Americans Becoming More Concerned About Job Loss and Debt

Americans becoming more concerned about job loss and ability to pay off debt is a growing issue, reflecting a deep-seated anxiety about the current economic landscape. The combination of inflation, automation, and globalization has created a sense of uncertainty about job security, leaving many feeling vulnerable and worried about their financial futures.

This concern isn’t unfounded; industries are experiencing significant job displacement, and the rising levels of household debt are adding further strain to financial well-being.

The impact of this anxiety is far-reaching, affecting consumer spending patterns and potentially hindering economic growth. People are becoming more cautious with their money, leading to a decrease in discretionary spending. This shift in consumer behavior could have a ripple effect throughout the economy, impacting businesses and potentially slowing down economic recovery.

Economic Anxiety and Job Security

The current economic landscape in the United States is marked by a growing sense of anxiety among Americans regarding job security and their ability to manage financial obligations. This unease stems from a confluence of factors, including persistent inflation, rapid technological advancements leading to automation, and the ongoing impact of globalization on domestic labor markets.

Inflation and Its Impact on Job Security

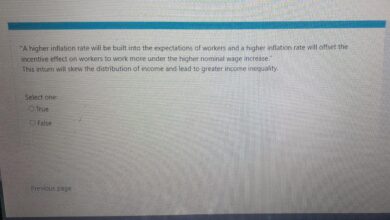

Inflation, a sustained increase in the general price level of goods and services, erodes purchasing power and reduces the real value of wages. When inflation outpaces wage growth, individuals struggle to maintain their living standards, leading to concerns about job security.

They may feel compelled to seek higher-paying jobs or take on additional work to compensate for the reduced value of their earnings.

With Americans becoming increasingly concerned about job loss and their ability to pay off debt, it’s more important than ever for businesses to build strong relationships with their clients. A winning sales strategy can be the difference between a successful business and one that struggles to stay afloat.

One way to make a lasting impression is by creating a custom sales folder that showcases your company’s value proposition in a professional and engaging way. Check out 3 steps to creating a winning custom sales folder to learn how to craft a sales folder that leaves a lasting impression and helps you secure more business in this uncertain economic climate.

Automation and Job Displacement, Americans becoming more concerned about job loss and ability to pay off debt

Automation, the use of technology to perform tasks previously done by humans, is transforming various industries. While it can boost productivity and efficiency, it also raises concerns about job displacement. As machines become more sophisticated, they can perform tasks once considered exclusive to human workers, potentially leading to job losses in sectors like manufacturing, transportation, and customer service.

Globalization and Competition

Globalization, the interconnectedness of economies worldwide, has led to increased competition for jobs and resources. Companies can now source goods and services from lower-cost locations, potentially impacting domestic employment. While globalization has benefits, such as access to cheaper goods and services, it can also lead to job losses in industries that face intense competition from overseas firms.

With Americans increasingly worried about job security and their ability to pay off debt, it’s more crucial than ever to prioritize financial stability. This means demanding better benefits, especially in the evolving hybrid work environment. Check out this insightful article on better benefits in a hybrid world heres what you can demand to learn how to advocate for yourself and secure a more secure future.

By understanding your rights and negotiating effectively, you can gain the financial support needed to weather economic storms and build a brighter future.

Industries Experiencing Job Displacement

Several industries have experienced significant job displacement due to automation, globalization, and other factors.

It’s no secret that Americans are increasingly worried about their financial futures. The rising cost of living coupled with the uncertainty surrounding job security is making it harder than ever to keep up with bills and pay off debt.

With so much on their minds, it’s understandable that many are tuning into the news to see what the future holds, especially when it comes to major events like the upcoming joint press conference by Speaker Johnson and former President Trump on election integrity at Mar-a-Lago.

The potential for political upheaval and its impact on the economy are adding to the anxieties of many Americans already struggling to make ends meet.

Manufacturing

The manufacturing sector has been particularly affected by automation and globalization. Advances in robotics and artificial intelligence have enabled companies to automate production processes, reducing the need for human labor. Globalization has also led to the relocation of manufacturing facilities to countries with lower labor costs, resulting in job losses in the United States.

Retail

The retail sector has undergone significant changes due to the rise of e-commerce and online shopping. As consumers increasingly shop online, traditional brick-and-mortar stores have faced challenges, leading to store closures and job losses. Automation in areas like inventory management and customer service has also contributed to job displacement.

Transportation

The transportation industry is facing disruption from autonomous vehicles and delivery drones. These technologies have the potential to significantly reduce the need for human drivers, raising concerns about job losses in the trucking, taxi, and delivery sectors.

Finance

The financial sector has also seen automation, with banks and other financial institutions adopting technologies like artificial intelligence and machine learning to automate tasks such as loan processing and customer service. This has led to job losses in areas like back-office operations and customer support.

Debt Burden and Financial Stress

The rising levels of household debt in the United States are a significant cause for concern, impacting the financial well-being of millions of Americans. This debt burden is creating financial stress, leading to difficulties in meeting basic needs and hindering long-term financial goals.

Types of Debt Burdening Americans

The increasing debt burden in the United States is driven by various types of debt, each posing unique challenges for Americans. These include:

- Student Loans:The rising cost of education has led to a significant increase in student loan debt, with many graduates struggling to repay their loans. As of 2023, the total student loan debt in the United States is estimated to be over $1.7 trillion.

- Credit Card Debt:High-interest rates and easy access to credit cards contribute to the growing credit card debt burden. In 2022, the average American household had over $8,500 in credit card debt, highlighting the widespread reliance on this form of borrowing.

- Mortgages:While mortgages are typically considered a good form of debt, rising home prices and low-interest rates have led to larger mortgage balances. Many Americans are struggling to make their mortgage payments, especially those with adjustable-rate mortgages.

Financial Stress and its Consequences

The increasing debt burden is significantly impacting the financial well-being of Americans, leading to a range of consequences:

- Difficulty Meeting Basic Needs:Many Americans are struggling to meet basic needs like food, housing, and healthcare due to their debt obligations. This can lead to a cycle of financial instability and hardship.

- Reduced Savings and Investment:High debt levels can limit individuals’ ability to save for retirement, emergencies, or other important financial goals. This can have long-term consequences for financial security.

- Mental Health Issues:Financial stress can lead to anxiety, depression, and other mental health issues. This can impact overall well-being and productivity.

Ending Remarks: Americans Becoming More Concerned About Job Loss And Ability To Pay Off Debt

The increasing concern about job loss and debt is a complex issue with far-reaching implications. It’s crucial to address these concerns through effective policies and solutions that promote job security, financial literacy, and economic stability. By working together, we can create a more secure and prosperous future for all Americans.