Credit Card Delinquencies Surge as Americans Struggle

Americans increasingly cant afford credit card payments as delinquencies hit record highs – Americans increasingly can’t afford credit card payments as delinquencies hit record highs, a stark reality that reflects the growing financial strain on households across the nation. This alarming trend, fueled by a perfect storm of economic factors, raises concerns about the long-term implications for individuals and the financial industry alike.

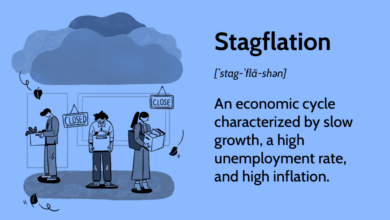

From soaring inflation and rising interest rates to stagnant wages and the allure of easy credit, Americans are grappling with a complex web of challenges that are making it increasingly difficult to manage their finances. The consequences are far-reaching, potentially leading to a cascade of defaults, increased loan losses for lenders, and even greater economic instability.

The Impact on the Financial Industry

The surge in credit card delinquencies has far-reaching implications for the financial industry, potentially affecting banks, credit card companies, and the broader economy. As more individuals struggle to make their payments, the financial landscape becomes more unstable, demanding proactive measures from industry players.

It’s a tough time for many Americans right now, with credit card delinquencies hitting record highs. The rising cost of living, combined with stagnant wages, is making it increasingly difficult for people to keep up with their bills. It’s a reminder that we need to address the root causes of this financial strain, and not just focus on the symptoms.

And while we’re talking about alarming trends, republicans are raising a terror alarm after illegal immigrants were caught with explosive devices , which is a completely different issue that requires a separate, nuanced discussion. But ultimately, the reality is that we need to find solutions to help Americans get back on their feet and achieve financial stability.

Increased Loan Losses, Americans increasingly cant afford credit card payments as delinquencies hit record highs

Rising delinquencies directly translate to increased loan losses for banks and credit card companies. When borrowers fail to make their payments, lenders face financial strain as their assets become less valuable. This can lead to reduced profitability, lower returns for investors, and potentially even necessitate loan write-offs.

It’s a tough time to be an American. With inflation soaring and wages stagnating, many are struggling to make ends meet. The result? Credit card delinquencies are hitting record highs, with more and more people unable to afford their monthly payments.

It’s not just the economy though, there are a number of health concerns that are also impacting people’s finances. For example, a recent study reported twenty eight types of kidney complications reported following covid 19 vaccination , which can lead to significant medical bills and lost wages.

It’s a vicious cycle, and it’s only going to get worse unless we see some real change in our economic and healthcare systems.

The financial industry’s ability to absorb these losses will depend on factors like the severity of the delinquency wave, the quality of their loan portfolios, and their ability to manage risk effectively.

Policy and Regulatory Considerations: Americans Increasingly Cant Afford Credit Card Payments As Delinquencies Hit Record Highs

The growing issue of unaffordable credit card payments necessitates a comprehensive approach involving policy solutions and regulatory measures to mitigate the problem and protect consumers. Existing regulations need evaluation, and new policies might be required to address the evolving financial landscape.

Existing Regulations and Potential Improvements

Current regulations aim to protect consumers from predatory lending practices and ensure transparency in credit card terms. However, the effectiveness of these regulations in addressing the issue of unaffordable payments requires examination.

- The Credit CARD Act of 2009 introduced provisions like restrictions on fees and interest rate increases, and a requirement for credit card companies to disclose their terms clearly. While these measures have contributed to some improvements, the act might require further strengthening to address the changing nature of credit card debt.

- The Consumer Financial Protection Bureau (CFPB) plays a crucial role in regulating credit card companies and ensuring fair lending practices. However, the CFPB’s authority and resources could be expanded to enhance its ability to address the issue of unaffordable payments, particularly in light of the growing trend of predatory lending practices.

Potential Policy Solutions

Several policy solutions could address the issue of unaffordable credit card payments and promote responsible lending practices.

- A proposal for a national debt ceiling for credit card balances could limit the amount of debt individuals can accrue, helping prevent them from taking on unsustainable levels of debt. This measure could be implemented alongside a robust consumer education program to empower individuals to manage their finances effectively.

- The implementation of a mandatory cooling-off period before credit card applications are approved could provide consumers with time to carefully evaluate their financial situation and avoid impulsive borrowing decisions. This period could allow consumers to consider alternative financing options or prioritize essential expenses before taking on additional debt.

- Introducing regulations that mandate credit card companies to offer affordable repayment plans, including options for debt consolidation and interest rate reductions, could provide relief to individuals struggling with unaffordable payments. These plans should be designed to be accessible and transparent, ensuring that consumers understand the terms and conditions of the repayment plan.

Examples of Successful Policies in Other Countries

Several countries have implemented policies that have been effective in addressing issues related to credit card debt and responsible lending.

- In the United Kingdom, the Financial Conduct Authority (FCA) introduced a “creditworthiness assessment” requirement for credit card companies, ensuring that lenders assess borrowers’ ability to repay before extending credit. This measure has helped reduce the incidence of unaffordable debt and promote responsible lending practices.

- Australia implemented a “credit reporting system” that includes a comprehensive record of borrowers’ credit history. This system enables lenders to make more informed decisions about creditworthiness and reduces the risk of extending credit to individuals who may struggle to repay.

This system has also contributed to a decline in credit card delinquency rates.

End of Discussion

The surge in credit card delinquencies serves as a stark reminder of the financial pressures facing American households. While there are no easy solutions, understanding the root causes and exploring potential policy interventions is crucial to mitigate the risks and promote a more sustainable financial landscape.

By fostering greater financial literacy, promoting responsible lending practices, and addressing the underlying economic challenges, we can help individuals regain control of their finances and navigate the complexities of debt management in a more equitable and sustainable way.

It’s a tough time for many Americans, with credit card delinquencies reaching record highs. The rising cost of living is making it harder to keep up with payments, and the stress of financial instability can take a toll on our mental and emotional well-being.

One way to potentially alleviate some of this pressure is to explore the benefits of workplace monogamy, as discussed in this insightful article 3 benefits of workplace monogamy and how to find it. By focusing on one job and dedicating your energy to mastering your craft, you might be able to increase your earning potential and gain financial stability, ultimately easing the burden of credit card debt.