S&P 500 Surges to New High, Erasing COVID-19 Losses

Sp 500 surges to new record high wiping out all covid 19 losses – The S&P 500 has reached a new record high, completely wiping out all losses incurred during the COVID-19 pandemic. This remarkable recovery is a testament to the resilience of the US economy and the power of the stock market to rebound from adversity.

The surge can be attributed to a combination of factors, including robust economic growth, low interest rates, and continued government support.

The market’s performance is particularly impressive considering the unprecedented challenges posed by the pandemic. Businesses were forced to shut down, unemployment soared, and the global economy contracted at a record pace. However, the S&P 500 has not only recovered but has surpassed its pre-pandemic highs, indicating a strong belief in the future of the US economy.

Market Performance

The S&P 500’s recent surge to a new record high is a significant milestone, demonstrating the resilience and growth of the US stock market. This achievement is particularly notable given the challenges of the past few years, including the COVID-19 pandemic and its economic repercussions.

Understanding the factors driving this surge and its historical context provides valuable insights into the current state of the market.

Factors Contributing to the Surge

The S&P 500’s record-breaking performance is attributed to a confluence of factors.

- Strong Corporate Earnings:Robust corporate earnings, driven by strong consumer spending and a rebounding global economy, have boosted investor confidence. Companies have consistently exceeded earnings expectations, signaling a healthy economic environment.

- Low Interest Rates:The Federal Reserve’s accommodative monetary policy, characterized by low interest rates, has encouraged borrowing and investment, fueling economic growth and supporting stock valuations.

- Technological Advancements:Continued innovation and technological advancements, particularly in sectors like artificial intelligence and cloud computing, have driven growth and created new investment opportunities.

- Government Stimulus Measures:Government stimulus packages, aimed at mitigating the economic impact of the pandemic, have provided liquidity and supported businesses, contributing to market recovery.

Historical Performance of the S&P 500

The S&P 500 has a long history of achieving new highs, reflecting the growth of the US economy and the evolution of the stock market. Examining its historical performance provides context for the current record-breaking surge.

- Previous Market Highs:The S&P 500 has experienced numerous record highs throughout its history, with notable milestones including the dot-com bubble of the late 1990s and the pre-pandemic peak of 2020. These periods were characterized by strong economic growth, technological advancements, and investor optimism.

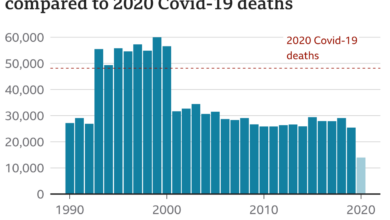

- Market Corrections:Despite its long-term upward trajectory, the S&P 500 has also experienced market corrections, characterized by significant declines. These corrections are often triggered by economic downturns, geopolitical events, or shifts in investor sentiment. The COVID-19 pandemic led to a sharp market correction in 2020, but the market has since recovered and surpassed previous highs.

- Long-Term Growth:Despite short-term fluctuations, the S&P 500 has consistently exhibited long-term growth, reflecting the overall growth of the US economy. Over the past decades, the index has delivered significant returns to investors, making it a popular investment vehicle for long-term wealth creation.

COVID-19 Impact

The COVID-19 pandemic had a profound impact on the S&P 500, causing a sharp decline in early 2020. However, the market rebounded quickly, reaching new highs in record time. Understanding the market’s reaction to the pandemic and its subsequent recovery provides valuable insights into the resilience of the US stock market and the influence of various factors on its performance.

Market Performance During the Pandemic

The S&P 500 experienced its most significant single-day decline on March 16, 2020, dropping over 12% due to the escalating pandemic and subsequent economic uncertainty. The index fell by more than 30% from its February 19, 2020, peak to its March 23, 2020, low, marking a period of intense market volatility and investor anxiety.

This downturn was the fastest bear market in history, taking just 23 trading days to reach a 20% decline.

Comparison to Previous Economic Downturns, Sp 500 surges to new record high wiping out all covid 19 losses

The speed and depth of the COVID-19-induced market downturn were unprecedented. While the 2008 financial crisis also led to a significant decline in the S&P 500, it took 17 months for the index to recover to its pre-crisis high. In contrast, the S&P 500 reached new highs in less than a year after the initial COVID-19-related market crash.

This rapid recovery can be attributed to several factors, including government stimulus measures, the Federal Reserve’s accommodative monetary policy, and the resilience of the US economy.

Industries Most Affected by the Pandemic

The pandemic had a disproportionate impact on certain industries, particularly those reliant on consumer spending, travel, and hospitality.

It’s incredible to see the S&P 500 surging to new record highs, completely erasing all the losses from the pandemic. It’s a testament to the resilience of the US economy, but it’s a stark contrast to the struggles faced by Europe’s tourism industry, which is being hit hard by the resurgence of the virus just as they were reopening.

While the stock market seems to be booming, it’s important to remember that the economic recovery is uneven and many industries are still struggling to get back on their feet.

- Travel and Hospitality:Airlines, hotels, and restaurants were severely affected by travel restrictions and lockdowns. This resulted in massive job losses and revenue declines for businesses in these sectors.

- Retail:Non-essential retail businesses were forced to close temporarily, leading to significant revenue losses. The shift towards online shopping accelerated, benefiting e-commerce giants like Amazon.

- Energy:The decline in global energy demand due to travel restrictions and economic slowdown led to a drop in oil prices and a significant impact on the energy sector.

Industries Benefiting from the Pandemic

While some industries suffered, others thrived during the pandemic.

- Technology:The increased reliance on technology for work, communication, and entertainment fueled growth in the technology sector. Companies like Zoom, Netflix, and Amazon benefited from the shift in consumer behavior.

- Healthcare:The pandemic increased demand for healthcare services, particularly for telehealth and pharmaceutical companies.

- E-commerce:As physical stores closed, online shopping surged, benefiting e-commerce platforms and logistics companies.

Recovery and Market Outlook

The S&P 500’s rapid recovery from the pandemic can be attributed to several factors, including:

- Government Stimulus:The US government implemented significant fiscal stimulus measures, including direct payments to individuals and businesses, providing much-needed support to the economy.

- Monetary Policy:The Federal Reserve lowered interest rates and implemented quantitative easing measures to stimulate the economy and boost liquidity.

- Consumer Spending:The pent-up demand from the pandemic-induced lockdowns and government stimulus contributed to a surge in consumer spending, driving economic growth.

- Corporate Earnings:Strong corporate earnings, driven by factors like the shift towards online shopping and the resilience of the technology sector, contributed to the market’s upward trajectory.

Economic Outlook: Sp 500 Surges To New Record High Wiping Out All Covid 19 Losses

The S&P 500’s surge to record highs, erasing all COVID-19 losses, paints a picture of a resilient economy. However, the current economic climate is complex, with both positive and negative factors influencing the stock market’s trajectory.

Experts’ Opinions on the Future of the S&P 500

Analysts are divided on the future direction of the S&P 500. Some experts believe the current bull market has legs, citing factors like strong corporate earnings, low interest rates, and a recovering economy. They argue that the index could continue to climb, potentially reaching new all-time highs.

The S&P 500 surged to a new record high, wiping out all COVID-19 losses, a testament to the resilience of the US economy. Amidst this positive news, the political landscape continues to be turbulent. In a fiery exchange, Donald Trump hit back at Michelle Obama after her scathing Democratic National Convention speech, claiming he wouldn’t be where he is today if not for Barack Obama’s presidency.

Read more about the Trump-Obama spat here. While political tensions simmer, the S&P 500’s performance suggests a continued path of economic recovery.

Others, however, express caution, pointing to rising inflation, supply chain disruptions, and geopolitical tensions as potential headwinds. They suggest that the market may be overvalued and could experience a correction in the near future.

Potential Risks and Opportunities for Investors

The current market presents both risks and opportunities for investors.

Risks

- Inflation:Rising inflation erodes purchasing power and can force the Federal Reserve to raise interest rates, potentially slowing economic growth and impacting corporate profits.

- Interest Rate Hikes:The Federal Reserve’s tightening monetary policy could increase borrowing costs for businesses and consumers, potentially leading to slower economic growth.

- Supply Chain Disruptions:Ongoing supply chain disruptions caused by the pandemic and geopolitical events continue to impact businesses, leading to higher costs and potentially slowing economic growth.

- Geopolitical Uncertainty:The ongoing war in Ukraine and other geopolitical tensions create uncertainty in the global economy, potentially impacting investor sentiment and market volatility.

Opportunities

- Economic Growth:The US economy is expected to continue growing, albeit at a slower pace, creating opportunities for businesses and investors.

- Strong Corporate Earnings:Many companies are reporting strong earnings, driven by robust consumer demand and a recovering economy. This could lead to further stock price appreciation.

- Low Interest Rates:While interest rates are rising, they remain historically low, making it relatively inexpensive for businesses to borrow money and invest in growth.

Investor Sentiment

The recent surge in the S&P 500, wiping out all COVID-19 losses, has sparked a wave of optimism among investors. This bullish sentiment is evident in various market indicators and investor behavior, reflecting a renewed confidence in the economy and corporate earnings.

Impact of Investor Confidence on Market Performance

Investor confidence plays a crucial role in driving market performance. When investors are optimistic about the future, they are more likely to invest in stocks, leading to higher demand and increased stock prices. Conversely, when investor confidence is low, investors may pull back from the market, leading to lower demand and declining stock prices.

“Investor sentiment is a powerful force in the stock market. When investors are bullish, they tend to buy stocks, driving prices up. Conversely, when they are bearish, they tend to sell stocks, driving prices down.”

Warren Buffett

Investor Strategies in Light of the Market Surge

The recent market surge has led to a shift in investor strategies. Many investors are now focusing on growth stocks, which are expected to benefit from the economic recovery. Some investors are also adopting a more aggressive approach, increasing their exposure to riskier assets.

“The market is always looking for a reason to go up. The recent surge in the S&P 500 is a testament to the power of investor sentiment. When investors are optimistic, they tend to buy stocks, driving prices up.”Peter Lynch

Last Point

The S&P 500’s remarkable recovery from the COVID-19 pandemic is a powerful reminder of the market’s ability to adapt and overcome challenges. While there are always risks and uncertainties in the market, the recent surge provides a positive outlook for investors.

It’s important to remember that past performance is not indicative of future results, and investors should always conduct thorough research and diversify their portfolios to manage risk.