US Economy: Stagflation Looms as Prices Rise, Growth Slows

Us economy flirting with stagflation as prices remain high while economy slows down – The US economy flirting with stagflation as prices remain high while the economy slows down sets the stage for a complex and uncertain economic landscape. This unique combination of high inflation and sluggish growth is a potent cocktail that could have far-reaching consequences for consumers, businesses, and the overall economy.

The current situation echoes historical instances of stagflation, prompting economists and policymakers to carefully analyze the factors driving this phenomenon.

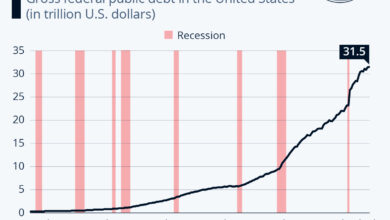

The US economy is facing a perfect storm. Inflation is at a multi-decade high, fueled by supply chain disruptions, rising energy prices, and strong consumer demand. At the same time, the economy is showing signs of slowing down, with GDP growth declining and unemployment rising.

This creates a challenging environment for businesses, which are grappling with rising costs and uncertainty about future demand. The Federal Reserve is caught in a difficult position, attempting to tame inflation without triggering a recession. This delicate balancing act is a defining challenge of the current economic climate.

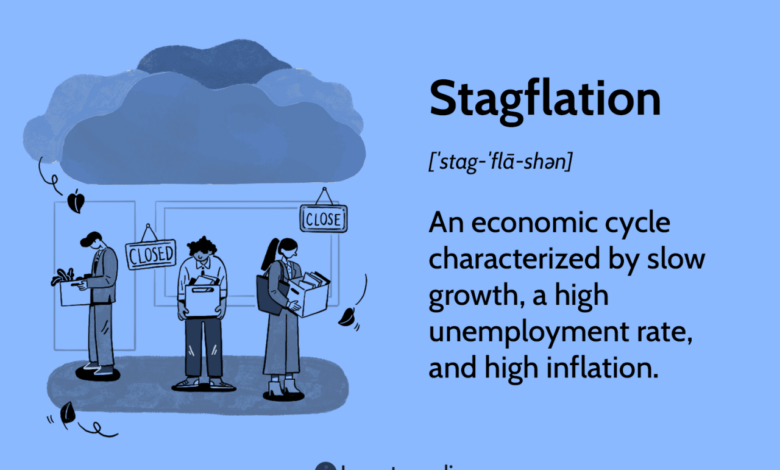

Defining Stagflation

Stagflation, a term coined in the 1970s, describes a peculiar economic situation characterized by a simultaneous occurrence of high inflation and stagnant economic growth. This economic phenomenon, contrary to traditional economic theory, defies the typical relationship between inflation and economic growth.

Characteristics of Stagflation

Stagflation is characterized by a combination of factors:

- High Inflation:A significant and persistent increase in the general price level of goods and services within an economy. This means that the purchasing power of money decreases, leading to a decline in real incomes.

- Stagnant Economic Growth:A period of slow or no growth in the economy’s output, as measured by indicators such as GDP. This translates to a lack of job creation, reduced investment, and overall economic inactivity.

- High Unemployment:Stagflation often leads to increased unemployment as businesses struggle to maintain profitability amidst rising costs and declining demand. This creates a vicious cycle, as higher unemployment further dampens consumer spending, contributing to economic stagnation.

Historical Examples of Stagflation

The concept of stagflation was first observed in the 1970s, during the oil crisis. The sharp increase in oil prices, coupled with other economic factors, led to a surge in inflation across many developed countries. The United States experienced a period of high inflation and stagnant growth during the 1970s, leading to a recession.

- 1970s Oil Crisis:The oil crisis of the 1970s, triggered by the OPEC oil embargo, led to a sharp increase in oil prices. This price hike had a significant impact on global economies, leading to stagflation in many countries, including the United States.

- 1970s in the US:The United States experienced a period of stagflation in the 1970s, characterized by high inflation and slow economic growth. This period was marked by the Vietnam War, the oil crisis, and other economic challenges, contributing to the rise of stagflation.

- Latin America in the 1980s:Latin American countries faced a period of stagflation in the 1980s, driven by factors such as high debt burdens, declining commodity prices, and political instability.

Stagflation in the Current US Economy

The US economy currently faces a challenging environment with elevated inflation and slowing economic growth. While inflation has shown signs of moderation, it remains above the Federal Reserve’s target of 2%. Meanwhile, economic growth has slowed, with the US economy facing a potential recession.

- High Inflation:The US has experienced persistent inflation since 2021, driven by factors such as supply chain disruptions, strong consumer demand, and the war in Ukraine. While inflation has moderated from its peak, it remains a concern for policymakers.

- Slowing Economic Growth:The US economy has slowed in recent quarters, with GDP growth declining. Factors contributing to this slowdown include rising interest rates, high inflation, and a cooling housing market.

- Potential Recession:Some economists predict a recession in the US economy, citing the combination of high inflation, slowing growth, and the possibility of further interest rate hikes.

Analyzing the US Economy

The US economy is currently navigating a complex landscape, grappling with persistent inflation and a slowing growth rate. While the unemployment rate remains relatively low, concerns about a potential stagflation scenario are rising. To understand the current economic situation, it’s crucial to analyze key indicators and compare them to historical periods of stagflation.

Inflation and Its Impact

Inflation has been a major concern for the US economy, with the Consumer Price Index (CPI) rising significantly in recent months. This surge in prices is attributed to a combination of factors, including supply chain disruptions, increased demand, and government stimulus measures.

The impact of high inflation is felt across various sectors, from rising energy costs to increased prices for essential goods and services.

Inflation is a persistent increase in the general price level of goods and services in an economy over a period of time.

Unemployment Rate

Despite the economic slowdown, the unemployment rate has remained relatively low, indicating a robust labor market. This is partly due to government support programs and a strong demand for workers in certain sectors. However, it’s important to note that the unemployment rate doesn’t fully capture the true state of the labor market, as it doesn’t account for underemployment or discouraged workers.

GDP Growth

The US economy experienced a period of strong growth following the pandemic, but this momentum has slowed down considerably in recent quarters. This slowdown can be attributed to factors such as rising interest rates, supply chain constraints, and global economic uncertainties.

The decline in GDP growth raises concerns about the economy’s ability to sustain its momentum in the coming months.

Comparison to Past Periods of Stagflation

The current economic conditions share some similarities with past periods of stagflation, particularly the 1970s. During that era, the US economy experienced high inflation and slow economic growth, leading to a period of economic stagnation. However, there are also significant differences between the current situation and the 1970s, including the structure of the economy, the nature of inflation, and the policy responses.

Factors Contributing to Economic Slowdown and High Inflation

The current economic slowdown and high inflation can be attributed to a confluence of factors, including:

- Supply Chain Disruptions:The global pandemic has significantly disrupted supply chains, leading to shortages and price increases for various goods.

- Increased Demand:The post-pandemic economic recovery has led to a surge in consumer demand, further exacerbating supply chain bottlenecks and driving up prices.

- Government Stimulus Measures:The government’s stimulus packages, while intended to support the economy during the pandemic, have contributed to increased demand and inflation.

- Rising Interest Rates:The Federal Reserve has been raising interest rates to combat inflation, which can slow down economic growth by making borrowing more expensive.

- Global Economic Uncertainties:The war in Ukraine, ongoing supply chain disruptions, and rising geopolitical tensions have created uncertainty and volatility in the global economy.

Exploring Potential Causes of Stagflation

Stagflation, a peculiar economic phenomenon characterized by simultaneous high inflation and slow economic growth, has become a growing concern in the United States. While the exact causes of stagflation are complex and multifaceted, several key factors have been identified as potential contributors to this economic predicament.

It’s a tough time for the US economy, with inflation still stubbornly high while growth seems to be slowing down. It’s almost like we’re flirting with stagflation, a scenario that feels all too familiar. Meanwhile, Trump suggests he will be arrested next week , adding another layer of uncertainty to an already volatile environment.

Whether or not that happens, it’s clear that the economy is facing significant challenges, and navigating these turbulent waters will require careful policy decisions and a bit of luck.

Supply Chain Disruptions

Supply chain disruptions have played a significant role in driving up prices across various sectors. The COVID-19 pandemic led to widespread lockdowns, border closures, and labor shortages, disrupting global supply chains and creating bottlenecks in the production and distribution of goods.

This has resulted in increased costs for businesses, which have been passed on to consumers in the form of higher prices. For example, the semiconductor shortage, a consequence of the pandemic’s impact on manufacturing facilities and logistics, has significantly impacted the automotive industry, leading to production delays and higher car prices.

The US economy is teetering on the edge of stagflation, a terrifying prospect for anyone who remembers the 1970s. High inflation continues to bite into our wallets, while economic growth stumbles, leaving many wondering if we’re headed for a recession.

It’s a difficult time, and it’s no surprise that people are looking for solutions. Perhaps that’s why, according to a recent Morning Consult poll, Donald Trump is seeing a surge in popularity while Ron DeSantis’s numbers are declining – read more about the poll’s findings here.

Whatever the reason, it’s clear that Americans are looking for leadership, and it remains to be seen how the current economic climate will affect the upcoming elections.

Rising Energy Prices, Us economy flirting with stagflation as prices remain high while economy slows down

The sharp increase in energy prices, particularly for oil and gas, has been another major contributor to inflation. The global energy crisis, driven by factors such as the war in Ukraine and the ongoing transition to renewable energy sources, has led to soaring energy costs, affecting businesses and consumers alike.

For instance, the price of gasoline has risen dramatically, putting pressure on household budgets and driving up transportation costs for businesses.

Government Policies

Government policies, including fiscal and monetary policies, can also contribute to stagflation. Excessive government spending, especially during times of economic stress, can lead to inflation by increasing the money supply and putting upward pressure on prices. Conversely, restrictive monetary policies aimed at curbing inflation can slow down economic growth by making borrowing more expensive for businesses and consumers.

For instance, the Federal Reserve’s aggressive interest rate hikes in 2022, aimed at taming inflation, have raised concerns about slowing economic growth and potentially pushing the economy into recession.

The Federal Reserve’s Role

The Federal Reserve plays a crucial role in managing inflation and economic growth. The Fed’s primary tools for controlling inflation include adjusting interest rates and buying or selling government bonds. By raising interest rates, the Fed makes it more expensive for businesses and consumers to borrow money, which can slow down economic activity and reduce inflation.

Conversely, by lowering interest rates, the Fed encourages borrowing and spending, which can stimulate economic growth. The Fed’s challenge is to find the right balance between controlling inflation and promoting economic growth, a delicate balancing act that has become particularly difficult in the current environment.

Perspectives on the Causes of Stagflation

There are different perspectives on the causes of stagflation. Some economists argue that the primary driver of stagflation is excessive government spending, which leads to inflation and crowds out private investment, slowing down economic growth. Others emphasize the role of supply chain disruptions and rising energy prices, arguing that these factors are primarily responsible for the current inflationary pressures.

Still others point to the Fed’s loose monetary policy in the years leading up to the pandemic, arguing that this contributed to the current inflationary environment.

Analyzing the Impact of Stagflation

Stagflation, a combination of stagnant economic growth and high inflation, presents a formidable challenge to consumers, businesses, and the overall economy. This economic phenomenon can have far-reaching consequences, impacting purchasing power, investment decisions, and overall economic stability.

Impact on Consumers

The impact of stagflation on consumers is multifaceted. Rising prices erode purchasing power, forcing consumers to cut back on spending. This can lead to a decline in demand for goods and services, further slowing economic growth.

It’s a tough time for the economy, with prices still soaring while the economy slows down, a situation that many experts are calling stagflation. This economic uncertainty might be contributing to the lack of enthusiasm among young black voters, who are seemingly not as excited about the Biden-Harris ticket as some analysts predicted, as highlighted in this recent article: young black voters not excited about joe biden kamala harris ticket analyst says.

Whether it’s the economic anxieties or other factors, this shift in voter sentiment could have significant implications for the upcoming elections, especially with the economy likely to remain a top concern for many Americans.

- Reduced purchasing power:As prices rise, consumers’ ability to purchase goods and services with their existing income diminishes. This can lead to a decrease in overall consumption, impacting businesses and the economy.

- Increased financial strain:Consumers may face increased financial strain as they struggle to afford essential goods and services. This can lead to an increase in debt, decreased savings, and a decline in overall financial well-being.

- Uncertainty and anxiety:The uncertainty surrounding stagflation can lead to anxiety among consumers, impacting their spending decisions and overall economic confidence.

Impact on Businesses

Stagflation presents a unique set of challenges for businesses. High inflation increases production costs, while slow growth reduces demand. Businesses must navigate this difficult environment to maintain profitability and stay competitive.

- Increased production costs:Businesses face rising costs for raw materials, labor, and energy, impacting profit margins and potentially leading to price increases.

- Reduced demand:Slow economic growth can lead to a decline in consumer demand for goods and services, reducing sales and impacting revenue.

- Investment uncertainty:Businesses may hesitate to invest in expansion or new projects due to the uncertain economic outlook, impacting job creation and overall economic growth.

Impact on Financial Markets

Stagflation can have a significant impact on financial markets. High inflation erodes the value of investments, while slow growth can lead to decreased corporate earnings and lower stock valuations.

- Stock market volatility:The stock market often reacts negatively to stagflation, as investors become uncertain about future economic prospects and corporate earnings.

- Bond market uncertainty:High inflation can lead to a decrease in bond prices, as investors demand higher returns to compensate for the erosion of purchasing power.

- Currency depreciation:Stagflation can weaken a country’s currency, making imports more expensive and potentially leading to inflation.

Exploring Potential Solutions: Us Economy Flirting With Stagflation As Prices Remain High While Economy Slows Down

Tackling stagflation requires a delicate balancing act. Policymakers must simultaneously combat inflation and stimulate economic growth, a challenging task given the conflicting nature of these goals. This section explores potential policy responses, including fiscal and monetary policies, analyzing their potential benefits and drawbacks, and highlighting the complexities of achieving this equilibrium.

Fiscal Policy Responses

Fiscal policy, which involves government spending and taxation, can play a significant role in addressing stagflation.

- Increased Government Spending on Infrastructure and Social Programs: Boosting public investment in infrastructure projects like roads, bridges, and public transportation can stimulate economic activity and create jobs. Additionally, expanding social programs such as unemployment benefits can provide a safety net for those affected by economic slowdowns, increasing aggregate demand.

- Targeted Tax Cuts for Businesses and Consumers: Tax cuts for businesses can encourage investment and hiring, while tax cuts for consumers can increase disposable income and stimulate spending. However, the effectiveness of tax cuts depends on their design and implementation, and they may not always be effective in stimulating economic growth.

Fiscal policy benefits include the potential to stimulate economic growth and create jobs. However, it can exacerbate inflation if not implemented carefully. Moreover, increased government spending can lead to higher budget deficits and national debt, which may have long-term economic consequences.

Monetary Policy Responses

Monetary policy, which involves controlling the money supply and interest rates, is another crucial tool in addressing stagflation.

- Raising Interest Rates: Higher interest rates can curb inflation by making borrowing more expensive, reducing consumer spending and business investment. However, this can also slow economic growth by discouraging investment and making it more difficult for businesses to expand.

- Quantitative Easing: Quantitative easing involves injecting money directly into the financial system by purchasing assets like government bonds. This can increase liquidity and lower long-term interest rates, potentially stimulating economic activity. However, it can also lead to inflation if it’s not managed carefully.

The effectiveness of monetary policy depends on various factors, including the state of the economy, consumer and business confidence, and global economic conditions. Balancing inflation control and economic growth remains a key challenge for policymakers.

Forecasting the Future

Predicting the trajectory of the US economy in the coming months and years is a complex endeavor, given the multifaceted nature of stagflation. The current economic landscape, marked by persistent inflation and slowing growth, presents a unique challenge for economists and policymakers alike.

Potential Trajectory of the US Economy

The future trajectory of the US economy is highly uncertain, with several factors potentially influencing its path. Experts generally agree that the US economy will likely experience a period of slow growth, potentially bordering on recession. However, the severity and duration of this slowdown remain unclear.

Likelihood of a Recession

A recession is a significant decline in economic activity, typically defined as two consecutive quarters of negative GDP growth. While the current economic slowdown has not yet reached recessionary levels, several factors suggest an increased likelihood of a recession in the near future.

- Persistent Inflation:High inflation erodes consumer purchasing power, leading to reduced spending and a decline in economic activity. The Federal Reserve’s aggressive interest rate hikes aim to curb inflation but may also contribute to a recession by slowing down economic growth.

- Supply Chain Disruptions:Ongoing supply chain disruptions, exacerbated by the war in Ukraine, have contributed to inflation and constrained economic growth. Resolving these disruptions will be crucial for economic recovery.

- Geopolitical Uncertainty:The war in Ukraine, heightened tensions with China, and other geopolitical events create significant uncertainty, impacting global trade and investment, and potentially hindering economic growth.

Factors Influencing the Economic Outlook

Several factors will play a significant role in shaping the US economic outlook in the coming months and years.

- Monetary Policy:The Federal Reserve’s monetary policy actions, including interest rate adjustments and asset purchases, will have a substantial impact on economic growth and inflation. The effectiveness of these measures in curbing inflation without triggering a recession remains to be seen.

- Fiscal Policy:Government spending and tax policies can influence economic activity. Fiscal stimulus measures can boost growth, but they can also contribute to inflation. The government’s fiscal policy decisions will be crucial for navigating the current economic challenges.

- Consumer Confidence:Consumer spending accounts for a significant portion of economic activity. Consumer confidence, influenced by factors such as inflation, employment, and wage growth, plays a vital role in shaping economic growth.

Risks and Opportunities Associated with Stagflation

Stagflation presents both risks and opportunities for the US economy. Understanding these dynamics is crucial for navigating the current economic landscape.

Risks

- Recession:Stagflation can lead to a recession, as high inflation erodes consumer spending and businesses face challenges in operating in an environment of rising costs and slowing demand.

- Investment Uncertainty:Businesses may hesitate to invest in new projects or expand operations due to the uncertainty associated with stagflation. This can further slow economic growth and hinder job creation.

- Social Unrest:Stagflation can lead to social unrest as consumers struggle with rising prices and declining living standards. This can create political instability and hinder economic recovery.

Opportunities

- Innovation:Stagflation can incentivize innovation as businesses seek to reduce costs and improve efficiency in a challenging economic environment. This can lead to the development of new technologies and products that enhance productivity and competitiveness.

- Structural Reforms:Stagflation can create an opportunity for policymakers to implement structural reforms that address underlying economic imbalances. This could include measures to improve labor market flexibility, enhance productivity, and promote long-term economic growth.

- Investment in Infrastructure:Stagflation can create an opportunity for government investment in infrastructure projects, which can stimulate economic activity and create jobs. This can help to address long-term economic challenges and enhance the country’s competitiveness.

Concluding Remarks

The potential for stagflation in the US economy is a serious concern, raising questions about the future trajectory of economic growth and the effectiveness of policy responses. While the economic outlook remains uncertain, understanding the causes, potential impacts, and possible solutions is crucial for navigating this challenging period.

The choices made by policymakers and the resilience of businesses and consumers will ultimately determine the course of the US economy in the coming months and years. This economic climate demands a proactive approach, with a focus on addressing the root causes of inflation and fostering sustainable economic growth.