Century-Old Bonds: Trumps Leverage Against Beijing

1 6t in century old chinese bonds offer trump unique leverage against beijing sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset.

Imagine a pile of century-old Chinese bonds, their faded ink whispering tales of a bygone era. These bonds, valued at a staggering 1.6 trillion dollars, could be Trump’s secret weapon in his ongoing trade war with China. The story of these bonds, their historical significance, and their potential to reshape global power dynamics is a fascinating one, full of intrigue and suspense.

Join me as we delve into the complex world of international finance and explore the implications of these bonds for the future of US-China relations.

The Potential Leverage for Trump

The discovery of these century-old Chinese bonds offers President Trump a unique opportunity to exert leverage over Beijing in various ways. The potential for using these bonds as a bargaining chip could have significant economic and political implications, both for the US and China.

Economic and Political Consequences of Using the Bonds

Using these bonds as leverage could potentially influence Chinese economic and political decisions.

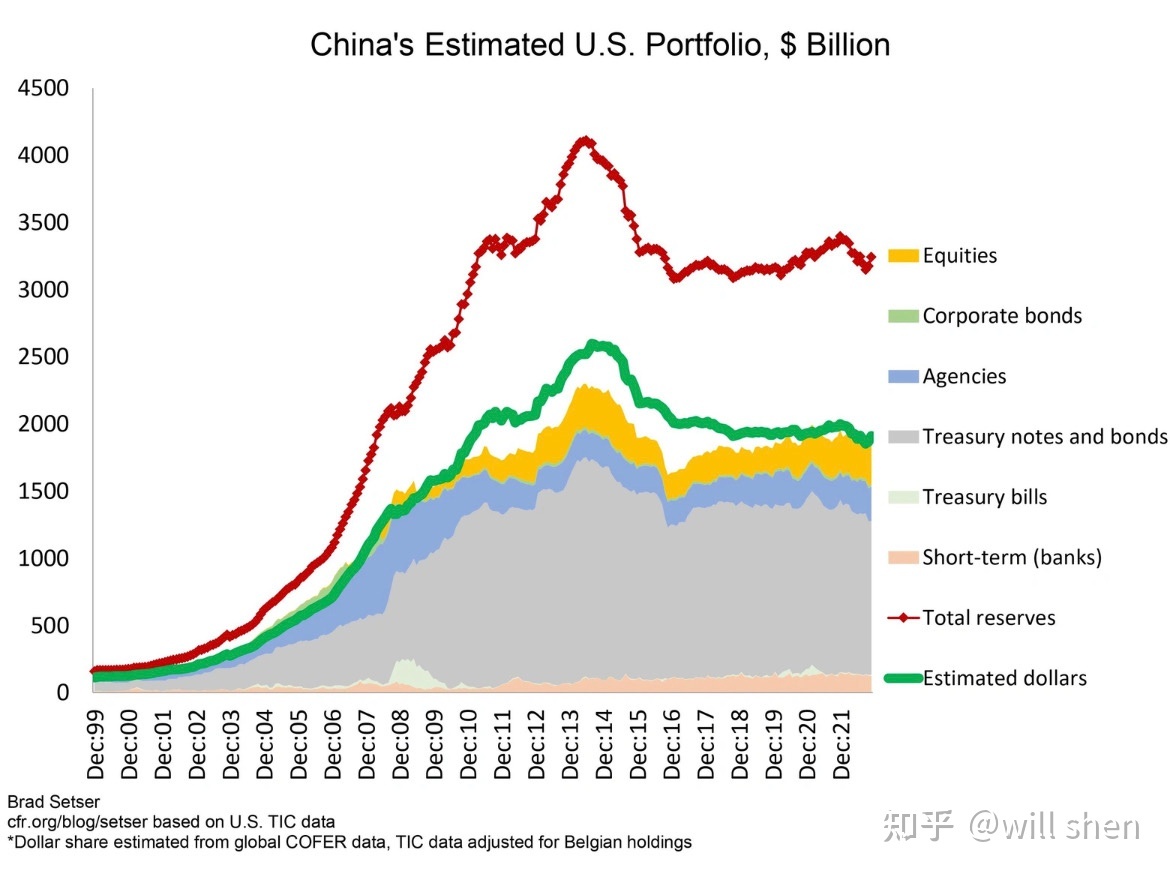

The news that the US holds $1.6 trillion in century-old Chinese bonds, giving Trump unique leverage against Beijing, adds another layer of complexity to the already tense relationship. This situation is further complicated by the Fed’s recent decision to quarantine cash from Asia in a precautionary bid to stem the spread of the coronavirus , raising questions about the potential impact on financial markets and the global economy.

It remains to be seen how these developments will play out, but it’s clear that the US-China relationship is entering uncharted territory.

- Economic Pressure:The US could threaten to sell the bonds, potentially causing a decline in the value of the Chinese yuan and disrupting Chinese financial markets. This could force China to make concessions in trade negotiations or other economic disputes.

- Political Pressure:The US could use the bonds as a bargaining chip to pressure China on issues such as human rights, intellectual property theft, or military expansion in the South China Sea. The threat of selling the bonds could create a sense of urgency for China to address US concerns.

The news about the 1.6 trillion dollars in century-old Chinese bonds offering Trump unique leverage against Beijing is certainly eye-catching, especially when you consider the complex geopolitical landscape. It’s interesting to think about how this development might resonate with a younger generation, perhaps someone who identifies with the mind of the Sanders millennial.

Ultimately, the impact of these bonds on U.S.-China relations remains to be seen, but it’s a story that will undoubtedly continue to unfold in the coming months.

Benefits and Drawbacks of This Strategy

This strategy presents both potential benefits and drawbacks for the US.

- Benefits:

- Increased Bargaining Power:The bonds could give the US significant leverage in negotiations with China.

- Addressing US Concerns:The US could use the bonds to pressure China on issues that have been difficult to address through traditional diplomatic channels.

- Drawbacks:

- Economic Instability:Selling the bonds could trigger market volatility and potentially harm the global economy.

- Escalation of Tensions:The use of such a tactic could escalate tensions between the US and China, potentially leading to a trade war or other conflicts.

- Damage to US-China Relations:This strategy could damage long-term relations between the two countries, making future cooperation more difficult.

The International Response

Trump’s actions regarding the century-old Chinese bonds could trigger a wave of international reactions, with significant implications for global trade, relations, and China’s standing. The international community’s response would be a complex interplay of political, economic, and strategic considerations.

Reactions from Other Countries

The potential reactions from other countries would depend on their individual relationships with both the United States and China.

- Countries with strong economic ties to China, like Japan, South Korea, and some European nations, might be hesitant to openly criticize Trump’s actions. They would likely seek to maintain their economic interests while also expressing concerns about potential disruptions to global trade and financial markets.

- Countries with strong alliances with the United States, like Australia and Canada, might be more vocal in their support for Trump’s actions. They might see this as an opportunity to strengthen their own strategic partnerships with the United States.

- Other countries, particularly those with a history of tension with China, like India and Vietnam, might view Trump’s actions as an opportunity to advance their own interests. They might see this as a chance to weaken China’s influence in the region.

The news that the United States holds $1.6 trillion in century-old Chinese bonds offers a unique leverage point for President Trump in his ongoing trade negotiations with Beijing. While the world waits to see how this situation unfolds, it’s worth noting that even here in the United States, election results are taking time to be finalized, as evidenced by michigan officials saying complete primary results won’t be released until Wednesday afternoon.

The global stage is filled with uncertainty, and the impact of these bonds on the U.S.-China relationship is a crucial factor to watch in the coming months.

Implications for Global Trade and Relations

Trump’s actions could significantly impact global trade and relations.

- The move could escalate tensions between the United States and China, leading to further trade disputes and economic sanctions. This could disrupt global supply chains and negatively impact businesses worldwide.

- It could also undermine trust and cooperation among nations, making it more difficult to address global challenges like climate change and pandemics.

- The international community might be less willing to engage with the United States on issues of global importance, particularly if they perceive American actions as unilateral and disruptive.

Impact on China’s Economic and Political Standing

Trump’s actions could have a significant impact on China’s economic and political standing.

- While China’s economic fundamentals remain strong, the move could lead to increased economic uncertainty and volatility in the Chinese financial markets. This could negatively impact foreign investment and economic growth.

- It could also damage China’s reputation as a reliable partner and undermine its global influence. Other countries might be less willing to engage with China on issues of global importance, perceiving it as an unreliable partner.

- China might be forced to adopt a more assertive foreign policy to counter the perceived threat from the United States, leading to increased regional tensions and instability.

The Moral and Ethical Dimensions

The potential use of century-old Chinese bonds as leverage against Beijing raises significant moral and ethical questions. While the bonds may offer a unique opportunity to exert pressure on China, it’s crucial to consider the broader implications and potential unintended consequences of such an approach.

The Ethical Dilemma of Leverage, 1 6t in century old chinese bonds offer trump unique leverage against beijing

The ethical implications of using these bonds as leverage stem from the potential for coercion and manipulation. This strategy could be seen as an attempt to exploit a historical vulnerability to achieve political objectives. It raises concerns about the legitimacy and fairness of using past debts to pressure a nation into complying with demands.

- Historical context:The bonds represent a historical debt incurred during a period of significant political and economic turmoil in China. Their use as leverage could be perceived as a form of historical revisionism, reopening old wounds and exacerbating existing tensions.

- Potential for unintended consequences:The use of leverage could backfire, potentially leading to a deterioration of relations and increased instability in the region. It could also create a precedent for other nations to use similar tactics, undermining the principle of international cooperation.

- Moral obligation:The moral implications of using leverage must be carefully considered. The bonds represent a historical debt, and their use as a bargaining chip could be seen as exploiting a past vulnerability.

The Risk of Collateral Damage

The use of these bonds as leverage could have unintended consequences for both China and the United States. It could potentially lead to economic instability, political turmoil, and even social unrest.

- Economic repercussions:The potential for economic repercussions is significant. A confrontation over the bonds could trigger a financial crisis in China, with global implications.

- Political instability:The use of leverage could exacerbate existing political tensions within China, potentially leading to instability and even violence.

- Social unrest:The use of leverage could be perceived as an attack on Chinese sovereignty, potentially leading to widespread social unrest and a backlash against the United States.

Alternative Approaches

Instead of resorting to leverage, there are alternative approaches to addressing the issues at hand.

- Diplomacy and negotiation:Open dialogue and negotiations can be a more constructive way to address concerns and find common ground. This approach emphasizes cooperation and mutual understanding, fostering a more stable and productive relationship.

- International cooperation:Working with other nations to address shared concerns can be more effective than unilateral actions. This approach strengthens international partnerships and promotes a more stable global order.

- Focus on common interests:Identifying areas of common interest and cooperation can help to build trust and reduce tensions. This approach emphasizes shared goals and encourages collaborative solutions.

Final Conclusion: 1 6t In Century Old Chinese Bonds Offer Trump Unique Leverage Against Beijing

The potential for these century-old bonds to influence the course of global politics is undeniable. While the legal and ethical implications are complex, their sheer value and historical context make them a significant factor in the US-China relationship. As we move forward, the story of these bonds will likely continue to unfold, shaping the landscape of international trade and diplomacy for years to come.