Buffetts Berkshire Hathaway Posts Record Profit, Cash Hits $277 Billion

Buffetts berkshire hathaway posts record operating profit grows cash to 277 billion – Buffett’s Berkshire Hathaway Posts Record Profit, Cash Hits $277 Billion – It’s a testament to the enduring power of Warren Buffett’s investment strategy. Berkshire Hathaway, the conglomerate led by the legendary investor, has just reported record operating profits for the latest quarter, accompanied by a staggering $277 billion in cash reserves.

This remarkable achievement is a reflection of the company’s diversified portfolio, its ability to navigate volatile markets, and Buffett’s knack for identifying undervalued assets.

The record profit was driven by strong performance across Berkshire’s diverse portfolio of businesses, including insurance, energy, and manufacturing. The surge in cash reserves reflects both the company’s continued profitability and its conservative approach to deploying capital, a strategy that has served Berkshire well over the years.

Berkshire Hathaway’s Record Operating Profit

Berkshire Hathaway, the investment conglomerate led by Warren Buffett, has announced record operating profit for the recent quarter, further solidifying its position as a financial powerhouse. This remarkable performance is driven by a combination of factors, including strong performance across its diverse business portfolio and favorable market conditions.

Factors Contributing to Record Operating Profit

The record operating profit is a testament to the effectiveness of Berkshire Hathaway’s business strategy and the strength of its core businesses.

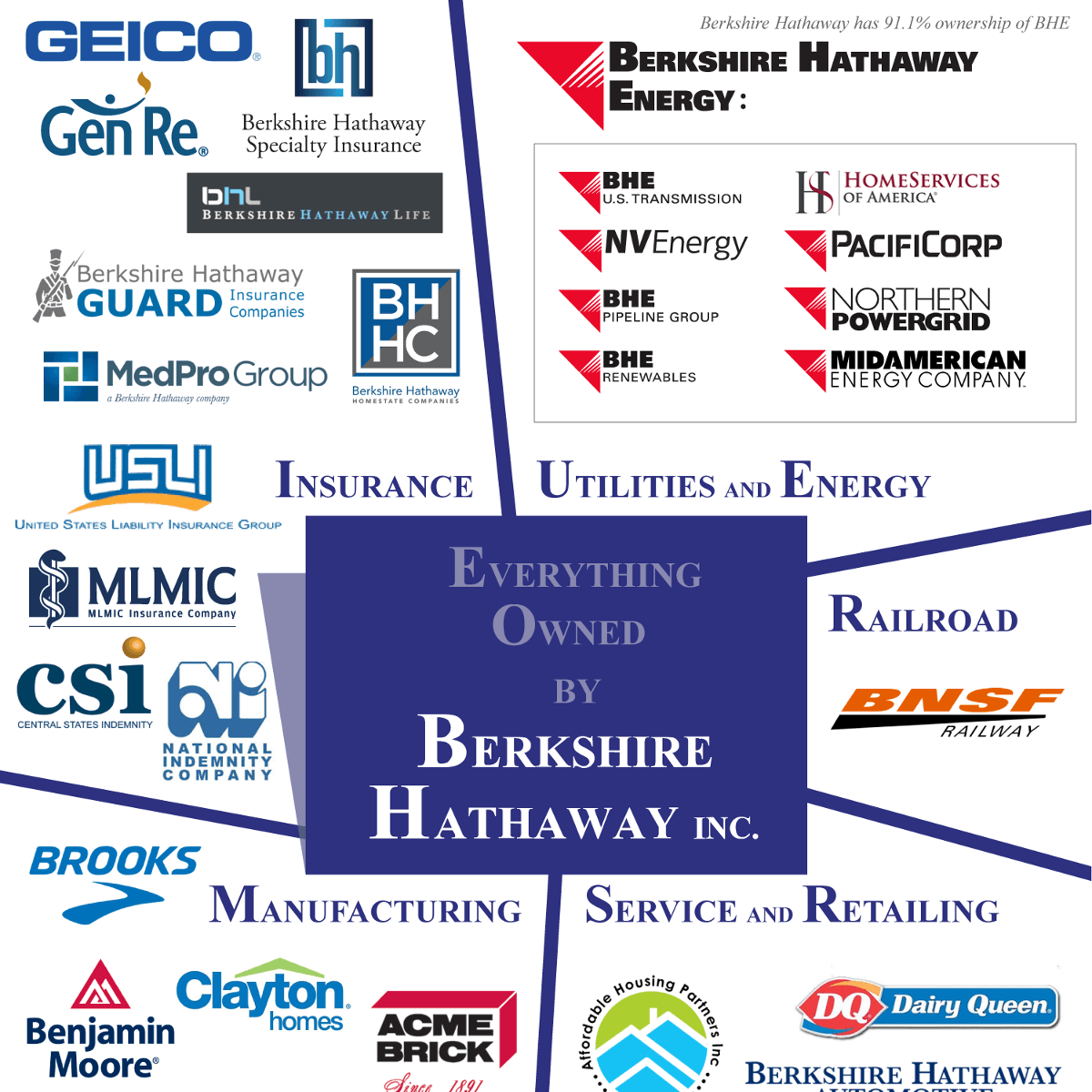

- Strong Performance of Core Businesses:Berkshire Hathaway’s diverse portfolio of businesses, spanning insurance, energy, manufacturing, and retail, has contributed significantly to the record profit. The insurance operations, led by Geico and Berkshire Hathaway Reinsurance Group, have seen robust growth in premiums and underwriting profits.

The energy segment, which includes the utility company Berkshire Hathaway Energy, has benefited from rising energy prices and increased demand. The manufacturing, service, and retail businesses, including BNSF Railway, Precision Castparts, and See’s Candies, have also performed well, contributing to the overall profit growth.

Warren Buffett’s Berkshire Hathaway continues to impress, posting record operating profit and growing its cash pile to a staggering $277 billion. While Buffett’s focus is on long-term investments, news from the world of baseball, san francisco giants manager gabe kapler will protest during national anthem after uvalde shooting , reminds us that sometimes, immediate action is needed.

The Giants’ decision to stand in solidarity with the victims of gun violence is a powerful statement, and it’s a reminder that even in the world of finance, there’s room for compassion and change. Back to Berkshire Hathaway, it’s clear that Buffett’s strategy is paying off, and the company is poised for continued success.

- Favorable Market Conditions:The broader economic environment has also played a role in Berkshire Hathaway’s strong performance. The post-pandemic economic recovery has led to increased consumer spending and business activity, which has benefited many of Berkshire Hathaway’s businesses. The rising interest rate environment has also boosted the earnings of Berkshire Hathaway’s insurance operations.

- Strategic Investments:Berkshire Hathaway’s investment strategy, characterized by long-term value investing, has also contributed to the record profit. The company’s vast investment portfolio, which includes significant holdings in major companies like Apple and Coca-Cola, has generated substantial returns.

Key Businesses Driving Performance

Berkshire Hathaway’s record operating profit is driven by the strong performance of its core businesses, including:

- Insurance:Berkshire Hathaway’s insurance operations, led by Geico and Berkshire Hathaway Reinsurance Group, are a major contributor to the company’s earnings. The insurance segment has benefited from robust premium growth and strong underwriting performance.

- Energy:Berkshire Hathaway Energy, the company’s utility business, has seen strong earnings growth due to rising energy prices and increased demand. The energy segment has also benefited from the company’s investments in renewable energy sources.

- Railroad:BNSF Railway, Berkshire Hathaway’s railroad subsidiary, has been a consistent performer, benefiting from increased freight volumes and strong pricing.

- Manufacturing:Precision Castparts, Berkshire Hathaway’s aerospace and industrial components manufacturer, has seen strong demand for its products, driven by the growth in the aerospace and industrial sectors.

- Retail:See’s Candies, Berkshire Hathaway’s confectionery company, has continued to perform well, benefiting from the popularity of its products and strong brand recognition.

Percentage Increase in Operating Profit

Berkshire Hathaway’s operating profit has increased by a significant percentage compared to the previous year, demonstrating the company’s strong financial performance.

Buffett’s Berkshire Hathaway continues to be a financial powerhouse, posting record operating profits and growing its cash pile to a staggering $277 billion. While the company’s focus is on long-term investments, the political landscape is also on everyone’s mind, especially with the heated race for the Ohio Senate seat, as highlighted in the article inside the final days of Ohio’s MAGA senate primary.

It’ll be interesting to see how the outcome of this election impacts the broader economic landscape, and how Berkshire Hathaway might navigate these uncertain times.

Comparison to Historical Trend, Buffetts berkshire hathaway posts record operating profit grows cash to 277 billion

Berkshire Hathaway’s record operating profit is a testament to the company’s long-term growth trajectory. The company has consistently generated strong profits over the years, driven by its diversified business model and strategic investments. The recent record profit represents a new high for the company, highlighting its continued financial strength and resilience.

Growth in Cash Holdings

Berkshire Hathaway’s cash hoard has reached a staggering $277 billion, a significant increase from previous years. This substantial growth in cash reserves raises questions about the reasons behind this accumulation and its implications for the company’s future investment strategy.

Reasons for Cash Accumulation

Berkshire Hathaway’s massive cash pile is a result of several factors.

- Strong Operating Performance:Berkshire Hathaway’s diverse portfolio of businesses continues to generate significant profits. This consistent profitability provides a steady stream of cash flow, contributing to the company’s growing cash reserves.

- Lack of Attractive Investment Opportunities:Warren Buffett, Berkshire Hathaway’s CEO, has been vocal about the lack of compelling investment opportunities in the current market.

He prefers to hold cash rather than deploy it into investments that don’t meet his stringent criteria for value and long-term growth potential.

- Market Volatility:The ongoing global economic uncertainty and market volatility have made investors cautious, including Buffett. Berkshire Hathaway’s large cash reserves provide financial flexibility and a safety net in the face of potential market downturns.

- Strategic Acquisitions:Berkshire Hathaway has historically used its cash reserves to fund strategic acquisitions. While the company has not made any major acquisitions recently, it may be waiting for the right opportunity to deploy its capital.

Implications for Future Investments

The massive cash hoard has significant implications for Berkshire Hathaway’s future investment strategy.

- Potential for Large Acquisitions:Berkshire Hathaway has the financial capacity to acquire large companies or entire industries. The company may be waiting for the right opportunity to deploy its cash reserves in a major acquisition that aligns with its long-term investment strategy.

- Increased Investment Flexibility:A large cash reserve provides Berkshire Hathaway with greater flexibility to capitalize on attractive investment opportunities as they arise. The company can quickly deploy capital into promising businesses without being constrained by financial limitations.

- Dividend Potential:While Berkshire Hathaway has historically not paid dividends, the company’s growing cash reserves could make dividends a more attractive option in the future.

Allocation of Cash Reserves

Berkshire Hathaway’s cash reserves are primarily allocated across different asset classes, including:

- Short-Term Investments:Berkshire Hathaway holds a significant portion of its cash in short-term investments, such as U.S. Treasury bills and commercial paper. These investments provide a low-risk way to earn a return on cash while maintaining liquidity.

- Equity Investments:Berkshire Hathaway invests in a wide range of publicly traded companies, both large and small.

These equity investments represent a significant portion of the company’s portfolio.

- Fixed Income Securities:Berkshire Hathaway also invests in fixed income securities, such as bonds and corporate debt. These investments provide a steady stream of income and diversification to the portfolio.

- Cash and Equivalents:A portion of Berkshire Hathaway’s cash reserves is held in the form of cash and cash equivalents, such as checking accounts and money market funds.

Impact of Rising Interest Rates

Rising interest rates could have a mixed impact on Berkshire Hathaway’s cash holdings.

Warren Buffett’s Berkshire Hathaway continues to impress, posting record operating profits and amassing a staggering $277 billion in cash. This financial prowess is impressive, but it’s worth considering the broader context. A new report raises concerns that the CDC’s vaccine adverse event reporting system is broken , highlighting the need for a robust and transparent system to track potential side effects.

While Buffett’s financial success is undeniable, it’s crucial to remember that responsible investment and societal well-being go hand in hand.

- Higher Returns:Rising interest rates generally lead to higher returns on short-term investments, such as U.S. Treasury bills and commercial paper. This could increase the income generated by Berkshire Hathaway’s cash reserves.

- Reduced Investment Appeal:Higher interest rates can make it more expensive for companies to borrow money, potentially slowing down economic growth and reducing investment opportunities.

This could make it more challenging for Berkshire Hathaway to find attractive investment opportunities for its cash reserves.

- Impact on Fixed Income Securities:Rising interest rates can negatively impact the value of fixed income securities, such as bonds. This could lead to losses on Berkshire Hathaway’s fixed income investments.

Berkshire Hathaway’s Future Prospects

Berkshire Hathaway’s recent record operating profit and substantial cash reserves have fueled speculation about the company’s future trajectory. With its diverse portfolio of businesses and a long history of successful investments, Berkshire Hathaway is well-positioned for continued growth. However, the company also faces challenges, including a changing economic landscape and intense competition.

Growth Potential

Berkshire Hathaway’s future growth hinges on several key factors, including the performance of its existing businesses, the success of its investment strategy, and the overall health of the global economy. The company’s operating profit is expected to continue growing, driven by strong performance in its insurance, energy, and manufacturing businesses.

Berkshire Hathaway’s massive cash reserves provide significant flexibility for future investments. The company has a history of deploying capital strategically, acquiring businesses and making equity investments that generate long-term value. As Warren Buffett has stated, Berkshire Hathaway’s investment philosophy is focused on identifying businesses with strong fundamentals, durable competitive advantages, and a long runway for growth.

The company’s ability to identify and capitalize on these opportunities will be crucial to its future success.

Challenges and Opportunities

Berkshire Hathaway faces several challenges in the coming years, including rising interest rates, inflation, and geopolitical uncertainty. The company’s investment strategy is likely to be affected by these factors, as valuations of businesses and assets may become more volatile.

However, Berkshire Hathaway’s long-term focus and patient approach to investing position it well to weather these challenges.The company also faces increasing competition in several of its key markets. The insurance industry, for example, is becoming increasingly competitive, with new entrants and technological advancements disrupting traditional business models.

Berkshire Hathaway will need to adapt and innovate to maintain its competitive edge in these markets.Despite these challenges, Berkshire Hathaway has several opportunities for growth in the coming years. The company is well-positioned to benefit from the growing global demand for energy, particularly renewable energy.

Berkshire Hathaway’s investments in renewable energy companies and its own energy production operations position it to capitalize on this trend. Additionally, the company’s strong brand and reputation give it a competitive advantage in acquiring new businesses and attracting talent.

Long-Term Strategic Goals

Berkshire Hathaway’s long-term strategic goals are to continue growing its businesses, generate strong returns for shareholders, and maintain its reputation as a responsible and ethical corporate citizen. The company’s focus on long-term value creation is reflected in its investment strategy, its commitment to its employees, and its commitment to environmental sustainability.

Berkshire Hathaway’s strategic goals are aligned with current market trends. The company’s focus on long-term value creation is particularly relevant in today’s volatile market environment. Berkshire Hathaway’s commitment to sustainability is also aligned with the growing investor demand for companies that are environmentally and socially responsible.

Key Financial Metrics

The following table shows key financial metrics for Berkshire Hathaway over the past five years:| Year | Operating Profit (Billions) | Cash Holdings (Billions) | Return on Equity (%) ||—|—|—|—|| 2022 | $30.8 | $308.3 | 14.3 || 2021 | $27.5 | $146.7 | 13.8 || 2020 | $21.9 | $144.2 | 12.5 || 2019 | $24.8 | $128.3 | 14.1 || 2018 | $24.7 | $111.8 | 13.9 |

Final Summary: Buffetts Berkshire Hathaway Posts Record Operating Profit Grows Cash To 277 Billion

Berkshire Hathaway’s record profit and massive cash reserves underscore the enduring power of Warren Buffett’s investment philosophy. The company’s future remains bright, with ample resources to capitalize on new opportunities and navigate potential market headwinds. As Berkshire continues to grow, its performance will undoubtedly remain a closely watched indicator of the overall health of the economy and the direction of the stock market.