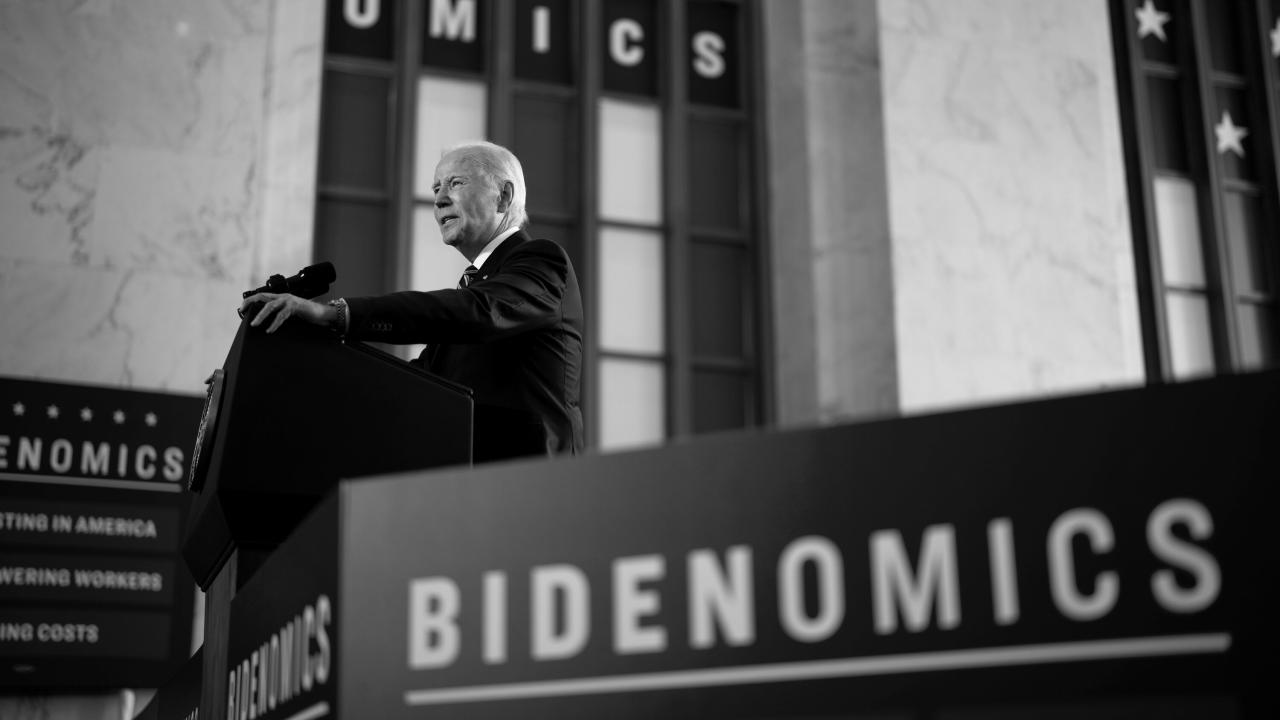

Biden on Economy: Are Americans Personally in Good Shape?

Biden on economy americans are personally in good shape – Biden on Economy: Are Americans Personally in Good Shape? This question is at the forefront of many minds as we navigate a complex economic landscape. While the US economy has shown signs of recovery, the impact on individual households varies widely.

This article delves into the key economic indicators, household finances, and government policies that shape the American economic experience. We’ll explore the distribution of wealth, the effectiveness of Biden’s economic initiatives, and personal perspectives from diverse demographics.

The journey to understand the economic well-being of Americans involves examining a multitude of factors. From GDP growth and unemployment rates to income inequality and the impact of government programs, we’ll uncover the forces that influence the financial stability of American households.

Through data analysis, expert opinions, and personal stories, we aim to provide a comprehensive picture of the current economic climate and its implications for individuals across the country.

Economic Indicators and Trends

The US economy is a complex and dynamic system, with numerous factors influencing its performance. Understanding key economic indicators is crucial for gauging the health of the economy and its impact on American households.

GDP Growth

The Gross Domestic Product (GDP) is the total value of goods and services produced in a country. GDP growth is a key indicator of economic health, as it reflects the overall level of economic activity. The US economy experienced a significant contraction in 2020 due to the COVID-19 pandemic, but has since rebounded with strong growth in 2021 and 2022.

The Biden administration has attributed this recovery to policies such as the American Rescue Plan and the Infrastructure Investment and Jobs Act.

Unemployment Rate

The unemployment rate measures the percentage of the labor force that is unemployed but actively seeking work. The unemployment rate has fallen significantly since the beginning of the Biden administration, reaching a 50-year low in 2022. This decline is attributed to a strong job market and government programs aimed at supporting workers.

President Biden’s recent pronouncements on the economy highlight the strength of the American consumer, but it’s worth considering global economic factors that might impact that narrative. For instance, the weakening of the Japanese yen to its lowest point in 20 years is a significant development, and you can read more about its causes and implications in this analysis.

While the yen’s weakness might not directly impact American consumers, it does point to broader global economic instability that could ripple outward, ultimately influencing how Americans perceive their own economic well-being.

Inflation

Inflation is a sustained increase in the general price level of goods and services. Inflation has been a significant concern in recent years, driven by factors such as supply chain disruptions and strong consumer demand. The Biden administration has implemented measures to address inflation, including releasing oil reserves and working to reduce supply chain bottlenecks.

Consumer Confidence

Consumer confidence measures the level of optimism consumers have about the economy. Consumer confidence is an important indicator, as it influences consumer spending, which is a major driver of economic growth. Consumer confidence has fluctuated in recent years, reflecting concerns about inflation and other economic uncertainties.

Economic Performance under Biden

The Biden administration has pointed to strong economic growth, low unemployment, and other positive indicators as evidence of its success in managing the economy. However, critics argue that the administration’s policies have contributed to inflation and other economic challenges.

Comparison to Previous Administrations

Comparing economic performance across different administrations is complex and subject to various factors. However, some key indicators can be used to assess relative performance. For example, GDP growth under Biden has been higher than under Trump, but inflation has also been higher.

American Household Finances

The financial health of American households is a crucial indicator of the overall economic well-being of the nation. Understanding household income, savings, debt levels, and wealth distribution provides valuable insights into the financial stability and challenges faced by Americans.

Household Income and Savings

Household income and savings levels are critical determinants of financial security.

- The median household income in the United States in 2021 was $70,784, according to the U.S. Census Bureau. This represents a significant increase from the previous year, but it still falls short of pre-pandemic levels.

- The personal savings rate, which measures the proportion of disposable income saved, has fluctuated in recent years. In 2021, the savings rate stood at 6.9%, down from a peak of 33.7% in April 2020. This decline is attributed to factors such as the reopening of the economy and increased consumer spending.

Debt Levels

Household debt levels have been on the rise in recent years, reflecting both increased borrowing and stagnant income growth.

- Total household debt, including mortgage, auto, student, and credit card debt, reached a record high of $16.5 trillion in the first quarter of 2023, according to the Federal Reserve Bank of New York.

- Student loan debt has become a significant financial burden for many Americans. As of the second quarter of 2023, total student loan debt outstanding stood at $1.6 trillion, with an average borrower owing over $37,000.

Wealth Distribution and Income Inequality

The distribution of wealth and income inequality in the United States remains a significant concern.

- The top 1% of earners in the United States hold a disproportionate share of the nation’s wealth. According to the Institute on Taxation and Economic Policy, the top 1% of earners held 38.6% of the nation’s wealth in 2021.

- Income inequality has also been widening in recent decades. The Gini coefficient, a measure of income inequality, has been steadily increasing, indicating a growing gap between the rich and the poor.

Factors Contributing to Financial Stability or Instability

Several factors contribute to the financial stability or instability of American households.

- Economic conditions:Economic downturns, recessions, and high unemployment rates can significantly impact household finances, leading to job losses, reduced income, and increased debt.

- Education and skills:Individuals with higher levels of education and specialized skills tend to earn higher incomes, improving their financial stability. Conversely, those with limited education and skills may face challenges in finding well-paying jobs, leading to financial insecurity.

- Access to affordable housing:Rising housing costs and limited access to affordable housing can strain household budgets, particularly for low- and middle-income families.

- Healthcare costs:The high cost of healthcare in the United States can pose a significant financial burden for many households, especially those with chronic illnesses or unexpected medical emergencies.

- Financial literacy:Individuals with strong financial literacy skills are better equipped to manage their finances, save for the future, and avoid debt traps. Conversely, those with limited financial literacy may struggle with budgeting, saving, and making informed financial decisions.

Impact of Government Policies

The Biden administration has implemented several economic policies aimed at stimulating the economy and providing relief to American households. These policies, such as the American Rescue Plan and the Infrastructure Investment and Jobs Act, have had a significant impact on the economic landscape and the financial well-being of individuals.

Impact on American Households

The American Rescue Plan, passed in March 2021, provided direct payments to individuals, expanded unemployment benefits, and increased funding for healthcare and education. The Infrastructure Investment and Jobs Act, signed into law in November 2021, allocated billions of dollars for infrastructure projects, including roads, bridges, and broadband internet.

These policies have had a direct impact on American households by providing financial assistance, creating jobs, and improving access to essential services.

While President Biden touts the strength of the American economy, with many feeling personally secure, the administration’s defense budget priorities are raising eyebrows. Under Biden’s defense budget, the US Air Force will continue to shed fighters , a move that some argue could weaken our national security, potentially impacting the economic stability we’re experiencing now.

Long-Term Effects on the Economy and Individual Finances

The long-term effects of these policies on the economy and individual finances are still being debated. Some argue that these policies have stimulated economic growth and reduced poverty, while others contend that they have led to inflation and increased government debt.

While President Biden might be focusing on the macro-economic picture, it’s important to remember that individual well-being is crucial. A strong economy benefits everyone, and that includes having access to user-friendly, efficient websites. That’s where ReactJS comes in, a powerful JavaScript library that can help build high-performance, interactive web applications.

Learn more about why you should use ReactJS for web development , and contribute to a stronger digital landscape, which in turn helps boost the economy and individual well-being.

The potential long-term effects will depend on a variety of factors, including the effectiveness of the policies, the response of the private sector, and global economic conditions.

Different Perspectives on the Effectiveness of Biden’s Economic Policies

There are diverse perspectives on the effectiveness of Biden’s economic policies. Some economists argue that the policies have been successful in mitigating the economic fallout from the COVID-19 pandemic and fostering economic growth. They point to the strong job market and the decline in unemployment as evidence of the policies’ success.

Others, however, contend that the policies have contributed to inflation and increased government debt, which could have negative consequences for the economy in the long run. They argue that the policies have been too stimulative and have not addressed the underlying structural problems in the economy.

Personal Perspectives and Experiences: Biden On Economy Americans Are Personally In Good Shape

The economic landscape is vast and diverse, and the impact of the current economic climate varies significantly depending on individual circumstances. To gain a comprehensive understanding, it is crucial to consider the personal experiences and perspectives of Americans across different demographics.

This section delves into the diverse narratives of individuals navigating economic challenges and opportunities, shedding light on the multifaceted nature of the economic reality in the United States.

Experiences Across Socioeconomic Groups

Understanding the personal experiences of Americans across different socioeconomic groups is essential for grasping the complexities of the current economic situation. This section explores how individuals from various income levels, age groups, racial backgrounds, and genders are navigating economic challenges and opportunities.

| Socioeconomic Group | Economic Challenges | Economic Opportunities |

|---|---|---|

| Low-Income Households | Rising costs of living, limited access to affordable healthcare, difficulty finding stable employment, food insecurity | Government assistance programs, access to job training and education, community support networks |

| Middle-Income Households | Stagnant wages, rising healthcare costs, student loan debt, job insecurity | Opportunities for career advancement, access to homeownership, investment in education and retirement |

| High-Income Households | Tax burdens, economic inequality, pressure to maintain a certain lifestyle | Investment opportunities, access to exclusive networks, potential for wealth accumulation |

| Young Adults | High student loan debt, difficulty finding affordable housing, competitive job market | Opportunities for career growth, access to new technologies, potential for entrepreneurship |

| Older Adults | Rising healthcare costs, potential for job displacement, concerns about retirement security | Access to Social Security and Medicare, opportunities for part-time work, potential for downsizing |

| Minorities | Racial disparities in income and wealth, limited access to quality education and healthcare, discrimination in employment | Growing entrepreneurial opportunities, support from community organizations, increasing representation in leadership roles |

| Women | Gender pay gap, childcare costs, lack of paid family leave | Growing opportunities in STEM fields, increasing representation in leadership roles, access to support networks |

Future Economic Outlook

The US economy is facing a complex and uncertain future. While recent years have seen strong growth, several challenges loom on the horizon, and these could significantly impact the economic well-being of American households. Understanding these challenges and opportunities is crucial for navigating the years ahead.

Potential Economic Challenges

The US economy faces several potential challenges in the coming years, including:

- Inflation:While inflation has recently moderated, it remains a concern. Persistent high inflation can erode purchasing power, making it harder for households to afford basic necessities. The Federal Reserve’s efforts to combat inflation through interest rate hikes could also slow economic growth.

- Rising Interest Rates:Higher interest rates make borrowing more expensive for businesses and consumers, potentially slowing economic activity. This could impact investment, spending, and job growth.

- Geopolitical Uncertainty:The ongoing war in Ukraine, tensions with China, and other geopolitical events create uncertainty and volatility in global markets. This can disrupt supply chains, raise energy prices, and impact economic growth.

- Debt Levels:The US national debt continues to rise, putting pressure on government finances. This could lead to higher interest payments, potentially crowding out spending on other priorities.

- Climate Change:The effects of climate change, such as extreme weather events and rising sea levels, could disrupt economic activity, damage infrastructure, and increase costs for businesses and consumers.

Factors Impacting Household Finances

Several factors could impact the economic well-being of American households in the coming years, including:

- Wage Growth:Wage growth has been slow in recent years, and real wages (adjusted for inflation) have declined for many workers. Continued slow wage growth could make it difficult for households to keep up with rising costs.

- Job Market:While the job market is currently strong, concerns exist about potential economic slowdowns or recessions. Job losses could impact household income and make it more difficult for people to find new employment.

- Housing Costs:Housing costs have been rising rapidly, making it more difficult for many Americans to afford homeownership or rent. This can put a strain on household budgets and limit spending on other goods and services.

- Healthcare Costs:Healthcare costs continue to rise, making it difficult for many Americans to afford necessary medical care. This can lead to financial strain and limit access to essential services.

- Education Costs:The cost of higher education has been rising, making it more difficult for students to afford a college degree. This can limit future earning potential and career opportunities.

Scenario Analysis, Biden on economy americans are personally in good shape

To understand the potential economic outcomes and their implications for Americans, we can analyze different scenarios:

- Scenario 1: Continued Growth:The US economy continues to grow at a moderate pace, inflation gradually declines, and interest rates remain stable. This scenario would likely benefit American households, with continued job growth, rising wages, and a stable housing market.

- Scenario 2: Economic Slowdown:The US economy experiences a slowdown, with slower growth, rising unemployment, and increased inflation. This scenario could negatively impact American households, leading to job losses, reduced income, and difficulty affording essential goods and services.

- Scenario 3: Recession:The US economy enters a recession, characterized by a significant decline in economic activity, high unemployment, and declining consumer spending. This scenario would have a severe impact on American households, leading to widespread job losses, financial hardship, and a decline in living standards.

Closing Notes

The state of the American economy is a dynamic and multifaceted issue. While there are encouraging signs of recovery, challenges remain. Income inequality, rising costs of living, and the long-term effects of government policies continue to impact the financial well-being of Americans.

By understanding the complexities of the economic landscape and the diverse experiences of individuals, we can better navigate the challenges and opportunities ahead. This journey requires ongoing dialogue, informed decision-making, and a commitment to ensuring that the benefits of economic growth are shared equitably across all segments of society.