Warren Buffetts Cash Pile: More Treasury Bills Than the Fed

Warren buffett flush with cash also owns more treasury bills than the federal reserve – Warren Buffett’s Cash Pile: More Treasury Bills Than the Fed – It’s a headline that has sent shockwaves through the financial world. The Oracle of Omaha, known for his astute investment decisions and long-term vision, has amassed a staggering amount of cash, surpassing even the Federal Reserve’s Treasury bill holdings.

This move has sparked intense speculation about Buffett’s market outlook and the potential impact of his investment strategy on the broader economy.

Buffett’s decision to hold such a massive amount of cash is not a whim. It reflects his deep understanding of market cycles, his ability to identify undervalued assets, and his unwavering commitment to value investing. His strategy, which often involves patiently waiting for the right opportunities, has been honed over decades and has consistently delivered exceptional returns.

But what does this massive cash pile signify for the market, and what are the potential implications for investors?

Warren Buffett’s Cash Position

The Oracle of Omaha, Warren Buffett, is renowned for his astute investment decisions. However, in recent years, his company, Berkshire Hathaway, has amassed a staggering amount of cash, leading many to question his strategy. This article delves into Warren Buffett’s current cash holdings, the reasons behind this strategy, and its potential implications for the market.

It’s mind-boggling to think that Warren Buffett, a man who seemingly has more cash than he knows what to do with, also holds more Treasury bills than the Federal Reserve. This speaks volumes about the current state of the economy and the potential for a recession.

It’s almost as if people are preparing for a storm, and this massive influx of cash into safe havens like Treasury bills might even be a reflection of a deeper fear, one that’s rooted in the alarming trend that mass shootings typically lead to looser gun laws not stronger ones.

This lack of trust in our institutions, whether it’s the government’s ability to address gun violence or the financial system’s ability to weather a storm, is likely driving the massive flow of money into Treasury bills. It’s a stark reminder that even the wealthiest individuals are looking for safe havens in a world that feels increasingly uncertain.

Warren Buffett’s Current Cash Holdings

Berkshire Hathaway’s cash holdings have been on an upward trajectory in recent years. As of the end of 2022, the company held over $128 billion in cash and equivalents. This represents a significant increase from previous years, with cash holdings exceeding $100 billion for the first time in 2019.

This massive cash pile is a departure from Buffett’s historical approach, where he typically sought out attractive investment opportunities.

Reasons for Buffett’s Large Cash Reserves

Several factors have contributed to Buffett’s significant cash reserves:

- Lack of Attractive Investment Opportunities:Buffett has publicly stated that he finds it challenging to identify compelling investment opportunities in the current market. This is attributed to the inflated valuations of many companies and the prevalence of speculative bubbles.

- Increased Market Volatility:The global economy has experienced heightened volatility in recent years, with geopolitical tensions, rising inflation, and supply chain disruptions creating uncertainty. This has made Buffett more cautious about deploying capital.

- Waiting for a Market Correction:Buffett believes that the current market is overvalued, and he is waiting for a correction to emerge before deploying his massive cash reserves. He anticipates that a market downturn will create opportunities to acquire undervalued assets at attractive prices.

- Strategic Acquisitions:Buffett has historically used Berkshire Hathaway’s cash reserves to acquire businesses with strong fundamentals and long-term growth potential. However, he has been relatively inactive on the acquisition front in recent years.

Implications of Buffett’s Cash Position on the Market

Buffett’s large cash position has significant implications for the market:

- Potential Market Correction:The anticipation of a market correction fueled by Buffett’s large cash reserves can create a self-fulfilling prophecy. If investors believe that Buffett is waiting for a downturn, they may also become more cautious, potentially leading to a decline in asset prices.

- Investment Opportunities:When Buffett eventually decides to deploy his cash reserves, it could create a significant buying spree, boosting the market. However, this could also lead to increased competition for attractive assets, potentially driving up valuations.

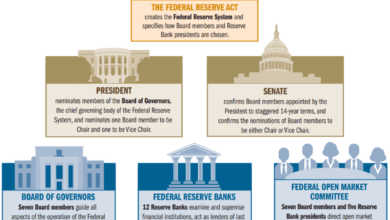

- Impact on Interest Rates:Berkshire Hathaway’s large cash reserves could also impact interest rates. As a significant holder of U.S. Treasury bonds, Buffett’s investment decisions can influence the demand for these bonds, which in turn affects interest rates.

Evolution of Buffett’s Investment Strategy

Buffett’s investment strategy has evolved over time, reflecting changing market conditions and his own investment philosophy:

- Value Investing:Buffett is known for his value investing approach, focusing on undervalued companies with strong fundamentals and long-term growth potential. This approach has been successful for him over decades.

- Focus on Long-Term Growth:Buffett is a long-term investor, and he believes in holding companies for the long haul. He avoids short-term trading and focuses on building a portfolio of businesses with sustainable competitive advantages.

- Shifting Priorities:In recent years, Buffett has become more cautious about investing in the stock market, opting to hold more cash and wait for attractive opportunities. This shift reflects his assessment of the current market environment and his belief that the market is overvalued.

Treasury Bill Holdings

Warren Buffett’s Berkshire Hathaway is known for its vast cash reserves, and a significant portion of that cash is invested in Treasury bills. Treasury bills, or T-bills, are short-term debt securities issued by the U.S. government. They are considered one of the safest investments due to the backing of the U.S.

government.

The Extent of Buffett’s Holdings

As of the most recent quarterly filing, Berkshire Hathaway held approximately $100 billion in Treasury bills. This represents a substantial portion of the company’s overall investment portfolio. While the exact amount fluctuates based on market conditions, Buffett’s significant allocation to Treasury bills highlights his preference for safe and liquid assets.

Comparison to Federal Reserve Holdings

The Federal Reserve, the central bank of the United States, also holds a large amount of Treasury bills. The Federal Reserve’s holdings are significantly larger than Buffett’s, as they are used to manage the money supply and interest rates. However, Buffett’s holdings are still notable because they represent a significant portion of the Treasury bill market.

Rationale for Investment

Buffett’s investment in Treasury bills is driven by several factors. First, they provide a safe haven for capital. Treasury bills are backed by the full faith and credit of the U.S. government, making them highly unlikely to default. Second, Treasury bills are highly liquid.

They can be easily bought and sold in the market, allowing Buffett to access cash quickly if needed. Third, Treasury bills offer a relatively stable return, although the returns are typically lower than other investment options.

Risks and Rewards

While Treasury bills are considered safe, they are not without risk. The primary risk is inflation. If inflation rises faster than the interest rate on Treasury bills, investors may lose purchasing power. However, Treasury bills are generally seen as a low-risk investment option, especially compared to stocks or bonds.

“The best thing that happens to a company is when it’s ignored by the market.”

Warren Buffett

Market Outlook

Warren Buffett’s massive cash hoard and significant Treasury bill holdings reflect a cautious stance on the current market conditions. This strategy is influenced by a complex interplay of factors, including the current economic climate, interest rates, and inflation. Understanding these factors is crucial for comprehending Buffett’s investment decisions and potential future market opportunities.

Factors Influencing Buffett’s Investment Decisions

The current market landscape is characterized by a confluence of factors, including:

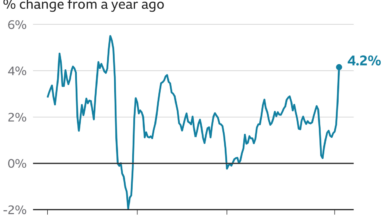

- Elevated Inflation:Inflation remains stubbornly high, eroding the purchasing power of investments and increasing uncertainty about future economic growth.

- Rising Interest Rates:The Federal Reserve’s aggressive interest rate hikes aim to curb inflation, but they also impact borrowing costs for businesses and consumers, potentially slowing economic activity.

- Geopolitical Tensions:Ongoing geopolitical conflicts, such as the war in Ukraine, contribute to global economic instability and market volatility.

- Supply Chain Disruptions:The lingering effects of the pandemic and geopolitical events continue to disrupt supply chains, impacting production costs and consumer prices.

These factors have created a challenging environment for investors, prompting Buffett to prioritize cash and safe-haven assets like Treasury bills. This approach reflects his focus on preserving capital and waiting for more favorable investment opportunities.

Buffett’s Perspective on Inflation and Interest Rates

Buffett has consistently expressed concern about the impact of inflation on the economy and corporate earnings. He has acknowledged that inflation can erode the value of investments over time and make it difficult for businesses to maintain profitability. His preference for holding cash and Treasury bills reflects his belief that these assets can provide a hedge against inflation, while also offering a relatively safe return in the current environment.

It’s wild to think that Warren Buffett, the “Oracle of Omaha,” is sitting on more cash than the US Federal Reserve. While he’s famously known for his stock picks, his recent move to load up on Treasury bills is a fascinating development.

This is especially interesting considering the news that U.S. intelligence is helping Ukraine target Russian generals. With so much uncertainty in the world, it seems Buffett is hedging his bets, playing it safe with a strategy that prioritizes stability over potential gains.

Whether this will prove to be a smart move or a missed opportunity remains to be seen, but it certainly adds another layer of intrigue to the world of finance.

Buffett’s Investment Strategy in the Current Economic Climate

Buffett’s investment strategy is characterized by a long-term value investing approach, focusing on identifying undervalued businesses with strong fundamentals and durable competitive advantages. However, in the current economic climate, he has adopted a more cautious approach, prioritizing cash and Treasury bills while waiting for opportunities to deploy capital in businesses that can navigate the current economic challenges and deliver long-term value.

Impact on the Economy

Warren Buffett’s investment decisions, particularly his substantial cash holdings and strategic allocation of capital, have a significant impact on the broader economy. His actions can influence market sentiment, affect interest rates, and shape investment trends.

Buffett’s Investment Decisions and the Economy

Buffett’s investment decisions are closely watched by market participants, and his moves can send ripples throughout the economy. When he invests in a company, it often leads to a boost in the company’s stock price and increased investor confidence. Conversely, when he chooses to hold a large amount of cash, it can signal caution about the market outlook and potentially discourage other investors from deploying capital.

Impact of Cash Holdings on Market Volatility

Buffett’s large cash holdings can have a significant impact on market volatility. When he decides to deploy this capital, it can lead to a surge in stock prices, particularly in the sectors he targets. However, his reluctance to invest can also contribute to market uncertainty and volatility, as other investors may follow his lead and adopt a more cautious approach.

Institutional Investors and Market Trends, Warren buffett flush with cash also owns more treasury bills than the federal reserve

Institutional investors, like Warren Buffett, play a critical role in shaping market trends. Their vast resources and sophisticated analysis allow them to identify undervalued assets and drive investment flows. Their decisions can influence the performance of specific sectors and even the overall direction of the stock market.

Investor Sentiment and Economic Growth

Investor sentiment is closely linked to economic growth. When investors are optimistic about the future, they are more likely to invest, which stimulates economic activity. Conversely, when investors are pessimistic, they tend to hold back on investments, which can lead to slower economic growth.

Buffett’s investment decisions can influence investor sentiment, particularly among retail investors who often follow his lead.

Buffett’s Investment Philosophy: Warren Buffett Flush With Cash Also Owns More Treasury Bills Than The Federal Reserve

Warren Buffett, often referred to as the “Oracle of Omaha,” is a legendary investor known for his exceptional track record and insightful investment strategies. His investment philosophy, rooted in value investing and long-term thinking, has consistently delivered remarkable returns over decades.

Key Principles of Buffett’s Investment Approach

Buffett’s investment philosophy is built on a foundation of core principles that guide his decision-making. These principles are not merely theoretical concepts but practical guidelines that have been tested and proven over time.

- Focus on Value Investing:Buffett strongly advocates for value investing, a strategy that involves identifying undervalued companies with strong fundamentals and purchasing their shares at a discount to their intrinsic value. This approach emphasizes the long-term potential of businesses rather than short-term market fluctuations.

- Long-Term Perspective:Buffett’s investment horizon is remarkably long. He believes in holding investments for the long term, often for years or even decades, allowing businesses to grow and generate substantial returns over time. This patient approach contrasts sharply with the short-term focus prevalent in the market.

- Understanding Businesses:Buffett emphasizes the importance of thoroughly understanding the businesses he invests in. He seeks companies with strong competitive advantages, sustainable earnings, and a clear path to future growth. He prefers to invest in businesses he can comprehend, avoiding complex financial instruments or industries he doesn’t fully grasp.

- Margin of Safety:Buffett always seeks a margin of safety in his investments. This means purchasing assets at a significant discount to their estimated intrinsic value, providing a buffer against potential miscalculations or unforeseen events. This approach helps mitigate risk and enhances the likelihood of profitable outcomes.

- Discipline and Patience:Buffett’s success is not merely attributed to his investment acumen but also to his unwavering discipline and patience. He avoids impulsive decisions, remaining calm amidst market volatility and sticking to his long-term investment plan. This disciplined approach has helped him weather market storms and capitalize on long-term opportunities.

Importance of Value Investing and Long-Term Thinking

Value investing, a core principle of Buffett’s philosophy, involves identifying undervalued companies with strong fundamentals and purchasing their shares at a discount to their intrinsic value. This approach emphasizes the long-term potential of businesses rather than short-term market fluctuations.

- Intrinsic Value:Value investors focus on the intrinsic value of a company, which is the true worth of its assets, earnings potential, and future prospects. They believe that market prices can fluctuate in the short term, but over the long term, they will converge with intrinsic value.

It’s fascinating to see Warren Buffett, the “Oracle of Omaha,” sitting on a mountain of cash, even holding more Treasury bills than the Federal Reserve. This is a sign of the times, with the world facing economic uncertainty. It’s a stark contrast to the political climate, where issues like immigration take center stage.

For instance, speaker johnson says 16 million illegal immigrants entered america under bidens watch , a claim that sparks debate and fuels anxieties. While the political landscape is rife with contentious issues, Buffett’s massive cash reserves highlight the precarious state of the global economy, prompting many to question the future direction of financial markets.

- Margin of Safety:Value investors seek a margin of safety, purchasing assets at a significant discount to their estimated intrinsic value. This provides a buffer against potential miscalculations or unforeseen events, increasing the likelihood of profitable outcomes.

- Long-Term Perspective:Value investing requires a long-term perspective, as it often involves holding investments for years or even decades, allowing businesses to grow and generate substantial returns over time. This patience contrasts with the short-term focus prevalent in the market.

Criteria for Selecting Investments

Buffett’s investment criteria are well-defined, guiding him in selecting companies with the potential to deliver long-term value. These criteria are not rigid but rather adaptable to changing market conditions and evolving business landscapes.

- Strong Competitive Advantage:Buffett seeks companies with a sustainable competitive advantage, a unique characteristic that allows them to outperform their rivals. This could be a strong brand, a cost advantage, a proprietary technology, or a dominant market position.

- Sustainable Earnings:Buffett prioritizes companies with a history of consistent and sustainable earnings growth. He prefers businesses with predictable cash flows and a proven track record of profitability, ensuring the ability to generate returns over time.

- Clear Path to Future Growth:Buffett looks for companies with a clear path to future growth, whether through expanding into new markets, developing new products, or increasing market share. He believes in investing in businesses with the potential to generate significant returns in the future.

- Strong Management Team:Buffett values companies with strong and ethical management teams. He believes that capable and trustworthy leadership is crucial for long-term success, ensuring that the business is well-run and its resources are effectively utilized.

- Reasonable Valuation:Buffett seeks investments at a reasonable valuation, ensuring that the price he pays aligns with the intrinsic value of the company. He avoids overpaying for assets, focusing on finding opportunities where the market undervalues the true potential of a business.

Factors Contributing to Buffett’s Success

Buffett’s success is a testament to his exceptional investment acumen, unwavering discipline, and a profound understanding of business and markets. His approach has consistently outperformed the market, earning him widespread recognition as one of the most successful investors of all time.

- Long-Term Perspective:Buffett’s success is rooted in his long-term perspective. He avoids the short-term noise and focuses on the long-term potential of businesses, allowing them to grow and generate substantial returns over time.

- Value Investing:Buffett’s commitment to value investing has enabled him to identify undervalued companies with strong fundamentals and purchase their shares at a discount to their intrinsic value. This approach has consistently delivered superior returns over decades.

- Discipline and Patience:Buffett’s success is not merely attributed to his investment acumen but also to his unwavering discipline and patience. He avoids impulsive decisions, remaining calm amidst market volatility and sticking to his long-term investment plan.

- Understanding Businesses:Buffett’s deep understanding of businesses has allowed him to make informed investment decisions. He focuses on companies he can comprehend, avoiding complex financial instruments or industries he doesn’t fully grasp.

- Margin of Safety:Buffett always seeks a margin of safety in his investments, purchasing assets at a significant discount to their estimated intrinsic value. This approach mitigates risk and enhances the likelihood of profitable outcomes.

- Focus on Quality:Buffett prioritizes investing in high-quality businesses with strong competitive advantages, sustainable earnings, and a clear path to future growth. This focus on quality has helped him build a portfolio of companies with exceptional long-term potential.

Historical Context

Warren Buffett’s investment decisions have been shaped by his decades-long experience in the market, coupled with his evolving philosophy. He has adapted his strategy to changing market conditions, demonstrating both successes and failures along the way. This historical perspective provides valuable insights into his current approach.

Buffett’s Early Years and Value Investing

Buffett’s early investment career was marked by a deep commitment to value investing, a strategy he learned from his mentor, Benjamin Graham. This approach focuses on identifying undervalued companies with strong fundamentals and holding them for the long term. Buffett’s early successes, such as his investment in GEICO, were rooted in this value-driven philosophy.

Comparison with Other Investors

Warren Buffett’s investment strategy, characterized by its focus on value investing and long-term holding, stands out in the world of finance. However, other prominent investors have also made their mark with unique approaches and philosophies. Comparing Buffett’s strategy with these investors sheds light on the diverse landscape of investment strategies and the factors that drive investment decisions.

Comparing Buffett’s Strategy with Other Investors

Buffett’s approach is often contrasted with the strategies of other prominent investors, such as:

- Growth Investors: These investors focus on companies with high growth potential, often in rapidly evolving industries. They are willing to pay a premium for companies with strong earnings growth and market dominance. Notable examples include Peter Lynch and Cathie Wood.

Their risk tolerance is generally higher than Buffett’s, as they are willing to invest in companies with higher valuations and more volatile earnings.

- Quantitative Investors: These investors rely heavily on data and algorithms to identify investment opportunities. They often use sophisticated statistical models to analyze large datasets and make investment decisions based on objective criteria. Notable examples include Renaissance Technologies and Two Sigma. Their risk tolerance varies depending on the specific algorithms and strategies employed.

- Activist Investors: These investors take a more active role in influencing the management of companies in which they invest. They may use their ownership stake to advocate for changes in corporate strategy, governance, or financial performance. Notable examples include Carl Icahn and Bill Ackman.

Their risk tolerance is often higher than Buffett’s, as they are willing to engage in potentially contentious battles with corporate management.

Factors Influencing Investment Decisions

The investment decisions of prominent investors are influenced by a variety of factors, including:

- Investment Philosophy: Each investor has a unique investment philosophy that shapes their approach to the market. Buffett’s philosophy emphasizes value investing, focusing on identifying undervalued companies with strong fundamentals.

- Risk Tolerance: Investors have different levels of risk tolerance, which influences their investment choices. Buffett’s approach is generally considered conservative, while other investors may be more willing to take on higher levels of risk.

- Market Conditions: Market conditions play a significant role in investment decisions. In periods of economic uncertainty, investors may adopt more cautious strategies, while in periods of strong growth, they may be more inclined to take on risk.

- Personal Experience and Beliefs: An investor’s personal experience and beliefs can also shape their investment decisions. For example, an investor who has experienced a market downturn may be more cautious in the future.

Diversity of Investment Strategies

The market offers a wide range of investment strategies, catering to different risk tolerances and investment objectives. Investors can choose from:

- Passive Investing: This approach involves investing in a diversified portfolio of assets, such as index funds or exchange-traded funds (ETFs), without actively trading. It is a low-cost and relatively low-risk strategy.

- Active Investing: This approach involves actively researching and selecting individual securities, with the goal of outperforming the market. It requires a higher level of expertise and may involve higher risk.

- Alternative Investments: This category includes investments outside of traditional stocks and bonds, such as private equity, real estate, and commodities. They often offer higher potential returns but also carry higher risk.

Implications for Retail Investors

Warren Buffett’s recent investment decisions, particularly his massive cash holdings and Treasury bill purchases, offer valuable lessons for retail investors navigating today’s uncertain market landscape. His approach, rooted in a long-term perspective and a focus on value, can be applied to individual investment strategies, even on a smaller scale.

Applying Buffett’s Principles

Buffett’s investment philosophy is built on a few core principles that can be adapted for individual investors:* Focus on Value:Buffett seeks businesses with strong fundamentals, a durable competitive advantage, and the potential for long-term growth. For retail investors, this means carefully researching companies before investing, understanding their business models, and looking beyond short-term fluctuations.

Long-Term Perspective

Buffett believes in holding investments for the long haul, weathering market fluctuations, and focusing on the underlying value of businesses. Retail investors can benefit from this approach by avoiding impulsive trading and focusing on building a diversified portfolio that can withstand market volatility.

Patience and Discipline

Buffett emphasizes the importance of patience and discipline in investing. He waits for the right opportunities, avoids panic selling, and sticks to his investment strategy. Retail investors can benefit from this approach by setting realistic goals, developing a plan, and sticking to it, even during periods of market uncertainty.

Navigating the Current Market

The current market environment, characterized by inflation, rising interest rates, and geopolitical uncertainty, presents challenges for investors. Buffett’s approach offers some insights for navigating this landscape:* Be Cautious:In times of uncertainty, it’s wise to exercise caution and avoid taking excessive risks.

Buffett’s large cash position reflects this principle.

Focus on Quality

Focus on investing in high-quality companies with strong balance sheets and resilient business models. This will help mitigate risk and provide stability during turbulent times.

Diversify

A diversified portfolio across different asset classes and sectors can help reduce overall risk and provide some protection against market downturns.

Stay Informed

Stay up-to-date on market trends, economic indicators, and geopolitical events. This will help you make informed investment decisions.

Resources for Retail Investors

Several resources can help retail investors make informed decisions:* Online Brokerage Platforms:Platforms like Fidelity, Charles Schwab, and TD Ameritrade offer research tools, educational materials, and investment advice.

Financial News Websites

Websites like The Wall Street Journal, Bloomberg, and Yahoo Finance provide up-to-date market news and analysis.

Investment Books and Articles

Books by Warren Buffett, Benjamin Graham, and other investment gurus offer valuable insights and strategies.

Financial Advisors

A qualified financial advisor can provide personalized advice and guidance based on your individual circumstances.

Outcome Summary

The sheer scale of Warren Buffett’s cash holdings, coupled with his unprecedented Treasury bill investment, raises fundamental questions about the current market environment and the future direction of the economy. While the Oracle of Omaha’s moves often signal significant market shifts, it’s crucial to remember that his decisions are based on his own unique perspective and risk tolerance.

His actions serve as a powerful reminder of the importance of long-term thinking, value investing, and the ability to navigate market cycles with patience and discipline.