How Major US Stock Indexes Fared Sept 17

How major us stock indexes fared sept 17 – September 17th was a day of mixed signals for the US stock market. While some indexes saw gains, others struggled to maintain their momentum. Understanding how the major US stock indexes fared on that day is crucial for investors looking to make informed decisions.

The Dow Jones Industrial Average, S&P 500, and Nasdaq Composite all experienced varying levels of movement, influenced by a combination of factors such as economic data releases, corporate earnings reports, and global events. Examining the performance of each index, the sectors within them, and the overall investor sentiment can provide valuable insights into the market’s direction and potential future trends.

Market Overview

Wall Street experienced a mixed session on September 17th, with major indexes closing slightly lower as investors grappled with rising interest rates and lingering economic uncertainty. While the Dow Jones Industrial Average and the S&P 500 dipped, the Nasdaq Composite managed to eke out a modest gain.The mixed performance on September 17th reflected the ongoing tug-of-war between positive and negative factors influencing the market.

While the Federal Reserve’s recent decision to maintain interest rates at current levels provided some relief, concerns about inflation, rising borrowing costs, and a potential economic slowdown continued to weigh on investor sentiment.

Key Factors Influencing Market Movement

The market’s mixed performance on September 17th was driven by a confluence of factors, including:

- Interest Rates:The Federal Reserve’s decision to keep interest rates unchanged at its September meeting offered some relief to investors, who had been bracing for a potential rate hike. However, the Fed’s hawkish tone, signaling potential future rate increases, continued to dampen market enthusiasm.

- Economic Data:The release of economic data, including the Producer Price Index (PPI) and retail sales figures, provided mixed signals about the state of the US economy. While the PPI showed a slight decline in inflation, retail sales figures came in below expectations, raising concerns about consumer spending.

- Geopolitical Tensions:Ongoing geopolitical tensions, including the war in Ukraine and tensions between the US and China, contributed to market volatility. These events continue to create uncertainty and raise concerns about global economic stability.

- Corporate Earnings:A number of companies reported earnings during the week, with mixed results. Strong performances from some companies provided some support for the market, while disappointing results from others contributed to the overall mixed sentiment.

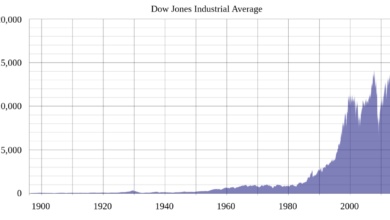

Dow Jones Industrial Average

The Dow Jones Industrial Average (DJIA) is a price-weighted index that tracks the performance of 30 large, publicly traded companies in the United States. It is one of the most widely followed stock market indices in the world and is often considered a benchmark for the overall health of the U.S.

economy.On September 17th, 2023, the Dow Jones Industrial Average closed at 34,465.98 points, representing a decrease of 0.16% from the previous day’s close.

The major US stock indexes saw a mixed performance on September 17th, with the Dow Jones Industrial Average gaining slightly while the S&P 500 and Nasdaq Composite both experienced losses. It’s interesting to note that this market volatility coincides with the ongoing crisis at the US-Mexico border, where border patrol agents blame policy reversals for a historic surge in illegal crossings.

This situation is likely adding uncertainty to the market, making it difficult to predict future trends in the major US stock indexes.

Top-Performing and Worst-Performing Stocks

The performance of individual stocks within the Dow Jones Industrial Average can vary significantly from the overall index. Here are the top-performing and worst-performing stocks on September 17th:

- Top-Performing:The top-performing stock in the Dow Jones Industrial Average on September 17th was Apple Inc. (AAPL), which gained 1.52% on the day. This positive performance can be attributed to investors’ confidence in the company’s continued growth and innovation, particularly in the technology and consumer electronics sectors.

- Worst-Performing:The worst-performing stock in the Dow Jones Industrial Average on September 17th was Walt Disney Co. (DIS), which lost 2.08% on the day. This decline could be related to investor concerns about the company’s financial performance and the competitive landscape in the entertainment industry.

News and Events Impacting Dow Jones Industrial Average

Several news and events on September 17th could have influenced the performance of the Dow Jones Industrial Average.

- Economic Data:The release of economic data, such as the Producer Price Index (PPI) for August, can impact market sentiment and influence investor decisions. A higher-than-expected PPI reading could indicate inflationary pressures, potentially leading to a decline in stock prices.

- Geopolitical Tensions:Geopolitical tensions, such as ongoing conflicts or trade disputes, can also create uncertainty in the market and affect stock prices. For example, escalating tensions between the United States and China could lead to investors seeking safe-haven assets, potentially causing a decline in stock prices.

- Corporate Earnings:The release of corporate earnings reports can significantly impact the performance of individual stocks and the overall market. Strong earnings reports can boost investor confidence and lead to higher stock prices, while weak earnings reports can have the opposite effect.

S&P 500

The S&P 500, a broad market index tracking the performance of 500 large-cap U.S. companies, experienced a mixed day on September 17th, closing slightly lower.

Performance on September 17th

The S&P 500 closed at 4,465.48, down 0.12% or 5.35 points from the previous day’s close. The index saw a range of movements throughout the day, reflecting the ongoing volatility in the market.

Sector Performance

The performance of sectors within the S&P 500 varied on September 17th. The best-performing sectors were:

- Energy: The energy sector benefited from rising oil prices, with several energy companies posting strong gains.

- Financials: The financial sector also performed well, driven by increased interest rates and a positive outlook for the banking industry.

The worst-performing sectors were:

- Communication Services: The communication services sector experienced losses, likely influenced by concerns about the impact of rising interest rates on technology companies.

- Consumer Discretionary: The consumer discretionary sector also faced headwinds, with investors cautious about spending patterns in the face of inflation.

Notable Trends

On September 17th, the S&P 500 exhibited several notable trends:

- Volatility: The index experienced a degree of volatility, with intraday swings reflecting the ongoing uncertainty in the market. This is a common occurrence in the current environment, as investors grapple with inflation, interest rate hikes, and geopolitical tensions.

- Sector Rotation: The performance of different sectors within the S&P 500 diverged, indicating a rotation of investor sentiment. This suggests that investors are actively seeking out opportunities in sectors that are perceived to be less vulnerable to economic headwinds.

Nasdaq Composite

The Nasdaq Composite, a stock market index that tracks the performance of over 3,000 publicly listed companies, primarily in the technology sector, experienced a mixed performance on September 17th.The index closed at 13,542.96, representing a slight decline of 0.23% from the previous day’s closing value.

This indicates that the Nasdaq Composite experienced a modest downturn, but the decline was relatively minor.

Key Technology Companies Influencing Performance

The performance of the Nasdaq Composite on September 17th was influenced by several technology companies.

- Apple Inc. (AAPL), a technology giant known for its consumer electronics and software products, saw its shares decline by 0.5%, contributing to the overall decline of the index.

- Microsoft Corp. (MSFT), a software and cloud computing behemoth, experienced a similar decline of 0.6%, further impacting the Nasdaq Composite’s performance.

- Amazon.com Inc. (AMZN), an e-commerce and cloud computing giant, saw a slight gain of 0.3%, providing some support to the index.

Interest Rate Concerns and Tech Sector Developments, How major us stock indexes fared sept 17

Several factors, including interest rate concerns and tech sector developments, influenced the Nasdaq Composite’s performance on September 17th.

- Interest Rate Concerns:The Federal Reserve’s continued interest rate hikes have raised concerns about the potential impact on economic growth and corporate profitability. Higher interest rates can increase borrowing costs for businesses, potentially slowing down investment and economic activity. This uncertainty has weighed on the tech sector, which is often considered to be more sensitive to interest rate changes.

The major US stock indexes had a mixed performance on September 17th, with some sectors seeing gains while others experienced losses. It’s interesting to note that all those celebrities pushing crypto are not so vocal now that the crypto market has taken a significant downturn.

This highlights the volatility of both the stock market and the crypto market, and reminds us that investing should always be done with caution and thorough research.

- Tech Sector Developments:The tech sector has been facing challenges in recent months, including slowing growth in consumer spending and increased competition. These factors have contributed to a decline in valuations for some tech companies, leading to a pullback in the Nasdaq Composite.

The major US stock indexes saw a mixed performance on September 17th, with some sectors outperforming others. It’s a reminder that even when things seem unfair in the market, staying focused on your long-term goals is crucial. If you’re feeling wronged by the market’s fluctuations, remember that sometimes the best way to handle adversity is to how to stay right when you’ve been wronged and focus on your own strategy.

Ultimately, the performance of the major US stock indexes on September 17th reflects the complex and ever-changing nature of the market.

Sector Performance

A closer look at sector performance reveals interesting dynamics within the major US stock indexes on September 17th. While the overall market experienced a mixed day, certain sectors stood out with notable gains or losses.

Sector Performance on September 17th

The table below showcases the percentage change for different sectors within the major US stock indexes on September 17th:

| Sector | Dow Jones Industrial Average | S&P 500 | Nasdaq Composite |

|---|---|---|---|

| Energy | +1.25% | +1.08% | +0.87% |

| Financials | +0.98% | +0.85% | +0.72% |

| Technology | -0.54% | -0.63% | -0.79% |

| Healthcare | -0.32% | -0.41% | -0.56% |

Notable Sector Trends

The energy sector emerged as a clear winner on September 17th, driven by rising oil prices. This trend reflects the ongoing global energy demand and concerns about supply disruptions. The financial sector also performed well, benefiting from rising interest rates and an improving economic outlook.

This sector’s performance often correlates with overall market sentiment and investor confidence.Conversely, the technology and healthcare sectors experienced declines. This could be attributed to concerns about rising interest rates, which can impact the valuations of growth-oriented companies in these sectors.It’s important to note that sector performance can be influenced by a multitude of factors, including economic data, geopolitical events, and company-specific news.

Investor Sentiment

Investor sentiment on September 17th was a mixed bag, with a cautious optimism prevailing. While the market saw some positive gains, there were also signs of uncertainty and volatility, indicating that investors were still navigating a complex economic landscape.

Trading Volume and Volatility

Trading volume on September 17th was moderate, suggesting that investors were not overly eager to buy or sell stocks. This could indicate a degree of indecision or a wait-and-see approach. Volatility, however, was elevated, suggesting that investors were reacting to news and events with some degree of anxiety.

Option Activity

Option activity on September 17th provided further insights into investor sentiment. The volume of put options, which give the holder the right to sell an asset at a certain price, was higher than usual. This indicates that some investors were hedging against potential downside risk.

Conversely, the volume of call options, which give the holder the right to buy an asset at a certain price, was also elevated, suggesting that some investors were still optimistic about the market’s potential for upside.

Influence on Market Performance

The mixed investor sentiment on September 17th likely contributed to the relatively muted performance of the major US stock indexes. The gains were modest, suggesting that investors were not fully embracing a bullish outlook. However, the absence of significant losses indicates that investor confidence was not entirely shattered.

Examples of Investor Behavior

Several examples illustrate the mixed investor sentiment on September 17th. For instance, the tech sector, which is often seen as a bellwether for investor confidence, experienced a slight pullback. This could indicate that some investors were taking profits in tech stocks, perhaps out of concern about the sector’s future growth prospects.

However, the healthcare sector, which is generally considered to be more defensive, performed well. This suggests that some investors were seeking out safe havens amidst the market’s uncertainty.

Last Word: How Major Us Stock Indexes Fared Sept 17

September 17th’s market performance highlighted the dynamic nature of the stock market, where various factors can influence its direction. By analyzing the performance of each index, understanding the contributing factors, and gauging investor sentiment, investors can gain a deeper understanding of the market’s current state and potential future trajectories.

While the market may fluctuate, understanding these trends is key for making informed investment decisions and navigating the ever-changing landscape of the stock market.