Americans Struggle, Biden Boasts: Paycheck to Paycheck Reality

Growing majority of americans living paycheck to paycheck even as biden boasts success of bidenomics – Americans Struggle, Biden Boasts: Paycheck to Paycheck Reality sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset.

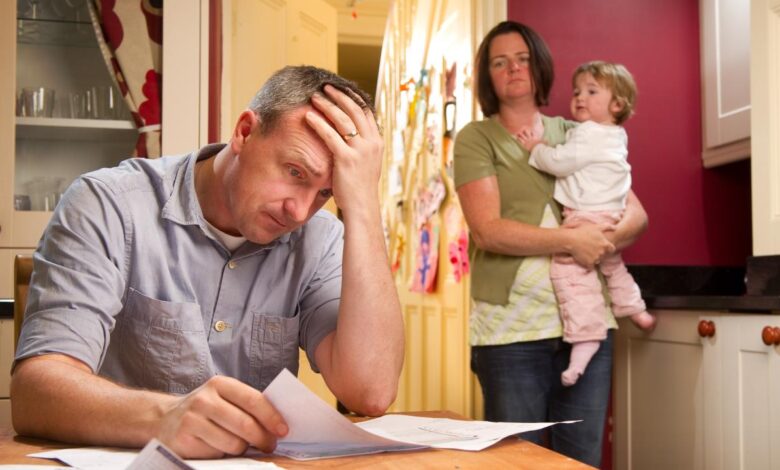

Despite President Biden’s pronouncements of economic success under his “Bidenomics” plan, a growing number of Americans are finding themselves struggling to make ends meet, living paycheck to paycheck. This stark reality raises questions about the true impact of current economic policies and the disparity between official narratives and the lived experiences of many Americans.

The Reality of Living Paycheck to Paycheck: Growing Majority Of Americans Living Paycheck To Paycheck Even As Biden Boasts Success Of Bidenomics

The American dream of financial stability and security is increasingly elusive for a growing number of Americans. Despite the recent economic recovery and positive job market, a significant portion of the population continues to struggle financially, living paycheck to paycheck.

This reality underscores the persistent challenges of economic inequality and the need for comprehensive policy solutions to address the root causes of financial insecurity.

The Prevalence of Paycheck-to-Paycheck Living

The percentage of Americans living paycheck to paycheck has risen steadily in recent years. A 2022 study by LendingClub found that 63% of Americans are living paycheck to paycheck, meaning they have little to no financial cushion and are vulnerable to unexpected expenses.

This figure represents a significant increase from previous years, highlighting the growing financial strain on American households.

Bidenomics

President Biden’s economic policies, often collectively referred to as “Bidenomics,” have been a subject of intense debate since his inauguration. These policies aim to address a range of economic challenges, including income inequality, climate change, and the lingering effects of the COVID-19 pandemic.

Key Economic Policies

The Biden administration has implemented a series of policies that aim to stimulate economic growth, create jobs, and promote social equity. Some of the key policies include:

- The American Rescue Plan Act of 2021: This $1.9 trillion stimulus package provided direct payments to individuals, extended unemployment benefits, and funded vaccine distribution and other pandemic-related relief efforts.

- The Infrastructure Investment and Jobs Act: This $1.2 trillion infrastructure bill aims to invest in roads, bridges, public transit, broadband internet, and clean energy projects, creating jobs and modernizing the nation’s infrastructure.

- The Inflation Reduction Act of 2022: This $430 billion bill focuses on climate change, healthcare, and deficit reduction. It includes investments in renewable energy, tax credits for electric vehicles, and provisions to lower prescription drug costs.

Potential Impact on Financial Well-being, Growing majority of americans living paycheck to paycheck even as biden boasts success of bidenomics

The impact of Bidenomics on the financial well-being of Americans is complex and multifaceted. Proponents argue that these policies have helped to create jobs, boost economic growth, and reduce poverty. They point to the low unemployment rate and strong job growth as evidence of the success of Bidenomics.

It’s a bit ironic, isn’t it? We’re hearing about the success of “Bidenomics,” but a growing majority of Americans are still living paycheck to paycheck. It makes you wonder about the true impact of these economic policies. Meanwhile, there’s a new study that might be of interest to those with hypertension: should hypertension patients drink coffee or tea new study reveals best beverage choice.

It’s a reminder that even amidst economic discussions, we need to prioritize our health and make informed choices about our lifestyle. Perhaps, focusing on personal health and wellness could be a better way to navigate these challenging times.

However, critics argue that the policies have contributed to inflation and increased the national debt. They contend that the focus on government spending and regulation has hampered private sector growth and innovation.

Arguments for and Against the Effectiveness of Bidenomics

Arguments for Effectiveness

- Job creation and economic growth: The economy has experienced strong job growth since Biden took office, with the unemployment rate falling to its lowest level in decades. This suggests that Bidenomics has been successful in stimulating economic activity and creating jobs.

- Reduced poverty: The American Rescue Plan Act and other social safety net programs have helped to reduce poverty rates, particularly among vulnerable populations such as children and families.

- Investment in infrastructure and clean energy: The Infrastructure Investment and Jobs Act and the Inflation Reduction Act represent significant investments in infrastructure and clean energy, which could have long-term benefits for the economy and the environment.

Arguments Against Effectiveness

- Inflation: Inflation has reached its highest levels in decades, eroding the purchasing power of consumers and increasing the cost of living. Critics argue that the stimulus spending and other policies of Bidenomics have contributed to this inflation.

- Increased national debt: The Biden administration has increased the national debt significantly, raising concerns about the long-term sustainability of government finances.

- Hindered private sector growth: Some argue that government regulations and spending have discouraged private sector investment and innovation, hindering economic growth.

Contrasting Narratives

The Biden administration has touted the success of its economic policies, collectively known as “Bidenomics,” pointing to a strong job market and declining unemployment as evidence of its effectiveness. However, a significant portion of the American population continues to struggle financially, living paycheck to paycheck and facing rising costs of living.

This discrepancy highlights a stark contrast between the administration’s narrative of economic success and the lived experiences of many Americans.

Economic Indicators and Lived Experiences

The administration often cites positive economic indicators like low unemployment rates and strong job growth as evidence of Bidenomics’ success. The unemployment rate has indeed fallen to pre-pandemic levels, and the economy has added millions of jobs since Biden took office.

These figures paint a picture of a healthy and robust economy. However, these positive indicators are often overshadowed by the realities faced by many Americans. Despite the low unemployment rate, many Americans are working multiple jobs to make ends meet, struggling with rising costs of living, and feeling financially insecure.

It’s hard to believe that while President Biden is touting the success of “Bidenomics,” a growing majority of Americans are still struggling to make ends meet, living paycheck to paycheck. It seems like we’re constantly bombarded with news about economic woes, but then there are stories like the one about the US military recovering priority sensors and electronics from the downed Chinese spy balloon.

It makes you wonder if we’re really prioritizing the right things when so many Americans are struggling to afford basic necessities.

- Rising Inflation:While the administration has highlighted the decline in inflation from its peak in 2022, inflation remains a significant concern for many Americans. The cost of essentials like food, housing, and energy continues to rise, putting a strain on household budgets and forcing many to make difficult choices.

- Wage Stagnation:Despite a strong job market, wages have not kept pace with inflation, leading to a decline in real wages for many Americans. This means that while people may be working more, they are still struggling to maintain their standard of living.

It’s hard to celebrate “Bidenomics” when a growing majority of Americans are living paycheck to paycheck, struggling to make ends meet. While the administration touts economic progress, the reality on the ground is a different story for many. Adding to the pressure is a coast to coast winter storm to hit millions with blizzard conditions icing , which will likely strain budgets further as people grapple with heating costs and potential travel disruptions.

The storm serves as a stark reminder of the economic fragility many Americans face, highlighting the need for policies that truly address the challenges of affordability and security in the face of increasingly volatile times.

- High Debt Levels:Many Americans are burdened by high levels of debt, including student loans, credit card debt, and medical debt. These debts make it difficult to save money, invest in the future, and cope with unexpected financial emergencies.

Explaining the Disconnect

The disconnect between the administration’s narrative of economic success and the lived experiences of many Americans can be attributed to several factors.

- Income Inequality:The benefits of economic growth have not been evenly distributed, with the wealthy experiencing a disproportionate increase in their wealth while many middle- and low-income Americans struggle to keep up. This widening gap in income inequality contributes to the perception that the economy is not working for everyone.

- Geographic Differences:The economic recovery has been uneven across different regions of the country. Some areas, particularly those with strong manufacturing or technology sectors, have seen significant economic growth, while others have lagged behind. This disparity can create a sense of disconnect between the national economic picture and the local realities of many communities.

- Focus on Macroeconomic Indicators:The administration’s focus on macroeconomic indicators like unemployment and GDP growth can obscure the lived experiences of many Americans who are struggling with rising costs of living, stagnant wages, and high debt levels. A more nuanced approach that considers the distribution of economic gains and the challenges faced by different segments of the population is needed to provide a more complete picture of the economy.

The Impact on Different Demographics

The economic challenges of living paycheck to paycheck are not distributed evenly across the population. Certain demographic groups, due to systemic factors and historical inequities, face amplified struggles. Understanding these disparities is crucial for crafting effective policy solutions.

Racial Minorities

Racial minorities in the United States disproportionately experience economic hardship. This is a result of historical and ongoing discrimination in areas such as housing, education, and employment.

- Higher Rates of Poverty:Black and Hispanic Americans have significantly higher poverty rates than their white counterparts. According to the U.S. Census Bureau, in 2021, the poverty rate for Black Americans was 19.5%, compared to 8.2% for white Americans.

- Lower Median Income:The median household income for Black and Hispanic Americans is consistently lower than for white Americans. This disparity is attributed to factors like wage gaps, occupational segregation, and limited access to quality education.

- Limited Access to Financial Resources:Racial minorities often have less access to financial resources, such as credit, savings, and homeownership, which can exacerbate their financial vulnerabilities. This can lead to higher interest rates on loans and difficulty accumulating wealth.

Low-Income Households

Low-income households, regardless of race or ethnicity, face significant challenges in making ends meet. The struggle to afford basic necessities like housing, food, and healthcare is a constant reality for these families.

- High Cost of Living:Rising costs for essentials like housing, healthcare, and transportation disproportionately impact low-income families. This makes it difficult to maintain a stable financial footing.

- Limited Access to Affordable Housing:The lack of affordable housing options forces many low-income families to spend a significant portion of their income on rent, leaving little for other necessities.

- Lack of Job Security:Low-wage jobs often lack benefits like paid time off, healthcare, and retirement plans, making it challenging for workers to build financial stability. These jobs also tend to have higher rates of turnover and instability, further contributing to financial insecurity.

Single Parents

Single parents, particularly single mothers, face unique economic challenges. They often juggle work and childcare responsibilities, making it difficult to secure stable employment and achieve financial security.

- Gender Pay Gap:Women, on average, earn less than men for the same work. This disparity is particularly pronounced for single mothers, who often have to shoulder the majority of childcare responsibilities, limiting their earning potential.

- Limited Access to Childcare:The cost of childcare can be a significant burden for single parents, consuming a large portion of their income. This can make it challenging to find affordable, reliable childcare that allows them to work.

- Lack of Support Systems:Single parents often lack the support networks that married couples have, making it harder to navigate financial challenges and access resources.

Potential Solutions and Future Outlook

The reality of a growing number of Americans living paycheck to paycheck, despite the Biden administration’s claims of economic success, necessitates a comprehensive approach to address the root causes and promote long-term financial stability. This section explores potential solutions and policy options that could foster wage growth, affordability, and financial security for all Americans.

Raising the Minimum Wage

Raising the federal minimum wage would directly impact millions of low-wage workers, providing them with greater purchasing power and contributing to a more equitable distribution of income. A higher minimum wage would not only increase the wages of those currently earning below the minimum but also have a ripple effect on wages across the board, as employers adjust their pay scales to remain competitive.

This would lead to increased consumer spending, boosting economic growth and creating a more robust economy.

Expanding Access to Affordable Housing

The affordability crisis in housing is a major factor contributing to financial instability. Expanding access to affordable housing through government subsidies, rent control measures, and investment in affordable housing development would help alleviate the burden of housing costs for many Americans.

By reducing the percentage of income dedicated to housing, families could allocate more resources to other essential needs, such as food, healthcare, and education.

Investing in Education and Job Training

Investing in education and job training programs is crucial for increasing wages and fostering a more skilled workforce. By providing access to affordable higher education, vocational training, and apprenticeship programs, individuals can acquire the skills and knowledge necessary to secure higher-paying jobs.

This would not only benefit individual workers but also boost the overall economy by increasing productivity and innovation.

Strengthening Social Safety Nets

A robust social safety net provides a crucial safety cushion for individuals and families facing economic hardship. Strengthening programs such as unemployment insurance, food assistance, and healthcare subsidies would ensure that individuals and families have access to basic necessities during times of financial stress.

This would help to mitigate the impact of economic downturns and provide a safety net for those who are struggling to make ends meet.

Promoting Financial Literacy

Financial literacy is essential for making informed financial decisions and achieving financial stability. Promoting financial literacy through education programs, community outreach, and accessible resources would empower individuals to manage their finances effectively, avoid predatory lending practices, and build a strong financial foundation.

This would equip individuals with the tools and knowledge they need to navigate the complexities of personal finance and achieve their financial goals.

Addressing Healthcare Costs

High healthcare costs are a significant burden for many Americans, often leading to financial instability. Implementing policies that reduce healthcare costs, such as negotiating lower drug prices, expanding access to affordable healthcare coverage, and promoting preventive care, would alleviate the financial strain associated with healthcare and improve overall well-being.

Promoting Workplace Flexibility

Promoting workplace flexibility, such as offering paid family leave, sick leave, and flexible work arrangements, can help workers manage their work-life balance and avoid financial strain. This would empower workers to prioritize their well-being and ensure that they have the time and resources to address personal and family needs without compromising their financial stability.

Tackling Income Inequality

Addressing income inequality is crucial for promoting economic stability and opportunity for all Americans. Policies that aim to reduce income inequality, such as progressive taxation, minimum wage increases, and strengthening labor unions, would contribute to a more equitable distribution of wealth and create a more just and prosperous society.

Enhancing Consumer Protections

Strengthening consumer protections, such as regulations against predatory lending and deceptive marketing practices, would protect consumers from financial exploitation and empower them to make informed financial decisions. This would create a fairer and more transparent financial system, promoting financial stability and preventing unnecessary financial burdens on consumers.

Promoting Economic Growth

Investing in infrastructure, research and development, and clean energy would create jobs, stimulate economic growth, and foster a more sustainable economy. By creating a robust and competitive economy, individuals would have greater opportunities for employment and economic advancement, reducing the likelihood of living paycheck to paycheck.

Epilogue

The discrepancy between the administration’s economic success narrative and the realities of many Americans struggling financially demands a closer look. While economic indicators may show positive signs, the lived experiences of those facing stagnant wages, rising costs of living, and mounting debt paint a different picture.

This disparity underscores the need for a nuanced approach to economic policy that addresses the needs of all Americans, not just those who are already financially secure.