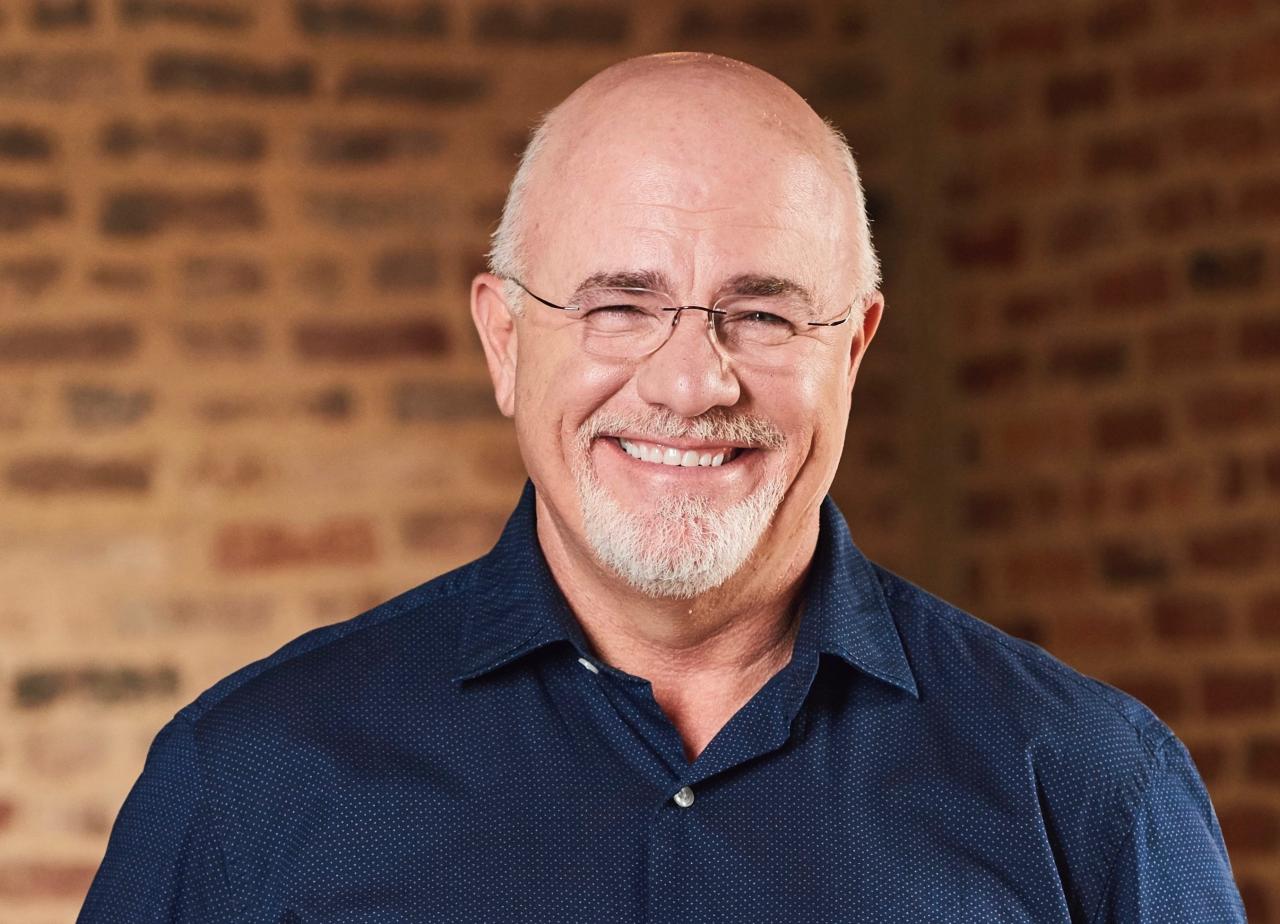

Dave Ramsey: When Cash Beats Investing

Dave ramsey heres when its better to pile up cash than invest – Dave Ramsey, the financial guru known for his “baby steps” approach, often advocates for building a substantial cash reserve before venturing into investments. But when does prioritizing cash over investing make sense? In this post, we’ll explore the scenarios where Ramsey’s philosophy of cash accumulation reigns supreme, offering insights into his perspective and the benefits of financial security.

Ramsey’s core principle is centered around building a solid financial foundation, which involves tackling debt, establishing an emergency fund, and saving for specific goals. While investing is an important aspect of long-term wealth building, Ramsey emphasizes the need to address immediate financial needs and secure your financial future before taking on the risks associated with investing.

The Benefits of Building a Cash Cushion

Having a healthy emergency fund is one of the most crucial aspects of building a solid financial foundation. It’s a safety net that protects you from unexpected life events, allowing you to navigate financial challenges without resorting to debt or jeopardizing your long-term financial goals.

The Peace of Mind That Comes with a Healthy Emergency Fund, Dave ramsey heres when its better to pile up cash than invest

A healthy emergency fund provides peace of mind knowing that you can handle unexpected expenses without disrupting your financial stability. Imagine facing a sudden job loss, a medical emergency, or a major car repair. Having a cash cushion allows you to address these situations without panic or financial strain.

It removes the stress of worrying about where the money will come from, giving you the time and freedom to focus on resolving the issue at hand.

The Role of Cash in Navigating Unexpected Financial Challenges

Cash is king when it comes to navigating unexpected financial challenges. Here’s why:

- Immediate Access:Unlike investments, cash is readily available, allowing you to access it immediately when needed. You don’t have to wait for a stock to sell or a bond to mature.

- Predictable Value:Cash maintains its value, unlike investments which can fluctuate in value due to market volatility. You know exactly how much money you have available, providing certainty in uncertain times.

- Flexibility:Cash can be used for any purpose, making it incredibly flexible in managing unexpected expenses. Whether it’s a medical bill, home repair, or unexpected travel, cash provides the necessary funds to address these situations without limitations.

Advantages of Cash Versus Investments in Different Financial Circumstances

The decision to prioritize cash or investments depends on your individual financial circumstances. Here’s a table comparing the advantages of each in different situations:

| Financial Situation | Cash | Investments |

|---|---|---|

| High-Risk Tolerance | Less advantageous | More advantageous |

| Low-Risk Tolerance | More advantageous | Less advantageous |

| Short-Term Goals (e.g., emergency fund, down payment) | More advantageous | Less advantageous |

| Long-Term Goals (e.g., retirement) | Less advantageous | More advantageous |

| High-Income Earner | More advantageous | Less advantageous |

| Low-Income Earner | Less advantageous | More advantageous |

Outcome Summary: Dave Ramsey Heres When Its Better To Pile Up Cash Than Invest

The balance between cash and investments is a crucial aspect of personal finance. While Dave Ramsey’s emphasis on cash accumulation might seem unconventional, it highlights the importance of financial security and peace of mind. Ultimately, the best approach is to assess your individual circumstances, financial goals, and risk tolerance to determine the optimal allocation between cash and investments.

Remember, building a solid foundation is the key to achieving long-term financial success.

Dave Ramsey’s advice to pile up cash before investing is solid, especially when you’re facing financial instability. It’s a strategy that echoes the current political climate, where even the most powerful figures, like Donald Trump, trump hits back at michelle obama after searing dnc speech says he would not be here if not for her husband , can be swayed by economic pressures.

Building a solid financial foundation, just like building a solid political base, requires a strategic approach, and sometimes, that means putting investment on hold until you have a comfortable cash cushion.

Dave Ramsey’s advice to build a cash cushion before investing resonates deeply right now. The recent coronavirus crisis hitting Europe’s tourism industry soon after reopenings highlights the unpredictable nature of the world. Having a solid financial foundation can provide a buffer against unexpected setbacks, whether it’s a job loss or a global pandemic.