Americans Near-Term Inflation Expectations Stuck at Record High

Americans near term inflation expectations stuck at record high – Americans’ near-term inflation expectations stuck at record high, a concerning trend that has ripple effects throughout the economy. The latest data paints a stark picture, with consumers bracing for continued price increases. This isn’t just a recent phenomenon; historical context reveals that these expectations are rooted in a confluence of factors, from supply chain disruptions to geopolitical tensions.

This persistent belief in elevated inflation has tangible consequences, influencing consumer spending habits, business investment decisions, and even the Federal Reserve’s monetary policy. Understanding the root causes of these expectations is crucial for navigating the economic landscape ahead.

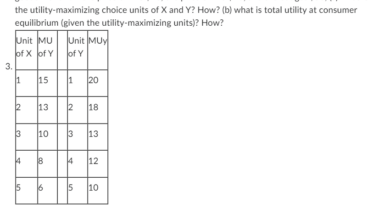

Factors Contributing to High Inflation Expectations

Americans’ elevated inflation expectations are driven by a complex interplay of factors, including recent economic events, government policies, and underlying structural changes in the economy.

It’s a bit unnerving to see Americans’ near-term inflation expectations stuck at record highs. This, coupled with the fact that a leading US economic indicator has fallen for the 10th straight month, suggesting a recession is on the horizon , makes me wonder if we’re in for a rough ride.

The combination of high inflation and a weakening economy could lead to a perfect storm of economic uncertainty, and it’s something we’ll need to keep a close eye on in the months to come.

Recent Economic Events

The recent economic events, such as supply chain disruptions and the war in Ukraine, have significantly contributed to the surge in inflation and, consequently, Americans’ heightened inflation expectations.

- Supply Chain Disruptions:The COVID-19 pandemic caused widespread disruptions in global supply chains, leading to shortages of goods and raw materials. This scarcity drove up prices for a wide range of products, contributing to the overall increase in inflation. For example, the semiconductor shortage, a key component in many electronic devices, has led to higher prices for cars, computers, and other products.

- War in Ukraine:The war in Ukraine has further exacerbated global supply chain disruptions, particularly in energy markets. Russia, a major exporter of oil and natural gas, has faced sanctions from Western countries, leading to a surge in energy prices. The war has also disrupted the supply of wheat and other agricultural commodities, further contributing to food inflation.

Government Policies

Government policies, both fiscal and monetary, have also played a role in shaping inflation expectations.

- Fiscal Policy:The government’s response to the pandemic, including stimulus checks and expanded unemployment benefits, injected a significant amount of money into the economy. While these measures were intended to support the economy during the pandemic, they also contributed to increased demand, potentially fueling inflationary pressures.

- Monetary Policy:The Federal Reserve has maintained a loose monetary policy for several years, keeping interest rates low and injecting liquidity into the financial system. This policy was aimed at stimulating economic growth but has also contributed to higher inflation.

Impact on Different Socioeconomic Groups

The impact of these factors on inflation expectations is not uniform across all socioeconomic groups.

- Low-Income Households:Low-income households tend to be more vulnerable to inflation, as a larger proportion of their income is spent on essential goods and services, such as food, energy, and housing. The rising prices of these goods and services can significantly erode their purchasing power.

- High-Income Households:High-income households, on the other hand, may have more resources to absorb the impact of inflation. They may have a larger proportion of their income invested in assets that tend to appreciate during inflationary periods, such as stocks and real estate.

Economic Implications of High Inflation Expectations

Sustained high inflation expectations can have significant and far-reaching consequences for the economy, impacting consumer spending, business investment, and overall economic growth. Understanding these implications is crucial for policymakers and businesses alike, as it can guide strategies for navigating a challenging economic landscape.

Impact on Consumer Spending

High inflation expectations can lead to a decrease in consumer spending, as individuals anticipate rising prices in the future. This can create a vicious cycle where consumers delay purchases, leading to lower demand, which in turn contributes to further price increases.

The news that Americans’ near-term inflation expectations are stuck at record highs is concerning, especially when you consider the role of misinformation in shaping public opinion. It’s a complex issue, intertwined with the rise of the disinformation industrial complex vs domestic terror , which can manipulate public sentiment and fuel economic anxieties.

Understanding the forces behind these expectations is crucial for navigating the economic landscape and ensuring that we’re making informed decisions based on facts, not fear-mongering.

For instance, if consumers expect the price of a car to rise significantly next year, they might postpone their purchase, leading to lower demand for cars in the present.

Impact on Business Investment

High inflation expectations can also negatively impact business investment. Companies may be hesitant to invest in new projects or expand their operations if they anticipate rising costs and lower returns. This can stifle economic growth by reducing the availability of capital for new ventures and innovation.

For example, a company might delay a planned factory expansion if they expect the cost of materials and labor to rise significantly in the future.

It’s no surprise that Americans are still feeling the pressure of inflation, with near-term expectations stuck at a record high. This anxiety is likely fueled by the recent news that US homebuilder sentiment has tanked again amid a spike in mortgage rates , erasing months of gains.

This trend, coupled with persistent price increases, suggests that the road to economic stability may be longer and bumpier than we initially hoped.

Wage-Price Spiral

High inflation expectations can fuel a wage-price spiral, a phenomenon where rising prices lead to demands for higher wages, which in turn lead to further price increases. This can create a self-perpetuating cycle of inflation, making it difficult to control.

For instance, if workers demand higher wages to compensate for rising prices, businesses might raise their prices further to cover the increased labor costs, leading to even higher inflation.

Implications for Monetary Policy

The Federal Reserve, the central bank of the United States, uses monetary policy tools to control inflation. High inflation expectations can make it more challenging for the Fed to manage inflation effectively. If the Fed raises interest rates to curb inflation, it can slow economic growth and potentially lead to a recession.

However, if the Fed does not act decisively, inflation expectations could become entrenched, making it even more difficult to control inflation in the future. For example, the Fed might raise interest rates to cool down the economy and curb inflation, but if inflation expectations remain high, businesses might continue to raise prices, potentially leading to a recession.

Addressing Inflation Expectations: Americans Near Term Inflation Expectations Stuck At Record High

High inflation expectations can become self-fulfilling prophecies, as businesses and consumers anticipate higher prices and adjust their behavior accordingly. This can lead to a vicious cycle of rising prices and expectations, further exacerbating inflation. Therefore, addressing these expectations is crucial for stabilizing the economy.

Strategies for Mitigating High Inflation Expectations

Several strategies can be employed to mitigate high inflation expectations. These strategies aim to reduce uncertainty, increase confidence in the central bank’s commitment to price stability, and foster a more stable economic environment.

- Clear and Consistent Communication:Central banks must clearly communicate their inflation targets, the rationale behind their policy decisions, and their commitment to achieving price stability. This transparency helps manage expectations and fosters confidence in the central bank’s ability to control inflation.

- Credible Monetary Policy:Central banks should implement credible monetary policies that demonstrate their commitment to price stability. This may involve raising interest rates to curb demand and slow down the economy, if necessary. The effectiveness of monetary policy depends on the central bank’s reputation for independence and its ability to control inflation.

- Fiscal Policy Measures:Governments can use fiscal policy to address inflationary pressures. This may involve reducing government spending, raising taxes, or a combination of both. Fiscal policies can help to reduce aggregate demand and control inflation, but they must be carefully coordinated with monetary policy to avoid conflicting signals.

- Supply-Side Policies:Addressing supply-side bottlenecks, such as labor shortages or disruptions in global supply chains, can help to reduce inflationary pressures. Policies aimed at increasing productivity, improving infrastructure, and promoting competition can help to boost supply and moderate price increases.

- Public Education and Awareness Campaigns:Educating the public about inflation and the role of central banks in managing it can help to reduce uncertainty and build confidence in the economy. Public awareness campaigns can help to dispel myths and misconceptions about inflation, fostering a more informed and stable economic environment.

Role of Government Policies

Government policies play a crucial role in managing inflation expectations. Both fiscal and monetary policies can be used to influence inflation expectations.

- Fiscal Policy:Fiscal policy refers to the use of government spending and taxation to influence the economy. During periods of high inflation, governments may consider reducing spending or increasing taxes to curb aggregate demand. These measures can help to control inflation by reducing the pressure on prices.

- Monetary Policy:Monetary policy involves the use of interest rates and other tools to control the money supply and influence inflation. Central banks often raise interest rates during periods of high inflation to make borrowing more expensive and slow down economic activity.

This can help to curb demand and reduce inflationary pressures.

Effectiveness of Communication Strategies

The effectiveness of communication strategies from policymakers and central banks depends on several factors, including:

- Clarity and Transparency:Clear and consistent communication about inflation targets, policy decisions, and the rationale behind them is essential for managing expectations. Central banks should avoid ambiguity and provide straightforward explanations of their actions.

- Credibility and Reputation:The effectiveness of communication depends on the central bank’s credibility and reputation for independence and commitment to price stability. A central bank with a strong track record of controlling inflation will have a greater impact on expectations.

- Consistency and Persistence:Communication strategies must be consistent and persistent over time. Frequent changes in messaging or conflicting statements can undermine confidence and create uncertainty.

- Engaging with the Public:Central banks should actively engage with the public, explaining their policies and answering questions. This can help to build trust and understanding, leading to more effective management of inflation expectations.

Impact of Public Education and Awareness Campaigns, Americans near term inflation expectations stuck at record high

Public education and awareness campaigns can play a significant role in mitigating high inflation expectations by:

- Reducing Uncertainty:Educating the public about inflation, its causes, and the role of central banks in managing it can help to reduce uncertainty and dispel misconceptions. This can lead to more stable economic behavior and reduce the risk of self-fulfilling prophecies.

- Building Confidence:Public education campaigns can help to build confidence in the central bank’s ability to control inflation. This can reduce the risk of consumers and businesses adjusting their behavior in ways that exacerbate inflation.

- Promoting Long-Term Stability:A well-informed public is more likely to support policies that promote long-term economic stability, including those aimed at controlling inflation. This can contribute to a more stable economic environment and reduce the risk of future inflationary episodes.

Summary

The persistence of high inflation expectations presents a significant challenge, requiring a multi-pronged approach. Government policies, both fiscal and monetary, play a critical role in addressing the underlying factors driving these expectations. Clear communication from policymakers is essential to foster confidence and stability.

Ultimately, managing inflation expectations is a complex undertaking, but one that demands our attention as we navigate the evolving economic landscape.