US Oil Prices Hit $90, Sparking Inflation Fears

Us oil prices top 90 a barrel for the first time this year sparking inflation worries – US oil prices topping $90 a barrel for the first time this year has sparked inflation worries, sending ripples through the global economy. This significant price increase, driven by a complex interplay of factors, has the potential to impact consumer spending, fuel prices, and the overall economic landscape.

The surge in oil prices is attributed to a confluence of factors, including robust global demand, tight supply, geopolitical tensions, and ongoing energy transition initiatives. These factors are creating a perfect storm, pushing prices higher and raising concerns about inflation.

Rising Oil Prices and Inflation

The recent surge in oil prices, pushing them above $90 a barrel for the first time this year, has sparked renewed concerns about inflation. Oil is a crucial input for many industries, and its price increase can ripple through the economy, impacting consumer prices for various goods and services.

The news of US oil prices topping $90 a barrel for the first time this year is sending shivers down my spine, and it’s not just because of the potential for higher gas prices. This kind of volatility in the market always makes me think about the bigger picture, and the recent political climate hasn’t helped.

I’m talking about the situation with busloads of illegal aliens sent to Kamala Harris’s home on Christmas Eve , which was supposed to be headed for New York officials. It’s just another reminder that our country is facing some serious challenges, and it’s hard to see how rising oil prices are going to make things any easier.

The Relationship Between Oil Prices and Inflation

Rising oil prices contribute to inflation in several ways.

The recent spike in US oil prices topping $90 a barrel for the first time this year has ignited concerns about inflation, and while we grapple with the economic fallout, it’s important to remember the health implications of other recent developments.

A new study has linked the Novavax COVID-19 vaccine to an increased risk of heart inflammation, a finding that should be carefully considered, especially in light of the novavax covid 19 vaccine associated with heart inflammation study. As we navigate these complex challenges, it’s crucial to remain informed and prioritize both our economic well-being and our health.

- Increased Transportation Costs:Oil is a primary component of transportation costs, including gasoline, diesel fuel, and air travel. As oil prices rise, transportation costs increase, leading to higher prices for goods and services that rely on transportation.

- Higher Production Costs:Many industries use oil as an input in their production processes. For example, manufacturers use oil-based products like plastics and chemicals. Rising oil prices increase production costs, which are often passed on to consumers in the form of higher prices.

With US oil prices hitting $90 a barrel for the first time this year, inflation worries are starting to creep back in. It’s a reminder that the economy is still fragile, and that events like the recent spike in energy costs can have a significant impact on everyday people.

It’s also a stark contrast to the seemingly detached reality of some government officials, like FBI agent Loren Cannon in Portland, whose actions seem to be completely out of touch with the real struggles of the people they’re supposed to serve.

This is what out of touch with reality looks like Loren Cannon FBI Portland. While we’re all feeling the pinch of rising prices, it’s important to remember that we’re not all in the same boat, and some are far more vulnerable than others to the effects of economic instability.

- Impact on Consumer Spending:When oil prices rise, consumers have less disposable income to spend on other goods and services. This can lead to a decrease in consumer demand, slowing economic growth.

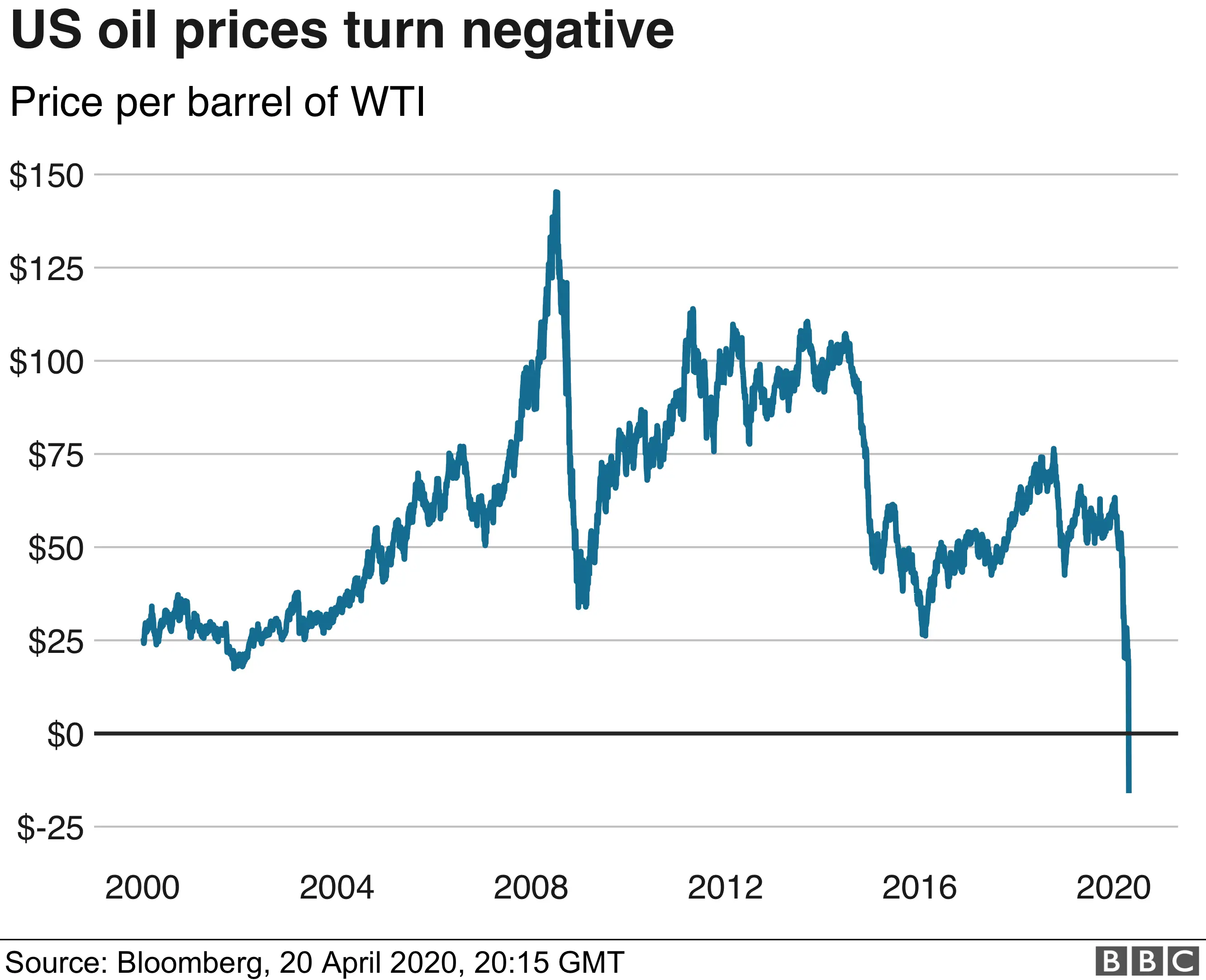

Historical Examples of Oil Price Spikes and Inflation

History provides several examples of how oil price spikes have impacted inflation.

- The 1973 Oil Crisis:The Arab oil embargo in 1973 led to a sharp increase in oil prices, contributing to a period of high inflation in the United States and other countries.

- The 1979 Oil Crisis:Another oil crisis in 1979, caused by the Iranian Revolution, led to another surge in oil prices and contributed to a second wave of inflation in the 1970s.

- The 2008 Financial Crisis:The global financial crisis of 2008 led to a decline in oil demand, causing prices to fall. However, as the economy recovered, oil prices rose again, contributing to inflationary pressures.

Potential Impact of Rising Oil Prices on the Economy

The recent rise in oil prices could have several implications for the economy.

- Higher Inflation:As discussed earlier, rising oil prices can contribute to higher inflation, eroding purchasing power and making it more expensive for consumers to buy goods and services.

- Reduced Consumer Spending:Consumers may cut back on spending on non-essential goods and services due to higher transportation and other costs associated with rising oil prices. This can slow economic growth.

- Increased Economic Uncertainty:High oil prices can create uncertainty in the economy, making businesses hesitant to invest and consumers reluctant to spend. This can lead to a slowdown in economic activity.

Factors Contributing to the Oil Price Surge

The recent surge in oil prices, pushing them above $90 a barrel for the first time this year, is a complex issue driven by a confluence of factors. The interplay of global supply and demand dynamics, geopolitical events, and economic uncertainties has contributed to this significant price increase.

Understanding these factors is crucial to grasping the current market conditions and predicting future price trends.

Global Supply and Demand Dynamics

The global oil market is a delicate balance between supply and demand. Any disruption to this equilibrium can lead to price fluctuations. In recent months, several factors have contributed to a tightening of the market, pushing prices higher.

- Increased Demand:As the global economy recovers from the pandemic, demand for oil has surged, particularly in Asia, where industrial activity and travel have rebounded. This surge in demand has outpaced supply growth, leading to a tighter market.

- Limited Supply Growth:Despite the increase in demand, oil production has not kept pace. OPEC+, a group of major oil-producing countries, has been hesitant to increase production significantly, citing concerns about market stability and the need to maintain a balanced approach to supply.

Additionally, several factors have hampered supply growth, including sanctions on Russian oil production, production disruptions in countries like Libya, and a decline in investment in new oil projects due to the transition to renewable energy sources.

Geopolitical Events

Geopolitical events, particularly those impacting major oil producers or key oil transit routes, can significantly impact oil prices.

- Russia-Ukraine War:The ongoing war in Ukraine has significantly disrupted global energy markets. Sanctions imposed on Russia, a major oil exporter, have limited its ability to export oil, further tightening supply. The war has also created uncertainty about future oil flows from the region, adding to price volatility.

- Middle East Tensions:Political tensions in the Middle East, a region that accounts for a significant portion of global oil production, can also influence oil prices. For example, ongoing conflicts in Yemen and Syria have created uncertainties about oil production and transportation in the region.

Economic Uncertainties, Us oil prices top 90 a barrel for the first time this year sparking inflation worries

Global economic uncertainties, such as inflation, interest rate hikes, and recession fears, can also impact oil prices.

- Inflation:High inflation rates, coupled with rising energy costs, can lead to a vicious cycle, further increasing prices. As consumers and businesses face higher costs, they may reduce their demand for oil, potentially leading to price adjustments. However, in the short term, the impact of inflation on oil prices is likely to be positive, as it may drive demand for oil as a hedge against inflation.

- Interest Rate Hikes:Central banks around the world are raising interest rates to combat inflation, which can slow economic growth and potentially reduce demand for oil. However, the impact of interest rate hikes on oil prices is complex and depends on various factors, such as the pace and magnitude of rate hikes, the overall economic outlook, and the response of oil producers.

- Recession Fears:Fears of a global recession can lead to a decline in economic activity and a reduction in demand for oil. However, the impact of recession fears on oil prices is also complex and depends on various factors, such as the severity of the recession, the response of oil producers, and the availability of alternative energy sources.

Final Wrap-Up: Us Oil Prices Top 90 A Barrel For The First Time This Year Sparking Inflation Worries

The recent rise in oil prices is a stark reminder of the interconnectedness of the global economy and the volatility of energy markets. As we navigate this turbulent period, understanding the underlying drivers of oil price fluctuations and their impact on various sectors is crucial.

The potential for sustained inflation remains a significant concern, and policymakers and businesses alike will need to closely monitor the situation and adapt their strategies accordingly.