Inflation Surges Again: Hotter Than Expected for the Second Month

Inflation comes hotter than expected for second straight month – Inflation comes hotter than expected for the second straight month, and it’s a trend that’s causing concern across the globe. This relentless rise in prices is impacting everything from our grocery bills to our ability to save for the future.

The effects are felt by individuals, businesses, and the economy as a whole, and it’s a topic that demands our attention.

This persistent inflation isn’t just a blip on the radar; it’s a force to be reckoned with. We’re seeing a perfect storm of factors contributing to this surge, from supply chain disruptions to pent-up demand. The question on everyone’s mind is: how long will this last, and what can we do about it?

Inflation’s Impact on the Economy: Inflation Comes Hotter Than Expected For Second Straight Month

Inflation, the persistent increase in the general price level of goods and services, has become a major concern for policymakers and individuals alike. While some inflation is considered healthy for a growing economy, excessive inflation can erode purchasing power, disrupt economic stability, and hinder long-term growth.

The recent surge in inflation, exceeding expectations for the second consecutive month, has raised alarms about its potential impact on the global economy.

Factors Contributing to Inflation

The current inflationary surge is driven by a complex interplay of factors, including:

- Supply Chain Disruptions:The COVID-19 pandemic has caused widespread disruptions to global supply chains, leading to shortages of raw materials, components, and finished goods. This has increased production costs and fueled price increases. For example, the semiconductor shortage has impacted the production of automobiles, electronics, and other goods, contributing to higher prices in these sectors.

- Strong Consumer Demand:As economies reopened after the pandemic, pent-up demand for goods and services surged, leading to higher prices. This demand was fueled by government stimulus measures and increased savings during the pandemic.

- Rising Energy Prices:The global energy crisis, driven by factors such as the war in Ukraine and reduced oil production, has significantly increased energy prices. This has rippled through the economy, raising transportation costs, production costs, and consumer energy bills.

- Labor Shortages:The tight labor market, with low unemployment rates, has given workers greater bargaining power, leading to higher wages. While this is positive for workers, it can also contribute to inflationary pressures as businesses pass on increased labor costs to consumers.

Long-Term Effects of Persistent Inflation, Inflation comes hotter than expected for second straight month

Persistent inflation can have significant and potentially damaging long-term effects on the economy:

- Reduced Economic Growth:High inflation can discourage investment and economic activity. Businesses may become hesitant to invest in expansion or new projects due to uncertainty about future prices and profitability. Consumers may also postpone major purchases, leading to lower demand and slower economic growth.

The news that inflation is coming in hotter than expected for the second straight month is a serious blow to the economy. It’s a reminder that we’re still grappling with the fallout of the pandemic and the war in Ukraine, and it’s crucial to understand the complexities of these issues.

For a deeper dive into the challenges facing our nation, check out this transcript of Jeh Johnson on the state of national security. These economic headwinds are a stark reminder of the importance of strong leadership and effective policy solutions to navigate these turbulent times.

- Erosion of Purchasing Power:Inflation reduces the purchasing power of consumers, as their money buys fewer goods and services. This can lead to a decline in living standards and exacerbate income inequality.

- Economic Instability:Uncontrolled inflation can lead to economic instability and volatility. It can trigger a cycle of wage-price spirals, where rising prices lead to higher wages, which in turn lead to even higher prices. This can create uncertainty and undermine confidence in the economy.

- Distorted Investment Decisions:Inflation can distort investment decisions, as investors may favor short-term, speculative investments over long-term, productive investments. This can lead to misallocation of resources and hinder economic growth.

Policy Responses to Combat Inflation

Policymakers have a range of tools at their disposal to combat inflation:

- Monetary Policy:Central banks can raise interest rates to slow down economic activity and reduce demand. Higher interest rates make borrowing more expensive, which can curb consumer spending and business investment.

- Fiscal Policy:Governments can use fiscal policy, such as tax cuts or increased government spending, to stimulate or restrain economic activity. In the case of inflation, governments may choose to reduce spending or increase taxes to reduce demand.

- Supply-Side Measures:Governments can also take steps to address supply chain disruptions and other supply-side constraints. This could include investing in infrastructure, reducing trade barriers, and providing support to businesses facing supply chain challenges.

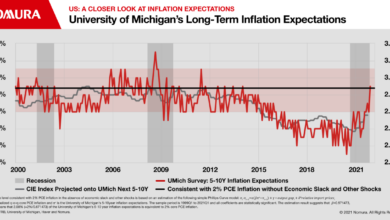

Historical Context of Inflation

Inflation, a persistent increase in the general price level of goods and services, is a complex economic phenomenon with a rich history. Understanding its historical context helps us grasp the current inflationary period and its potential consequences.

The news of inflation coming in hotter than expected for the second month in a row is a real bummer, especially when you consider that on top of that, Albanese Confectionery Group Inc. has recalled select peanut butter products due to a potential health risk.

It’s tough to stomach the rising prices, and now we have to worry about the safety of our snacks too. Hopefully, things will start to cool down soon, both in terms of inflation and food safety concerns.

Throughout history, inflation has been a recurring feature of economic cycles, often driven by diverse factors such as wars, natural disasters, and technological advancements. Analyzing historical instances of inflation sheds light on the underlying causes, consequences, and policy responses.

Comparison of Inflationary Periods

Comparing the current inflationary period to past historical instances reveals both similarities and differences. The current inflationary surge, driven by supply chain disruptions, increased energy prices, and robust consumer demand, bears resemblance to previous inflationary periods. For instance, the 1970s saw a surge in inflation due to the oil crisis and rising energy prices.

However, the current situation is unique in its context of a global pandemic and geopolitical tensions.

It’s a tough time to be a consumer, with inflation coming in hotter than expected for the second month in a row. It’s enough to make you want to scream at the TV, but maybe not quite as loudly as Fox News reporter Benjamin Hall, who recently rebutted his colleague Greg Gutfeld’s insensitive take on war coverage.

At least Hall’s frustration is understandable, given the realities of war and the economic turmoil it’s causing.

| Inflationary Period | Causes | Effects | Policy Responses |

|---|---|---|---|

| 1970s Oil Crisis | Rising oil prices due to the OPEC embargo | High inflation, stagflation, economic recession | Price controls, wage-price guidelines, monetary tightening |

| 1980s Volcker Disinflation | Aggressive monetary tightening by the Federal Reserve | Reduced inflation, recession | High interest rates, tight money supply |

| 2008 Financial Crisis | Subprime mortgage crisis, housing bubble burst | Recession, deflationary pressures | Quantitative easing, fiscal stimulus |

| 2020s Post-Pandemic Inflation | Supply chain disruptions, high demand, energy price surge | Rising prices, wage pressures, potential for economic slowdown | Monetary tightening, fiscal restraint |

Causes of Inflation

Understanding the underlying causes of inflation is crucial for policymakers to formulate effective responses. Throughout history, inflation has been triggered by various factors, including:

- Demand-Pull Inflation:Occurs when aggregate demand exceeds aggregate supply, leading to price increases as consumers compete for limited goods and services. This was evident during the post-pandemic period, where pent-up demand fueled by government stimulus packages outstripped supply capacity.

- Cost-Push Inflation:Occurs when the cost of production increases, forcing businesses to raise prices to maintain profit margins. Examples include the oil crisis of the 1970s, where rising energy costs pushed up prices across the economy.

- Built-in Inflation:Occurs when wages and prices rise in a self-perpetuating cycle. This can be driven by factors such as labor unions demanding higher wages, which in turn leads to businesses raising prices, creating a vicious cycle.

- Imported Inflation:Occurs when rising prices of imported goods and services contribute to domestic inflation. This is particularly relevant in the current context, with global supply chain disruptions and rising commodity prices contributing to inflation.

Consequences of Inflation

Inflation can have both positive and negative consequences for the economy. While moderate inflation can stimulate economic growth by encouraging investment and spending, high and persistent inflation can have detrimental effects, including:

- Erosion of Purchasing Power:Inflation erodes the purchasing power of consumers, reducing their ability to afford goods and services. This can lead to a decline in living standards.

- Distortion of Investment Decisions:High inflation can distort investment decisions, as businesses may focus on short-term profits rather than long-term investments. This can hinder economic growth.

- Uncertainty and Volatility:High inflation creates uncertainty and volatility in the economy, making it difficult for businesses to plan and invest. This can lead to a decline in economic activity.

- Social Unrest:High inflation can lead to social unrest, as consumers struggle to cope with rising prices. This can create political instability and economic turmoil.

Inflation’s Impact on Global Markets

Inflation in one country can have far-reaching consequences for global markets and trade. When prices rise in a major economy, it can affect the cost of imports and exports, leading to ripple effects across the world.

Impact on Trade

Inflation can significantly impact international trade. As prices rise in one country, its exports become more expensive for other nations, potentially reducing demand. Conversely, imports from countries with lower inflation rates become relatively cheaper, potentially increasing demand. This shift in trade patterns can disrupt global supply chains and affect the competitiveness of businesses in various countries.

For instance, if the United States experiences high inflation, its exports to Europe may become less attractive, leading to a decline in US exports and potentially impacting US businesses.

Potential for Global Economic Instability

Inflation can contribute to global economic instability. When prices rise rapidly in one country, it can trigger a chain reaction, leading to inflation in other countries. This is especially true for countries with close economic ties, as they are likely to be affected by changes in the price of imported goods.

For example, if a major oil-producing country experiences high inflation, it can lead to higher oil prices globally, affecting economies that rely heavily on oil imports. This can further exacerbate inflationary pressures in these countries, potentially leading to economic instability.

International Cooperation in Addressing Inflation

International cooperation is crucial for managing global inflationary pressures. Central banks and governments worldwide can work together to coordinate monetary and fiscal policies to mitigate the impact of inflation. This could involve measures like raising interest rates, reducing government spending, and promoting international trade agreements.

Additionally, international organizations like the International Monetary Fund (IMF) can provide technical assistance and financial support to countries struggling with high inflation. For instance, the IMF’s “Standby Arrangements” can provide financial assistance to countries facing economic crises, including those caused by inflation.

Last Recap

Inflation is a complex issue with far-reaching consequences. It’s a reminder that our economic landscape is constantly shifting, and we need to be prepared to adapt. Understanding the causes, impacts, and potential solutions is crucial for navigating this challenging environment.

While the future remains uncertain, one thing is clear: inflation is a force that we can’t ignore.