US Credit Card Debts Rise, More Americans Become Delinquent: NY Fed

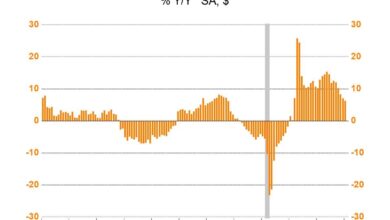

The US credit card debts rise more americans become delinquent ny fed news is alarming. As the cost of living continues to soar, many Americans are finding it increasingly difficult to make ends meet. This has led to a significant increase in credit card debt, with many borrowers struggling to keep up with their payments.

According to the New York Federal Reserve, credit card delinquency rates have been on the rise, indicating a growing number of individuals falling behind on their debt obligations. This trend has serious implications for both individuals and the economy as a whole.

The rise in credit card debt can be attributed to a number of factors, including inflation, rising interest rates, and economic uncertainty. Inflation has eroded the purchasing power of consumers, forcing them to rely more heavily on credit. Rising interest rates have made it more expensive to borrow money, increasing the cost of carrying credit card debt.

And economic uncertainty has made many consumers hesitant to spend, leading them to turn to credit cards to cover essential expenses.

Delinquency Rates and Their Impact

The recent rise in credit card delinquency rates among Americans is a concerning trend, signaling potential economic instability and highlighting the financial challenges faced by many individuals. Delinquency rates, which measure the percentage of borrowers who are behind on their payments, have been on the rise, reflecting a growing number of individuals struggling to meet their financial obligations.

Consequences of Rising Delinquency Rates, Us credit card debts rise more americans become delinquent ny fed

The increase in credit card delinquency rates carries significant consequences for both individuals and the broader economy. Rising delinquency rates can lead to a domino effect, impacting various aspects of the financial system.

Impact on Individuals

- Damaged Credit Scores:When individuals fall behind on their credit card payments, it negatively impacts their credit scores. This can make it more difficult to obtain loans, mortgages, or even secure lower interest rates on future credit products.

- Increased Debt Burden:Late payments often result in hefty late fees and higher interest rates, further exacerbating the debt burden and making it more challenging to climb out of financial distress.

- Financial Stress and Instability:Rising credit card debt can lead to significant financial stress, impacting overall well-being and potentially causing instability in other areas of life, such as housing and employment.

Impact on the Economy

- Reduced Lending:As delinquency rates rise, lenders may become more cautious about extending credit, leading to a decrease in lending activity. This can have a ripple effect on economic growth, as businesses and individuals may struggle to access the necessary funds for investments and expenditures.

- Financial Instability:High delinquency rates can contribute to financial instability, as banks and other financial institutions may face higher losses from defaults. This can lead to a tightening of credit markets and potentially even a recession.

The Role of the Federal Reserve: Us Credit Card Debts Rise More Americans Become Delinquent Ny Fed

The Federal Reserve (Fed) plays a crucial role in monitoring and influencing credit card debt levels in the United States. As the central bank, the Fed has a mandate to promote price stability and maximum employment, which includes managing financial stability and ensuring the smooth functioning of the credit market.The Fed’s influence on credit card debt stems from its ability to control the cost and availability of credit.

It’s a tough time to be a consumer in the US. Credit card debt is soaring, and more and more Americans are becoming delinquent on their payments. This comes at a time when there are a lot of questions about the Biden family’s financial dealings.

Recently, Eric Schwerin testified that Joe Biden and the Biden family used alias email accounts during his vice presidency. Whether or not this has any impact on the current economic situation remains to be seen, but it certainly doesn’t help ease the minds of those struggling with their finances.

By adjusting interest rates and reserve requirements, the Fed can impact the lending practices of banks and other financial institutions, ultimately influencing the terms and conditions of credit card offers.

Potential Measures to Address Rising Delinquency Rates

The Fed can employ a range of measures to address rising delinquency rates in credit card debt. These measures can be categorized as either monetary policy tools or supervisory actions:

Monetary Policy Tools

- Interest Rate Adjustments:The Fed can raise interest rates to make borrowing more expensive, potentially reducing consumer demand for credit and slowing down the growth of credit card debt. Higher interest rates can also encourage borrowers to prioritize debt repayment, reducing the likelihood of delinquency.

- Reserve Requirements:By increasing reserve requirements, the Fed can reduce the amount of money banks have available for lending, which can limit the supply of credit and potentially slow down the growth of credit card debt.

Supervisory Actions

- Stress Tests:The Fed can conduct stress tests to assess the resilience of financial institutions to economic shocks. These tests can identify potential vulnerabilities in credit card lending practices and encourage banks to adopt more prudent lending standards.

- Regulatory Guidance:The Fed can issue guidance to banks and other financial institutions regarding responsible lending practices, including setting limits on credit card interest rates and fees. This guidance can help ensure that credit card products are offered in a safe and responsible manner.

Effectiveness of Past Fed Interventions

The effectiveness of past Fed interventions in managing credit card debt has been mixed. Some interventions have been successful in slowing down the growth of credit card debt and reducing delinquency rates, while others have had less of an impact.The effectiveness of Fed interventions depends on a variety of factors, including the overall economic climate, consumer behavior, and the specific measures employed.

The news that US credit card debt is rising and more Americans are becoming delinquent is a stark reminder of the financial struggles many face. It’s easy to get caught up in the whirlwind of consumerism, especially when we’re bombarded with messages of endless possibilities and instant gratification.

This constant pressure to acquire more, more, more can be exacerbated by the illusion of free speech on platforms like Twitter, which can often be a breeding ground for misinformation and harmful narratives. This myth of free speech can lead to a distorted sense of reality, making it even harder to prioritize responsible financial practices.

Ultimately, it’s crucial to be mindful of our spending habits and resist the allure of a culture that glorifies consumption over financial well-being.

For example, during the 2008 financial crisis, the Fed’s aggressive interest rate cuts and liquidity injections helped to stabilize the financial system and prevent a collapse in credit card lending. However, these interventions also contributed to a period of low interest rates and easy credit, which fueled a surge in consumer borrowing, including credit card debt.

“The Federal Reserve’s role in managing credit card debt is complex and multifaceted. While the Fed has a range of tools at its disposal, the effectiveness of these tools depends on a variety of factors, including the overall economic climate and consumer behavior.”

Consumer Behavior and Financial Literacy

The rising credit card debt in the United States is a complex issue, driven by a combination of factors including consumer spending habits, financial literacy, and economic conditions. Understanding these factors is crucial for developing effective strategies to address the problem and improve the financial well-being of individuals and families.

Factors Influencing Consumer Spending Habits and Credit Card Usage

Consumer spending habits are influenced by a multitude of factors, including:

- Economic Conditions:During periods of economic growth and low unemployment, consumers tend to spend more freely, often relying on credit cards for larger purchases. Conversely, during economic downturns, consumers may cut back on spending and rely more heavily on credit cards to make ends meet.

The news about rising credit card debt and delinquencies is definitely concerning, but it seems like there’s always something else to worry about. Today, it’s the widening investigation into Hunter Biden’s art dealings, with his dealer being subpoenaed, as reported by this news outlet.

Maybe if we all focused on managing our finances a bit better, we wouldn’t have to worry so much about these other things.

- Marketing and Advertising:Aggressive marketing campaigns, often targeting impulsive purchases and offering enticing rewards programs, can encourage consumers to use credit cards more frequently.

- Availability of Credit:Easy access to credit, particularly through readily available credit cards, can lead to overspending and the accumulation of debt.

- Lifestyle and Social Norms:Societal pressures to maintain a certain lifestyle, including keeping up with the Joneses or making large purchases for special occasions, can contribute to credit card debt.

- Lack of Financial Planning:Many consumers lack a comprehensive financial plan, making it difficult to track spending, budget effectively, and avoid excessive credit card use.

Industry Perspectives and Solutions

The rising tide of credit card debt and delinquency is a pressing concern for the industry, prompting financial institutions and experts to seek innovative solutions. Credit card companies are actively exploring strategies to promote responsible credit card usage and financial literacy among consumers.

Strategies to Address Rising Credit Card Debt and Delinquency

Financial institutions are implementing a variety of strategies to address the growing problem of credit card debt and delinquency. These strategies aim to empower consumers with financial literacy, promote responsible borrowing habits, and provide support for those struggling with debt.

- Financial Education and Counseling:Many credit card companies offer resources and programs designed to educate consumers about managing their finances effectively. These programs may include online tools, workshops, and access to certified financial counselors who can provide personalized guidance on budgeting, debt management, and credit score improvement.

For example, Capital One offers a free online budgeting tool and access to certified financial counselors through their “Money Management” program.

- Responsible Credit Card Usage Practices:Credit card companies are emphasizing responsible credit card usage practices through various initiatives. This includes providing clear and concise information about interest rates, fees, and repayment options, as well as offering tools for setting spending limits and tracking expenses. For instance, Discover offers a “Spending Tracker” feature that allows users to monitor their spending habits and identify areas for potential savings.

- Debt Management and Relief Programs:Recognizing the challenges faced by individuals struggling with debt, credit card companies are developing debt management and relief programs. These programs may include options for consolidating debt, reducing interest rates, and extending repayment terms. For example, Citibank offers a “Debt Consolidation Loan” that allows customers to combine multiple debts into a single loan with a lower interest rate.

- Early Intervention and Support:Credit card companies are implementing early intervention strategies to identify consumers who may be at risk of delinquency. This may involve sending alerts about missed payments, offering payment plans, and connecting individuals with financial counselors. For instance, American Express utilizes a “Cardmember Support” program that provides personalized guidance and assistance to customers experiencing financial difficulties.

Innovative Approaches to Promote Responsible Credit Card Usage and Financial Literacy

The credit card industry is exploring innovative approaches to promote responsible credit card usage and enhance financial literacy among consumers. These approaches aim to address the root causes of debt accumulation and empower individuals with the tools and knowledge they need to manage their finances effectively.

- Gamification and Interactive Tools:Incorporating gamification and interactive tools into financial education programs can make learning more engaging and accessible. This can involve using mobile apps, online games, and interactive simulations to teach budgeting, saving, and credit management concepts in a fun and engaging way.

For example, the “Mint” app uses gamification to encourage users to track their spending and reach financial goals.

- Personalized Financial Coaching:Providing personalized financial coaching can offer tailored guidance and support to individuals based on their specific financial circumstances. This can involve working with certified financial counselors who can provide personalized advice on budgeting, debt management, and investment strategies. For instance, the “Credit Karma” platform offers personalized credit score monitoring and recommendations for improving credit health.

- Data-Driven Insights and Predictive Analytics:Utilizing data-driven insights and predictive analytics can help credit card companies identify consumers at risk of delinquency and provide timely intervention. This can involve analyzing spending patterns, repayment history, and other relevant data to predict potential financial distress and offer targeted support.

For example, some credit card companies are using artificial intelligence (AI) to analyze consumer data and provide personalized financial recommendations.

End of Discussion

The rise in credit card debt and delinquency rates is a serious concern that requires immediate attention. While the Federal Reserve plays a crucial role in managing credit card debt levels, it’s important for individuals to take proactive steps to improve their financial literacy and manage their debt responsibly.

By understanding the factors contributing to this trend and adopting effective debt management strategies, individuals can protect their financial well-being and contribute to a more stable economy.